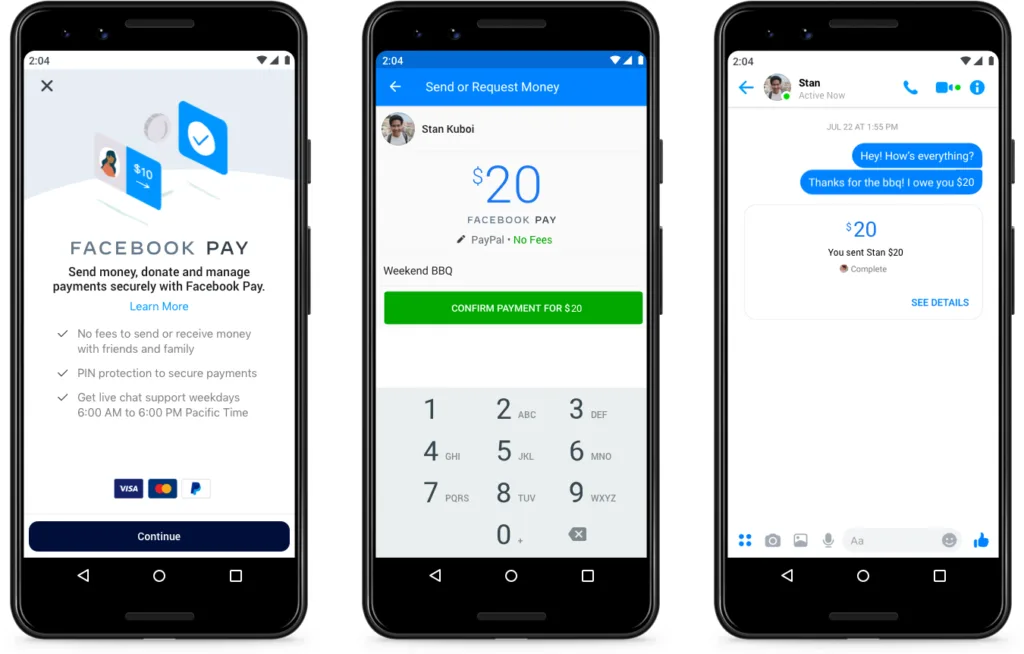

Facebook Pay is a convenient way to securely send and receive payments directly on the Facebook platform. Whether you’re buying products from a Facebook Marketplace seller or paying for a virtual event, the platform offers a hassle-free payment experience. However, sometimes things don’t go as planned, and you may need to request a refund.

If you paid for a product or service using Facebook Pay, you can request a refund if you did not receive what you paid for or if the product or service was not as described. To request a refund, follow these steps:

1. Open the Facebook app, tap on the three horizontal lines in the bottom right corner, and select “Settings & Privacy.”

2. Tap on “Settings,” scroll down to “Facebook Pay,” and select “Payment History.”

3. Find the transaction you want to request a refund for, and tap on “Report a Problem.”

4. Select the reason for your refund request, and provide additional details about the issue.

5. Tap on “Submit.”

If your refund request is approved, you’ll receive a notification from Facebook, and your money will be refunded to your linked payment method within 5-7 business days.

What You Can Request a Refund For

You can request a refund for a variety of reasons, including:

– You did not receive what you paid for

– The product or service was not as described

– The event you paid for was canceled or rescheduled

– You were charged multiple times for the same transaction

– You did not authorize the transaction

If you think you’ve been charged for something you didn’t authorize, you can dispute the charges through Facebook’s Payments Support Center. You’ll find the contact link under the “Get Help” section at the bottom of the page. You may need to provide transaction information for Facebook to assist you.

Facebook may also offer “goodwill refunds” at their discretion. Goodwill refunds are provided as a gesture of goodwill in situations where Facebook determines that the customer has not received the expected level of service. These refunds may not be aailable for all transactions and are subject to Facebook’s terms and conditions.

Facebook also offers a Purchase Protection policy for eligible purchases made through Facebook Pay. If you receive a product that is damaged, defective, or not as described, you may be eligible for a refund. To be eligible for Purchase Protection, you must meet certain criteria, including filing a claim within a specific timeframe.

Facebook Pay can be a convenient way to make payments on the Facebook platform, but things don’t always go as planned. If you need to request a refund, follow the steps outlined above, and be sure to provide as much detail as possible. Remember, Facebook may also offer goodwill refunds and has a Purchase Protection policy in place for eligible purchases.

Getting a Refund for Facebook Pay Transactions

You can request a refund for a transaction made throgh Facebook Pay. The refund process depends on the type of transaction and the policies of the merchant or service provider you made the purchase from.

If you made a purchase from a merchant, you can request a refund directly from them. If they are unable or unwilling to process the refund, you can reach out to Facebook Pay support for assistance. To request a refund, navigate to the transaction in your payment history and select “Dispute Purchase” or “Report a Problem.”

For person-to-person payments, you can request a refund by selecting the payment in your payment history and choosing “Request Refund.” The recipient will have the option to approve or deny the refund request. If the recipient does not respond within 30 days, Facebook Pay support may be able to assist you in getting your money back.

It’s important to note that Facebook Pay may not be able to process refunds for all transactions, and some refunds may take several days to process. Additionally, Facebook Pay may require documentation or additional information to process a refund. Always review the refund policy of the merchant or service provider before making a purchase, and keep records of your transactions in case you need to request a refund.

How Long Does It Take For Facebook Pay To Process Refunds?

If you have canceled a payment in Messenger, it usualy takes 5-7 business days for Facebook Pay to refund the money back to your linked payment method. However, the exact duration of the refund process may vary depending on the policies of your bank or financial institution. Additionally, it’s worth noting that if there are any issues or errors during the refund process, it may take longer for the funds to be returned to your account. Nonetheless, Facebook Pay strives to ensure that the refund process is completed as quickly and efficiently as possible, and you can typically expect to receive your refund within a week of canceling the payment.

Can I Get a Refund from Facebook If I Was Scammed?

Facebook offers a Purchase Protection policy to protect its users from fraudulent transactions. If you have been scammed through a purchase made on Facebook, you may be eligible for a refund, but this is at Facebook’s discretion. To request a refund, you would need to file a claim with Facebook’s Purchase Protection team, providing evidence of the fraudulent transaction. If your claim is approved, Facebook will refund you the full purchase price of the product along with any shipping costs. However, it’s important to note that Facebook’s Purchase Protection policy has certain limitations, such as only covering eligible purchases made on the Facebook platform and within the specifid time period. Therefore, it’s essential to read and understand Facebook’s Purchase Protection Policy to know the specific terms and conditions.

Filing a Dispute on Facebook Pay

You can file a dispute on Facebook Pay. If you notice unauthorized or unrecognized charges on your account, you can dispute them by contacting Facebook’s Payments Support Center. To access the support center, go to the Get Help section at the bottom of the Facebook Pay page and click on the Contact link. You may be asked to provide transaction information to help Facebook investigate the issue and resolve the dispute. It’s important to review your Facebook Pay transactions regularly to ensure that all charges are legitimate and to take prompt action if you notice any discrepancies.

Dealing with Facebook Pay Scams

If you have been scammed on Facebook Pay, it is important to take action as soon as pssible to try and recover your funds. The first step you should take is to contact the seller directly through the Facebook Pay transaction history and attempt to resolve the issue. If the seller is unresponsive or unwilling to cooperate, you can contact Facebook Pay customer service to report the issue and request a refund.

To contact Facebook Pay customer service, you can navigate to the “Help & Support” section in the Facebook Pay settings. From there, you can submit a report detailing the issue you experienced and provide any relevant evidence, such as screenshots or receipts. Facebook Pay will then review your report and determine if a refund is appropriate.

If you are unable to recover your funds through Facebook Pay customer service, you may need to take additional steps such as filing a dispute with your bank or credit card company. It is also important to report the seller as a scammer to Facebook, so that they can take appropriate action to prevent others from being scammed in the future.

If you have been scammed on Facebook Pay, it is important to act quickly and take all necessary steps to try and recover your funds and prevent future scams.

Consequences of Being Scammed on Facebook

If you get scammed on Facebook, it can be a frustrating and stressful experience. However, there are steps you can take to try and recover your losses. First and foremost, it’s important to report the scam to Facebook. You can do this by going to the post or profile of the scammer and clicking the “Report” button. Facebook will investigate the report and take necessary action, which may include removing the scammer’s account.

If you’ve lost money or personal information, it’s essential to contact your local law enforcement agency. They can help you file a report and potentially recover any stolen funds. It’s also a good idea to contact your bank or credit card company to alert them to the scam and prevent any furthr unauthorized charges.

It’s important to remember that prevention is key when it comes to online scams. Be cautious when interacting with unfamiliar individuals or businesses on Facebook, and avoid clicking on suspicious links or downloading unknown attachments. If a deal seems too good to be true, it probably is. By staying vigilant and taking immediate action if you do fall victim to a scam, you can minimize the damage and protect yourself from future incidents.

Can I Receive a Refund from My Bank if I am Scammed?

If you have been scammed and have transferred money from your bank account, you should contact your bank immediately to report the fraud. In most cases, banks will refund you if you’ve transferred money due to a scam, but this depends on the specific circumstances of the case. Banks have fraud protection policies in place, and they are responsible for ensuring that their customers are protected from any financial loss due to fraudulent activity. However, it’s important to note that the bank may need to investigate the situation befre they can process your refund. Therefore, it’s crucial that you report the scam as soon as possible to increase the chances of getting a refund.

Recovering Funds Lost to Scams

If you have been scammed and lost money, there is a chance that you may be able to recover the funds. However, the likelihood of recovering the money depends on a number of factors.

Firstly, it is important to report the scam to the relevant authorities, such as the police or the Financial Conduct Authority (FCA). This will help to prevent others from falling victim to the same scam and may also assist in the recovery of your funds.

If you made the payment using a credit card, you may be able to claim a refund from your card provider under Section 75 of the Consumer Credit Act. This applies to purchases between £100 and £30,000 and means that your card provider is jointly liable with the seller for the goods or services purchased. However, this only applies to credit cards and not to debit cards.

If you made the payment using a bank transfer or a debit card, you may be able to claim a refund under the Payment Services Regulations. This allows you to claim a refund from your bank if the payment was unauthorised, fraudulent or a mistake. However, there are limitations to this, such as a time limit of 13 months from the date of the payment and the requirement for the bank to prove that you authorised the payment.

In some cases, it may also be possible to recover the funds through legal action. This would involve hiring a solicitor and taking the matter to court, which can be a lengthy and expensive process.

While there is a chance of recovering scammed money, it is important to take steps to prevent scams from happening in the frst place, such as being cautious with personal information and not responding to unsolicited emails or phone calls.

Recovering Money After Being Scammed

When you have been scammed, recovering your money can be a difficult and frustrating process. However, there are steps you can take to increase your chances of getting your money back.

First, gather as much information as possible about the scam and the scammer. This includes any emails, phone numbers, or other contact information, as well as any receipts, invoices, or other documents related to the transaction.

Next, contact your bank or credit card company as soon as possible. Explain what happened and provide them with any documentation you have. They may be able to reverse the transaction and refund your money, or they may be able to put a hold on the payment to investigate further.

If you paid with a wire transfer or other non-reversible method, contact the receiving bank or financial institution and explain the situation. They may be able to freeze the account and prevent the scammer from accessing your funds.

You should also report the scam to the appropriate authorities, such as the Federal Trade Commission (FTC) or the Internet Crime Complaint Center (IC3). This will help to prevent othrs from falling victim to the same scam.

Be vigilant in the future and take steps to protect yourself from future scams. This includes being cautious of unsolicited emails and phone calls, verifying the identity of anyone you do business with, and using secure payment methods whenever possible.

Source: about.fb.com

Disputing a Transaction After Payment

You can dispute a transaction that you have paid for. There are several eligible reasons to dispute a charge, including fraud, unauthorized charges, billing errors, bad service, and service not rendered. If you notice a charge on your credit card statement that you did not make, you shold contact your credit card issuer immediately to report the unauthorized charge and initiate a dispute. Similarly, if you receive a bill that includes errors or charges that you did not authorize, you can also dispute the charge. Additionally, if you willingly made a purchase but received bad service or the service was not rendered as expected, you can also dispute the charge. Your credit card issuer can assist you in resolving the dispute and getting your money back. It is important to act quickly and report any unauthorized charges or errors to your credit card issuer as soon as possible to increase the chances of a successful dispute.

Conclusion

If you have purchased a paid online event thrugh Facebook Pay and it was unavailable or rescheduled by the creator, you can initiate a refund process by reaching out to Facebook Pay. However, it is important to note that refunds may not be possible for purchases made outside of Facebook Pay. If your payment was canceled in Messenger, the refund will be issued to your linked payment method within 5-7 business days. Facebook may also offer goodwill refunds at their discretion. In the case of Purchase Protection claims, you will receive a full refund for the purchase price and any shipping costs if your claim is approved. It is also possible to dispute charges on your mobile phone through Facebook’s Payments Support Center. Facebook Pay offers a straightforward refund process for eligible purchases, and customers can feel assured that their concerns will be addressed promptly.