Semiannually is a term used to describe something that occurs twice a year, every six months. This can refer to a variety of events, such as the payment of dividends, the issuance of financial statements, or the frequency of loan interest payments.

One common example of a semiannual occurrence is the payment of dividends by a company to its shareholders. A company may choose to pay out a portion of its profits to shareholders twice a year, typically in the form of a cash payment or additional shares of stock. This payment is referred to as a semi-annual dividend.

Another example of a semiannual event is the issuance of financial statements by a company. Publicly-traded companies are required to release financial statements at regular intervals, typically quarterly or semiannually. These statements provide information about a company’s financial performance, including revenue, expenses, and profits.

In the world of finance, the term semiannual is also commonly used to describe the frequency of loan interest payments. When interest is compounded semiannually, it means that the interest is calculated and added to the principal balance twice a year. This can have a significant impact on the total amount of interest paid over the life of a loan.

For example, if you have a five-year loan that compounds interest semiannually, the total interest up to that period is added to the principal nine times. This means that the interest adds up over time, and borrowers may end up paying more in interest than they would with a loan that compounds interest less frequently.

Semiannually refers to an event or occurrence that happens twice a year, every six months. This term is commonly used in finance to describe the frequency of loan interest payments and the payment of dividends by companies. Understanding the implications of semiannual compounding can help borrowers make informed decisions about thir loans and investments.

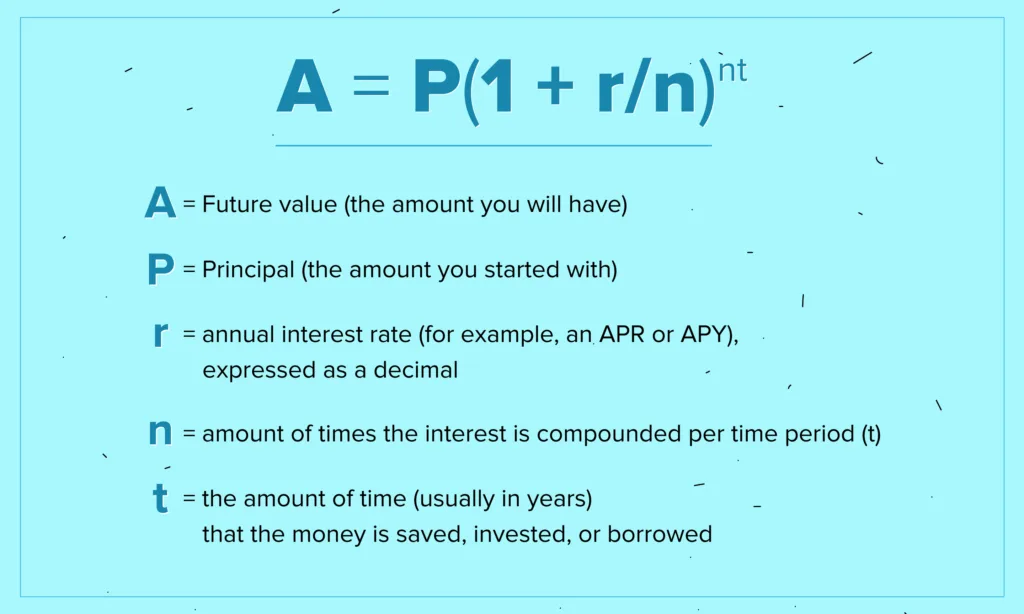

Calculating the Amount of Semiannual Payments

Semiannually refers to a period of time that occurs twice a year, typically every six months. In mathematical terms, semiannually can be expressed as a frequency of 2 times per year or as a time period of 0.5 years.

For example, if an individual pays their car insurance semiannually, they would make two payments per year, spaced six months apart. Similarly, a company may report its financial statements semiannually, which means it would release its financial reports twice a year.

It is important to note that the term semiannually is often used interchangeably with the term biannually, which also refers to something happening twice a year. However, it is worth noting that some people use these terms to refer to slightly diferent time periods, so it is always best to clarify the specific frequency or time period being referred to.

Frequency of Semi-Annual Events

Semi-annual refers to something that occurs twice a year. The prefix “semi-” means “half,” but in this case, it does not refer to half of a year. Instead, it means “occurring twice in a year on a regular basis.” Therefore, semi-annual events, such as semi-annual sales or semi-annual reports, happen twice a year, typically every six months. It is important to note that semi-annual events do not necessarily occur exactly every six months, but rather twice within a year.

What Is the Meaning of Semi-Annually?

Semi-annually is a term used to decribe the frequency of an event or occurrence that takes place twice a year, or every six months. This means that something that happens semi-annually will occur once every half-year or twice per annum.

To put it simply, “semi” means “half,” and “annually” means “yearly.” Therefore, semi-annually can be thought of as “half-yearly” or “twice a year.”

Semi-annual events are common in many areas of life, including finance, business, and education. For example, a company may issue semi-annual financial reports to its shareholders, or schools may have semi-annual parent-teacher conferences to discuss a student’s progress.

When someone uses the term “semi-annually,” they are referring to something that occurs twice a year or every six months.

Compounding Semiannually

Compounded semiannually is a term used to descibe the frequency at which interest is added to a loan or investment. Specifically, it means that interest is being compounded twice a year, or every six months. This compounding frequency has significant implications for the total amount of interest paid or earned over the life of the loan or investment.

When interest is compounded semiannually, the interest earned or charged during the first six months is added to the principal amount, and interest is then calculated on the total amount for the next six months. This process is repeated every six months until the loan or investment reaches maturity.

For example, if you have a $10,000 loan with an annual interest rate of 6% compounded semiannually, after the first six months, the interest earned would be $300. This amount is added to the principal, bringing the total amount to $10,300. Interest for the next six months is then calculated based on the new total amount, and so on.

It’s important to note that the compounding frequency can significantly impact the total amount of interest paid or earned over time. For instance, if the same loan had an annual interest rate of 6% compounded monthly, the total interest paid would be more significant than if it were compounded semiannually.

Compounded semiannually means that interest is added to a loan or investment twice a year, or every six months. This compounding frequency can have significant implications for the total amount of interest paid or earned over time.

Conclusion

Semiannual is a term used to describe an event or occurrence that takes place twie a year, every six months. This term is commonly used in finance to describe the frequency of interest payments or dividend payouts. When interest is compounded semiannually, it means that the interest is added to the principal every six months, resulting in a higher total interest earned over time.

Semiannual payments can be beneficial for both lenders and borrowers, as they allow for more frequent payments and compounding of interest. However, it is important to understand the terms and conditions of any financial agreement before agreeing to semiannual payments or compounding of interest.

The term semiannual is an important concept in finance and can have a significant impact on the total amount paid or earned over time. By understanding the meaning and implications of this term, individuals can make more informed financial decisions and achieve their financial goals.