As a member of ELGA Credit Union, you may have heard of the importance of knowing your routing number. Your routing number is an essential piece of information that is required for various financial transactions. In this article, we will discuss what a routing number is, why it is important, and how you can find your ELGA routing number.

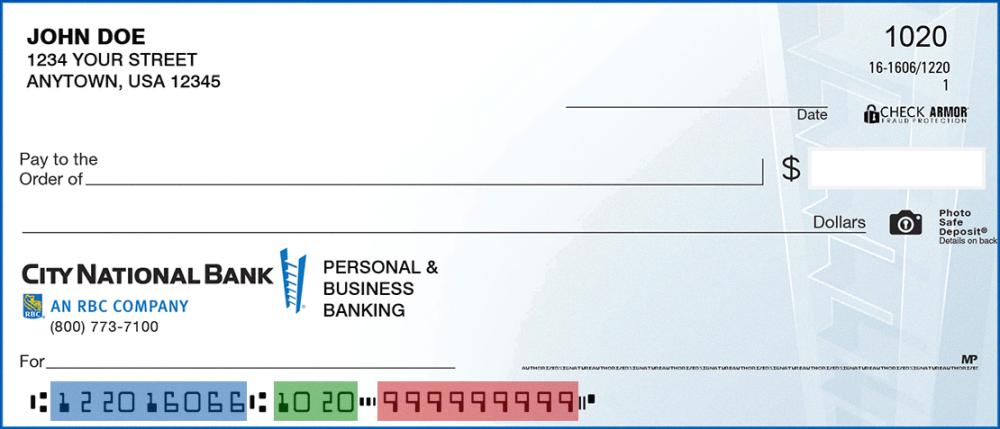

A routing number is a unique nine-digit code that identifies a financial institution in a transaction. It is also known as an ABA routing number, routing transit number (RTN), or a routing transit routing number (RTR). Each financial institution in the United States has a unique routing number that is used to identify it in financial transactions.

A routing number is required for various financial transactions, such as direct deposit, wire transfers, electronic bill payments, and ACH transactions. Without a routing number, it is impossible to complete these transactions. Therefore, it is crucial to have accurate routing number information to ensure that financial transactions are processed correctly and efficiently.

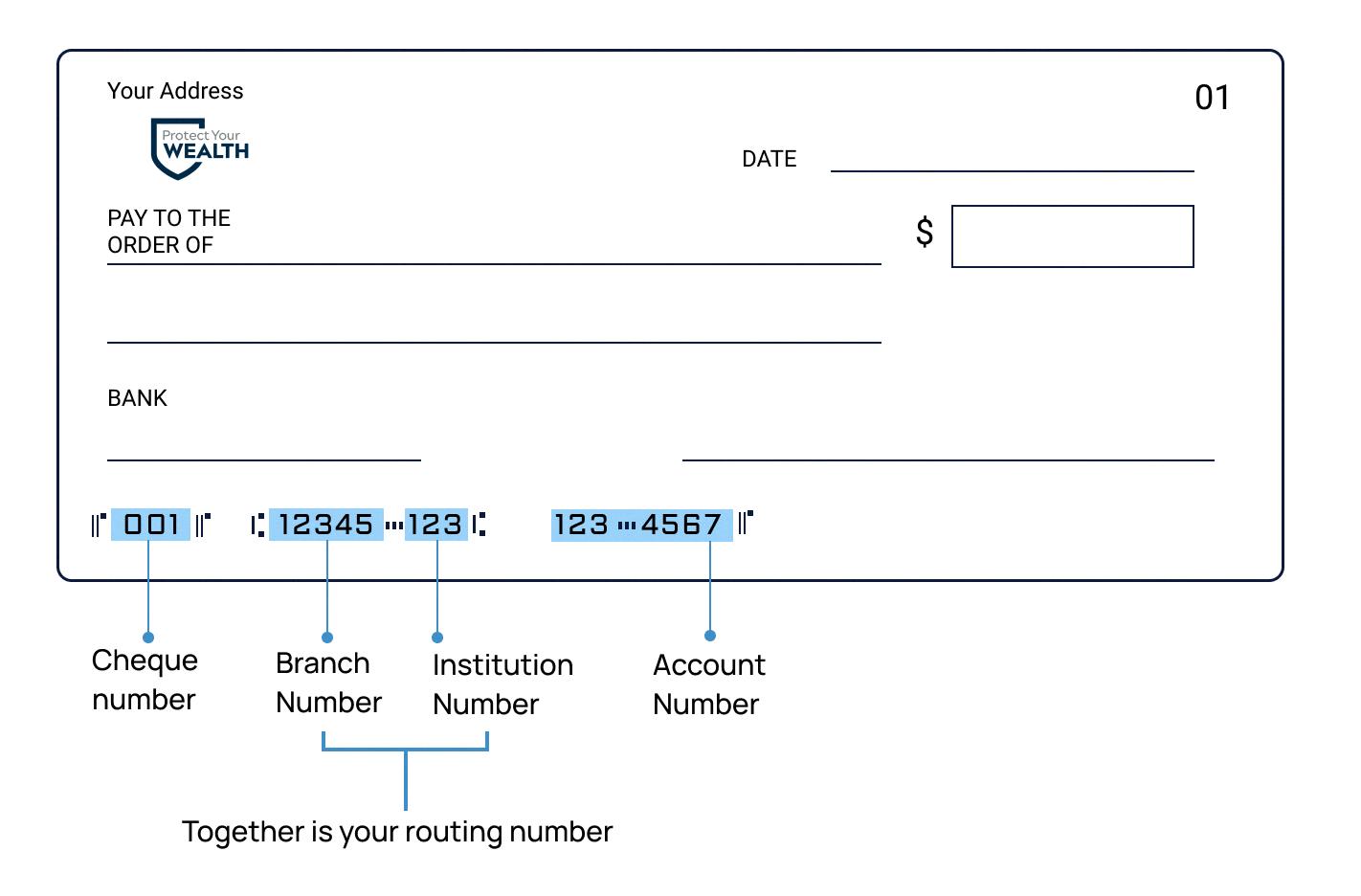

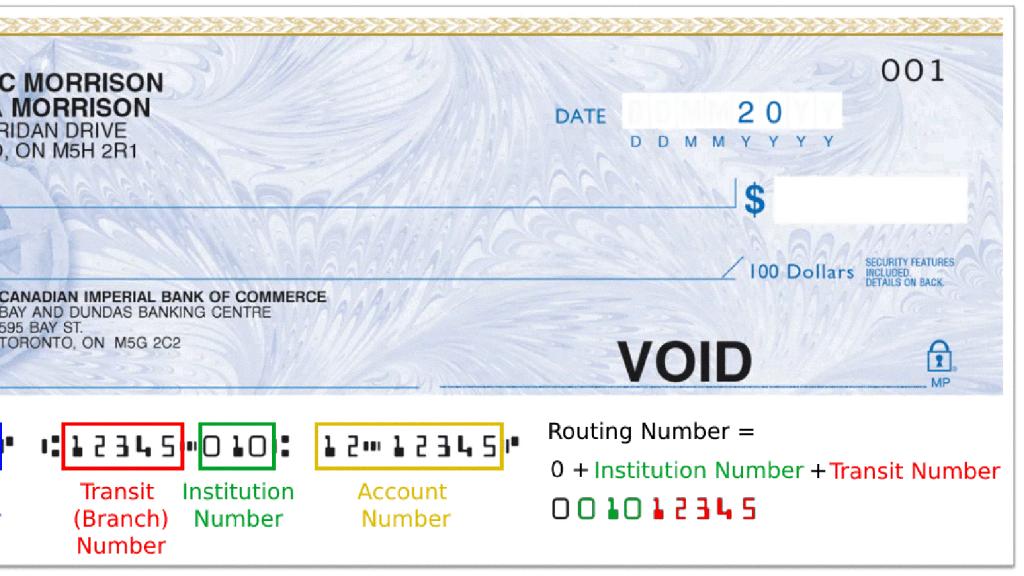

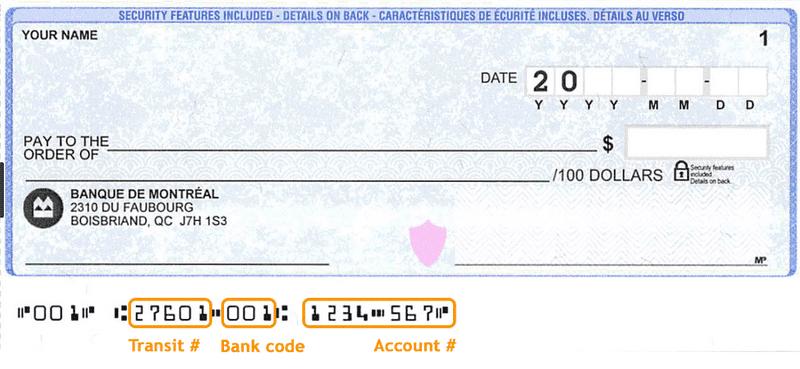

There are several ways to find your ELGA routing number. The easiest way is to check your ELGA checks. Your routing number will be printed on the bottom left-hand corner of your check. Another way to find your routing number is to log in to your ELGA online banking account. Your routing number is typically displayed in your account information, or you can contact ELGA customer service for assistance.

Knowing your ELGA routing number is essential for completing financial transactions. It is a unique nine-digit code that identifies ELGA Credit Union in financial transactions. You can find your routing number on your ELGA checks or by logging in to your ELGA online banking account. If you have any questions or concerns abot your routing number, contact ELGA customer service for assistance.

What Is My ELGA Account Number?

Your ELGA account number is a unique identification number that is assigned to your account. You can find your ELGA account number on the top of your monthly statement on the right hand side. It will typically be a series of digits that are specific to your account. You can use this number to access your account information online, make deposits or withdrawals, and manage your account. If you are unable to locate your ELGA account number, you can contact customer service for assistance. They will be able to provide you with your account number and answer any oher questions you may have about your account.

Source: protectyourwealth.ca

Can I Overdraft My ELGA Credit Union Account?

You can overdraft your ELGA Credit Union account if you have opted-in for our overdraft services. Our overdraft service allows you to overdraw your account up to a certain limit, whih is determined based on your account history and creditworthiness. However, please note that overdrawing your account does come with fees and interest charges, which can vary depending on the amount overdrawn and the length of time it takes to repay the balance. Therefore, we recommend that you use our overdraft service responsibly and only when necessary to avoid incurring unnecessary fees and charges. If you have any further questions about our overdraft services or how to opt-in, please feel free to contact us or visit one of our branches.

Understanding the Meaning of a MICR Number in Banking

A MICR number, also knwn as Magnetic Ink Character Recognition number, is a unique code assigned to a bank account that is used for automatic deposits and withdrawals. This code is printed using magnetic ink on the bottom of checks, making it easily scannable by machines. The MICR number typically consists of a routing number, account number, and check number. It is essential to have the correct MICR number when setting up automatic payments, direct deposit, or any other electronic transfer of funds. You can easily find your MICR number on the bottom of your checks, or by logging into your digital banking account and accessing your account details.

What is a Plan Lead Account Number?

A Plan Lead Account Number is a designated account withn your bank that is responsible for paying any fees required by your Bank Plan. This account acts as the primary account holder that is responsible for paying monthly Plan fees and transaction fees. It is typically the main account used for managing your banking activities and serves as the primary point of contact between you and your bank. The Plan Lead Account is also used to determine the number of reward miles you have earned through your banking activities. The number of reward miles earned is rounded down to the nearest whole number and credited to the Plan Lead Account. By designating a Plan Lead Account, you can easily manage your banking activities and ensure that you are meeting all of your financial obligations while earning rewards in the process.

Locating My Account Number

Looking up your account number is a straightforward process that can be done in a few diffrent ways depending on your banking institution. One of the easiest ways is to simply check your account statement or online banking portal, as your account number is typically displayed prominently on these documents. If you don’t have access to your statement or online banking account, you can also call your bank’s customer service hotline and request your account number. Additionally, your account number can be found on the bottom of your checks, usually in the second set of numbers printed on the bottom left-hand side. Another option is to visit your bank in person and show a valid form of identification, such as a driver’s license, to retrieve your account number. By using any of these methods, you should be able to quickly and easily look up your account number and access your banking information.

Source: cansumer.ca

Maximum Withdrawal Amount From Overdraft Account

As per the latest announcement by the Reserve Bank of India, overdraft and cash credit account holders can now withdraw up to Rs 50,000 in a week. This is an increase from the previous limit of Rs 25,000 per week. This relaxation in cash withdrawal norms is aimed at providing more liquidity to individuals and businesses during the ongoing COVID-19 pandemic. It is important to note that this limit is applicable only to overdraft and cash credit accounts and not to savings accounts, for which the withdrawal limit remains unchanged at Rs 24,000 per week.

Withdrawing Money When Overdrawn

If you have opted in to debit card and ATM overdraft, you may be able to withdraw money even if you do not have enouh funds in your account. However, this will depend on the policies of your bank or financial institution. It is important to note that if you make a withdrawal or purchase that exceeds your available balance, you will likely incur fees and interest charges. These fees can add up quickly and make it even more difficult to get back on track financially. Additionally, if you have not opted in to overdraft protection, your transaction may be declined if you do not have sufficient funds in your account. It is always a good idea to monitor your account balance regularly and avoid relying on overdraft protection as a long-term financial strategy.

How Long Can a Credit Union Account Remain Negative?

However, in general, credit unions may allow accounts to become negative due to overdrafts or other fees. The length of time an account can remain negative may vary depending on the credit union’s policies and the specific circumstances of the account. It is important to review your credit union’s account agreement and speak with a representative to fully understand their policies and any fees or consequences associated with having a negative balance.

What Financial Institution Has Routing Number 125108272?

The bank that has routing number 125108272 is Columbia State Bank. This routing number is used for electronic transactions such as direct deposits, wire transfers, and automatic bill payments. Columbia State Bank is located in Lakewood, Washington and can be contacted at (253) 471-5075 for any further inquiries.

Source: cnb.com

Routing Number 082901538

The routing number 082901538 belongs to First Security Bank, which is located at 110 East Race Street in Searcy, Arkansas. This number is used for Automated Clearing House (ACH) transactions, which is a type of electronic fund transfer commonly used for direct deposit, bill payments, and other transactions. It is important to note that routing numbers are unique to each bank and are used to identify the financial institution when processing electronic transactions. So, if you are conducting a transaction with First Security Bank, you will need to use this routing number to ensure it is processed correctly.

Are MICR and Routing the Same?

MICR and routing are not the same thing, althogh they are related. MICR stands for Magnetic Ink Character Recognition, and is a special font used to print numbers and characters on checks and other financial documents. The purpose of MICR is to allow banks and other financial institutions to easily scan and read the information on the check, using magnetic ink recognition technology.

The routing number, on the other hand, is a specific set of nine digits printed in the MICR font on the bottom-left corner of a check. This number is used to identify the financial institution where the account is held, and is used to process transactions between different banks.

So, while MICR is the type of font used to print the routing number, they are not interchangeable terms. The routing number is just one piece of information that is printed using the MICR font, and is crucial for ensuring that checks are processed accurately and efficiently.

Finding a Routing Number Without a Check

If you don’t have a check, tere are a few ways to find your routing number. One way is to log into your online banking account and look for the routing number listed in your account information. Another option is to call your bank’s customer service line and ask for the routing number. You can also check your bank’s website or mobile app, as many banks include the routing number in their online resources. If you have a bank statement, you can find the routing number listed at the bottom of the statement. Lastly, you can visit your bank in person and ask a teller for your routing number.

Are ACH and Routing Numbers the Same?

ACH and routing numbers are not exacty the same, although they do share similarities. A routing number is a nine-digit code used to identify a financial institution for paper or check transfers. On the other hand, an ACH routing number is also a nine-digit code, but it is used specifically for electronic transfers. In other words, while both ACH and routing numbers serve the purpose of identifying a financial institution, they are used for different types of transactions. So while an ACH routing number is technically an ABA routing number, it is used specifically for electronic transfers rather than paper or check transfers.

Source: policyme.com

Conclusion

The ELGA Credit Union routing number is a vital piece of infomation for members who need to make automatic deposits or withdrawals from their account. This number, 272480115, can be easily found on the bottom of checks or by accessing the account details in digital banking. Additionally, knowing this routing number can help members avoid errors or delays when making financial transactions. At ELGA Credit Union, we strive to provide our members with the resources and information they need to manage their finances effectively. By providing clear and concise information about our routing number, we hope to empower our members to make informed financial decisions and achieve their goals.