If you’re in the process of applying for a mortgage, you may have heard the term “DU approval” mentioned. But what exactly is DU approval, and why is it so important?

DU (Desktop Underwriter) is an underwriting system created by Fannie Mae, a government-sponsored enterprise that purchases and securitizes mortgages. The system uses a set of business rules to evaluate loan application and credit report data against Fannie Mae’s Selling Guide to determine whether or not the loan will meet Fannie Mae’s credit policies.

So, what does this mean for you as a borrower? Essentially, if your loan is approved by DU, it means that Fannie Mae has determined that your loan meets their credit policies and is eligible for sale and delivery to them. This can be a huge advantage when it coms to securing a mortgage, as lenders are often more willing to offer favorable terms and rates for loans that are DU-approved.

To obtain DU approval, you’ll need to gather and complete a 1003 mortgage application form, and obtain consent from the borrower to order credit, income, employment, and asset verification reports. You’ll also need to order an automated VOE/VOI report, which verifies the borrower’s employment and income information. It’s important to explain the verification of assets (VOA) process to the borrower, and confirm that they have executed the VOA process.

Once all of this information has been gathered and submitted to DU, the system will use its business rules to evaluate the loan and determine whether or not it meets Fannie Mae’s credit policies. If the loan is approved, you’ll receive a front page of an Automated Underwriting System decision (AUS), typically a Fannie Mae DO or DU approval, along with a letter from the lender stating your credit-worthiness.

In addition to making it easier to secure a mortgage, DU approval can also help streamline the underwriting process. Because the system uses automated rules to evaluate loan applications, it can help reduce the need for manual underwriting, which can be a time-consuming and labor-intensive process.

DU approval is an important factor to keep in mind when applying for a mortgage. By ensuring that your loan meets Fannie Mae’s credit policies, you can increase your chances of securing favorable terms and rates, and streamline the underwriting process. So if you’re in the process of applying for a mortgage, be sure to ask your lender about DU approval, and work with them to gather all the necessary information to obtain it.

Understanding the DU Approval Process for Mortgages

A DU approval is a highly sought-after designation in the mortgage industry. DU stands for Desktop Underwriter, which is a software program developed by Fannie Mae, one of the largest providers of mortgage financing in the United States. Essentially, a DU approval is an automated underwriting system that evaluates a borrower’s creditworthiness by analyzing their credit report, income, and other financial data.

The DU approval process is designed to streamline the mortgage application process by providing lenders with an immediate decision on whther or not a borrower meets Fannie Mae’s credit policies. This can save both time and money for both the lender and the borrower.

To obtain a DU approval, a borrower must submit their loan application and credit report data to their lender. The lender will then input this information into the DU system, which will evaluate the borrower’s creditworthiness based on Fannie Mae’s guidelines. If the borrower meets these guidelines, they will receive a DU approval, which means that they are eligible for a mortgage loan from Fannie Mae.

It’s important to note that a DU approval is not a guarantee of a mortgage loan. While it does indicate that the borrower meets Fannie Mae’s credit policies, there are still other factors that could impact their ability to obtain a mortgage, such as their debt-to-income ratio or employment history. However, having a DU approval can be a significant advantage when applying for a mortgage, as it demonstrates to lenders that the borrower is a low-risk candidate for a loan.

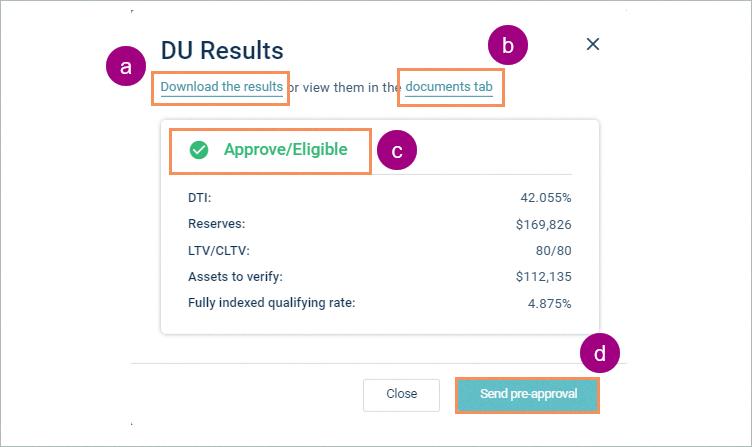

Source: help.blend.com

Obtaining DU Approval

To obtain DU (Desktop Underwriter) approval, you will need to follow these steps:

1. Complete a loan application: You will need to fill out a 1003 mortgage application form which includes details of your income, employment, assets, and credit history.

2. Order verification reports: You will need to obtain consent from the borrower to order credit, income, employment, and asset verification reports. These reports will be used to verify the information provided in the loan application.

3. Automated VOE/VOI report: You will also need to order an automated verification of employment/verification of income (VOE/VOI) report. This report will provie information on the borrower’s employment and income directly from the employer.

4. Verification of assets (VOA) process: You will need to explain the VOA process to the borrower. This process involves verifying the borrower’s assets, such as bank accounts and investments, to ensure they have the funds necessary to cover the down payment and closing costs.

5. Confirm execution of VOA process: you will need to confirm that the borrower has executed the VOA process and that all necessary documents have been provided.

Once these steps are completed, the lender will submit the loan application and verification reports to the DU system. The system will then analyze the information and provide a recommendation for approval or denial of the loan. If approved, the lender will receive a DU approval which indicates that the loan meets Fannie Mae’s underwriting guidelines.

Understanding DU in Underwriting

DU stands for Desktop Underwriter, which is an underwriting system developed by Fannie Mae, the government-sponsored enterprise that provides liquidity to the mortgage market. DU is a powerful tool that helps lenders efficiently complete credit risk assessments to determine whther a home loan is eligible for sale and delivery to Fannie Mae. It is an industry-leading underwriting system that uses automated technology to analyze a borrower’s creditworthiness and calculate their ability to repay the loan. DU takes into account a variety of factors, including the borrower’s credit history, income, assets, and liabilities, and uses this information to provide a comprehensive assessment of the borrower’s risk profile. The system is easy to use and provides lenders with a streamlined process for underwriting loans, which helps to reduce costs and improve efficiency. DU is an essential tool for lenders who want to ensure that their loans are of high quality and meet the standards set by Fannie Mae.

What Is a DU Pre-Approval?

A DU, or Desktop Underwriter, is not a pre-approval on its own. It is an automated system used by lenders to evaluate a borrower’s creditworthiness and determine whether they meet the eligibility requirements for a particular loan program. However, a DU approval can be a significant factor in obtaining a pre-approval. A lender will typically use the information provided by the borrower, including income, employment, and credit history, to run a DU analysis. If the borrower meets the requirements, the DU will provide an approval or a refer decision, which means the loan will need to be manually underwritten. A DU approval can strengthen a borrower’s pre-approval application by demonstrating to the seller that the borrower has been thorouhly vetted and is likely to be approved for the loan. Therefore, while a DU is not technically a pre-approval, it is an essential part of the pre-approval process.

Can Mortgage Applications Be Denied During Underwriting?

A mortgage can be denied during the underwriting process. Underwriting is the process of reviewing your loan application and verifying your financial information to determine if you qualify for a mortgage. During this process, the lender may discover information that was not disclosed on your application or find that you do not meet their lending criteria.

There are several reasons why a mortgage can be denied during underwriting. For example, if your credit score has dropped significantly since you applied for the loan, or if you have taken on new debt, this cold affect your ability to qualify for the loan. Additionally, if the lender discovers discrepancies or errors in your application, this could also lead to denial.

It is important to note that even if you are pre-approved for a mortgage, this does not guarantee that you will be approved during underwriting. Pre-approval is based on an initial review of your financial information, while underwriting involves a more thorough review of your financial history and current situation.

If your mortgage is denied during underwriting, you should work with your lender to understand the reasons for the denial and what steps you can take to address any issues. You may also want to consider working with a different lender or revisiting your financial goals and plans before applying for another mortgage.

What Happens After a Mortgage is Approved by an Underwriter?

After an underwriter approves a mortgage, the next step in the process is typically the formal offer and exchange of contracts. This involves the lender providing a formal mortgage offer to the borrower, which outlines the terms and conditions of the mortgage, including the interest rate, repayment schedule, and any fees or charges associated with the loan.

It’s important to note that even after approval, the lender does reserve the right to withdraw the application if circumstances change. For example, if the borrower’s financial situation canges significantly or if the property being purchased is found to have issues that affect its value, the lender may choose to withdraw the offer or change the terms of the mortgage.

Once the offer has been accepted and contracts have been exchanged, the mortgage funds will typically be transferred to the borrower’s solicitor or conveyancer, who will then complete the purchase of the property on behalf of the borrower. At this point, the borrower will officially become the owner of the property and will be responsible for making regular mortgage payments according to the terms of the loan.

Comparing a DU and a Pre Approval

A DU (Desktop Underwriter) loan approval can be considered better than a simple pre-approval in some ways. While a pre-approval generally involves basic information about your finances and creditworthiness, a DU loan approval involves a more detailed analysis of your financial situation. This includes verifying your income, employment, credit score, and debt-to-income ratio.

The process of obtaining a DU loan approval involves inputting your financial information into a software program that analyzes your creditworthiness based on the lender’s criteria. This analysis can provide a more accurate evaluation of your ability to qualify for a mortgage loan and the amount you can afford to borrow.

Moreover, a DU loan approval can help differentiate you from other homebuyers in a competitive market because it shows more detailed information than a simple pre-approval. This can give you an advantage when making an offer on a home, as it demonstrates to the seller that you have already undergone a rigorous financial analysis and are likly to be a reliable borrower.

While both a pre-approval and DU loan approval can be useful tools for homebuyers, a DU loan approval can offer more detailed information and potentially give you an advantage in a competitive market.

Understanding the Meaning of ‘Du Approve Ineligible’

When it comes to mortgage loans, lenders use a tool called Desktop Underwriter (DU) to evaluate the borrower’s creditworthiness and determine the level of risk associated with the loan. Based on this evaluation, DU provides lenders with one of three possible recommendations: Approve/Eligible, Approve/Ineligible, or Refer with Caution.

Approve/Ineligible means that DU has determined that the risk associated with the loan is acceptable, but the loan is not eligible for delivery to Fannie Mae. Fannie Mae is a government-sponsored enterprise that buys mortgages from lenders, providing lenders with funds to make more loans. Since loans that are generated using DU are often sold to Fannie Mae, being ineligible for delivery to Fannie Mae can be a significant limitation for the lender.

There are several reasons why a loan might be classified as Approve/Ineligible. For example, the borrower’s credit score may be too low, the loan amount may be too high, or the property may not meet Fannie Mae’s eligibility criteria. In some cases, lenders may still choose to approve the loan and sell it to another investor, but they will need to find a buyer who is willing to take on the additional risk associated with an ineligible loan.

DU’s Approve/Ineligible recommendation means that the loan is considered acceptable from a risk perspective, but it cannot be sold to Fannie Mae. This limitation can make it more challenging for lenders to find investors who are willing to purchase the loan, but it does not necessarily mean that the loan will be denied.

What Does ‘DU’ Stand For in Real Estate?

In real estate, DU stands for “Dwelling Unit.” A Dwelling Unit is a self-contained living space witin a larger building or complex that can be used for residential purposes. This could be a single-family home, an apartment, a townhouse, or a condominium. Each DU typically has its own entrance, kitchen, bathroom, and living area, and is designed to be a self-sufficient living space for one or more individuals or families. In real estate, the term “DU” is commonly used to refer to the number of separate living spaces within a particular property, as this can impact the property’s value, zoning regulations, and other factors.

Doing a DU For FHA Loans

We do run DU for FHA loans. DU stands for Desktop Underwriter, which is a software system developed by Fannie Mae that helps underwriters evaluate mortgage loan applications. When a borrower submits an FHA loan application, the lender can run it through DU to obtain an automated underwriting recommendation. This can help speed up the underwriting process and provide more accurate and consistent underwriting decisions. However, it’s important to note that DU is just one tool that lenders use to evaluate loan applications, and the final decision on whether to approve a loan ultimately rests with the lender.

Verifying Income with Du

DU or Desktop Underwriter is an automated underwriting system used by mortgage lenders to evaluate a borrower’s creditworthiness and determine the eligibility for a mortgage loan. To verify a borrower’s income, DU uses various third-party sources such as the borrower’s tax transcripts, W-2 forms, and pay stubs to validate the borrower’s employment and income information.

DU also uses its proprietary database, called the Verification of Employment and Income (VOE/I) database, to verify a borrower’s employment and income information. This database contains inormation from over 100 million employer records, including payroll data, tax records, and other employment-related information.

If the borrower’s employment and income information cannot be verified through these sources, DU may request additional documentation from the borrower, such as bank statements or other financial records.

It is important to note that DU validation service uses information provided by third-party verification reports to validate borrowers’ employment, income and asset data on a per-borrower per-component level. This means that the loan officer may not need to collect paper documents for validated employment, income and/or asset data in most cases.

Rejection After Pre-Approval: Is It Possible?

It is possible to get rejected after pre-approval for a mortgage. Pre-approval is the first step in the process of obtaining a mortgage, but it is not a guarantee that you will be approved for a loan. This is because pre-approval is based on an initial assessment of your financial situation, including your credit score, income, and debt-to-income ratio. However, during the underwriting process, the lender will conduct a more thorough examination of your financial history, including verifying your income and assets, checking your credit report, and reviewing your employment status. If any issues arise during this process that were not initially identified during pre-approval, the lender may reject your application. Common reasons for rejection include chnges in your financial situation, such as a loss of income or a significant increase in debt, or issues with the property appraisal. It’s essential to keep in mind that pre-approval is not a guarantee of approval, and it’s crucial to maintain financial stability and avoid making significant changes to your financial situation during the underwriting process to increase your chances of approval.

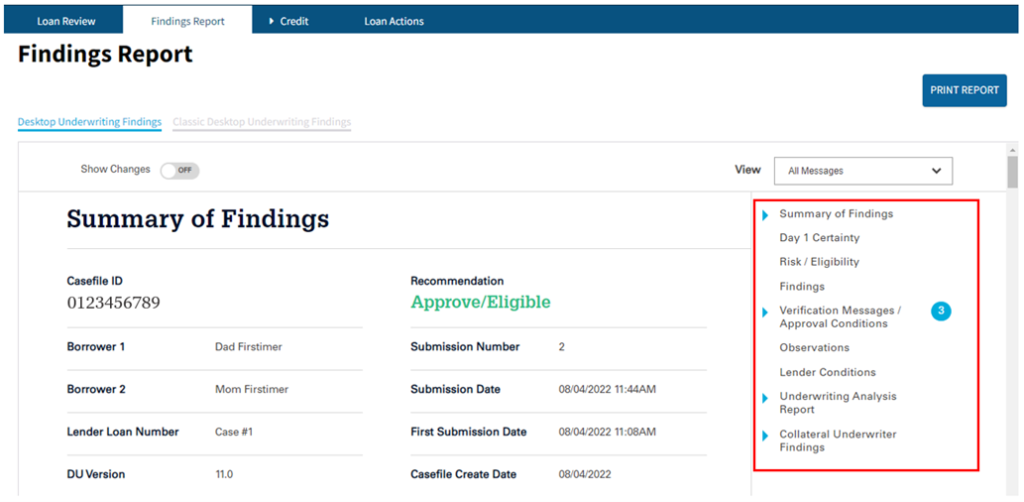

Interpreting DU Findings

The DU Underwriting Findings report is an important document that provides a comprehensive summary of the underwriting recommendation and eligibility component of a loan casefile. Essentially, it is a report generated by Fannie Mae’s Desktop Underwriter (DU) system, which analyzes the borrower’s creditworthiness and determines whether they meet the lender’s criteria for approval.

The report contains a wealth of information for the lender, including the borrower’s credit score, debt-to-income ratio, employment history, and other relevant financial factors. Based on this data, the report provides an overall underwriting recommendation, which can range from “approve” to “refer with caution” to “refer” (meaning the loan application may require furthr review).

In addition to the underwriting recommendation, the report also lists certain steps that the lender must complete in order to finalize the loan processing. These may include obtaining additional documentation or verifying certain information with the borrower or their employer.

The DU Underwriting Findings report serves as a crucial tool for lenders in evaluating loan applications and making informed decisions about whether to approve or deny them.

Conclusion

Obtaining a DU approval is an essential part of the mortgage application process. It provdes lenders with a powerful tool to evaluate a borrower’s creditworthiness and determine the eligibility of a loan for sale and delivery to Fannie Mae. By using the industry-leading underwriting system, lenders can efficiently complete credit risk assessments and establish a home loan’s eligibility. A strong Pre-Approval package typically includes a letter from a lender stating your creditworthiness, accompanied by the front page of a DU approval. This demonstrates to sellers and real estate agents that you are a serious and qualified buyer, which can help you stand out in a competitive market. a DU approval is a valuable asset in the home buying process and is highly recommended for anyone seeking a mortgage loan.