The concept of assets equals liabilities plus equity is an important one in the world of accounting and finance. It is commonly referred to as the balance sheet equation, or the ABCs of Accounting. This equation is used to determine a company’s financial position and povide insight into the overall financial health of a business.

At its most basic, assets equals liabilities plus equity is simply a way of expressing how much money a company has. Assets are the resources owned by a company that have value, while liabilities are debts owed by the company. Equity is the difference between assets and liabilities and reflects the amount that would be available to owners if all liabilities were paid off.

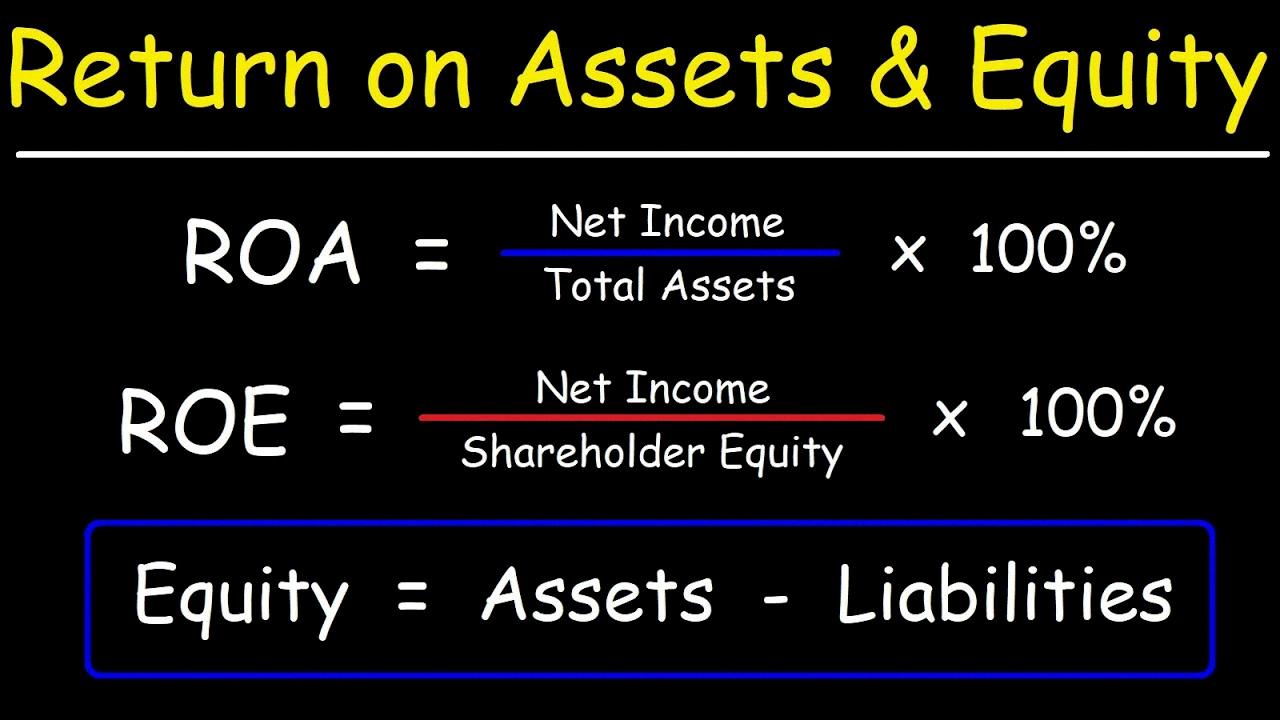

Essentially, assets equals liabilities plus equity tells you how much money a business has avilable after all its debts have been paid off. This useful equation can be used to calculate financial ratios such as return on investment (ROI), debt-to-equity ratio, working capital ratio, and more. It can also be used to analyze how well businesses are managing their finances over time by comparing assets and liabilities from different periods.

The formula for assets equals liabilities plus equity also serves as an important reminder for businesses that they need to manage their finances properly in order to remain profitable and successful in the long run. When companies take on too much debt or fail to invest enough in their operations, it can lead to serious cash flow problems that could put them at risk of insolvency or bankruptcy. Understanding this equation can help businesses ensure they remain financially healthy by helping them make informed decisions on when and whre to invest their funds.

In conclusion, understanding the concept of assets equals liabilities plus equity is essential for any business looking to remain financially secure over time. By applying this equation regularly and using it as part of ongoing financial analysis, businesses can ensure they are making smart investments that will help sustain their long-term growth and profitability.

The Relationship Between Assets, Liabilities, and Capital

Assets represent the resources controlled by a business that can be used to generate income. Liabilities, on the other hand, are amounts owed to creditors while capital is investment from owners. When we combine liabilities and capital, we get the total funding used to purchase assets. Therefore, assets are equal to liabilities plus capital because they represent the total amount of money that has been used to purchase and invest in resources that generate income.

The Basic Accounting Equation Formula

The basic accounting equation formula is Assets = Liabilities + Owner’s Equity. This equation, also knon as the Balance Sheet Formula, can be used to understand the financial position of a business. Assets are the resources owned by a business and are listed on the balance sheet. They include items such as cash, accounts receivable, inventory, investments, and property. Liabilities are amounts that a business owes to others and include accounts payable, notes payable, interest payable, payroll liabilities, and taxes due. Owner’s Equity is the amount of money that belongs to the owners of the business after all liabilities have been subtracted from its assets. This is also known as net worth or capital and can be calculated using the Owner’s Equity Formula: Owner’s Equity = Assets – Liabilities. The Statement of Owner’s Equity is a report that tracks changes in owner’s equity over time due to investments by owners and profits or losses made by the business.

The Formula for Calculating Assets

The asset formula is an equation that is used to calculate a company’s net worth. It states that Assets = Liabilities + Equity. In other words, a company’s assets are equal to the sum of its liabilities and its equity. Assets are items of economic vaue owned by a business, such as cash, investments, property, equipment, and inventory. Liabilities are debts or obligations owed by the business, such as accounts payable and loans payable. Equity is the difference between assets and liabilities—it’s essentially the money that owners have invested in the business. The asset formula helps to give an overall picture of a company’s financial health and can be used to assess its solvency.

Is Total Equity Equal to Liability Plus Capital?

Yes, the total of all assets is equal to the total of liabilities plus capital. The statement of financial position, also known as a balance sheet, is a financial statement that summarizes a company’s assets, liabilities, and equity. Assets represent the resources owed by a company that can be used to generate value or income. Liabilities are obligations owed by the company to external creditors or other parties. Capital is the amount of money invested in or borrowed by the company. The sum of all assets must thus equal the sum of all liabilities and capital in order for the statement to be balanced.

Do Assets Balance Liabilities and Equity?

Yes, assets do equal liabilities plus equity. This is a fundamental concept of business accounting and is often referred to as the accounting equation. The basic formula is Assets = Liabilities + Equity. This equation represents the two sides of a company’s balance sheet: what it owns (assets) and how it is financed (liabilities and equity). The double-entry bookkeeping system ensures that total assets are equal to total liabilities plus shareholders’ equity, which makes up the balance sheet. In other words, if a company acquires an asset, it must be offset by either a liability or an increase in equity.

The Three Accounting Equations

The three accounting equations are the Accounting Equation, Owner’s Equity equation, and Net Worth equation. The Accounting Equation states that Assets equal Liabilities plus Owner’s Capital minus Owner’s Drawings plus Revenues minus Expenses. This equation is a fundamental accounting principle that reflects the financial position of a business at a given time. The Owner’s Equity equation states that Owner’s Equity is equal to Assets minus Liabilities. This equation shows how much of the company is owned by its owners, as well as how much of the company is owed to creditors. The Net Worth equation states that Net Worth is equal to Assets minus Liabilities. This equation reflects how much a business is worth aftr taking into account all liabilities and assets. These three equations are essential in understanding and analyzing any business’s financial standing.

The Accounting Equation

The two accounting equations are fundamental to double-entry bookkeeping and the preparation of financial statements. The first equation is the balance sheet equation, which states that total assets must equal the sum of liabilities and shareholder’s equity: Assets = Liabilities + Shareholder’s Equity. This equation reflects the fact that a company’s assets are funded by either debt or equity.

The second accounting equation is the income statement equation, which states that total revenues must equal total expenses plus net income (or net loss): Revenues = Expenses + Net Income (or Net Loss). This equation demonstrates that a company’s revenues must at least cover its expenses in order to make a profit.

By combining these two equations, businesses can ensure that thir books are balanced and they can accurately report their financial position and performance.

Calculating Equity

The formula for equity is quie simple: Equity = Total Assets – Total Liabilities. This calculation can be found on a company’s balance sheet and is a useful tool to measure a company’s overall financial health.

Equity is the value of a company’s assets aftr subtracting its liabilities, and this equation can give an exact figure of how much equity the company has. It is important to note that if total assets are greater than total liabilities, then the company has positive equity; if total liabilities are greater than total assets, then the company has negative equity.

In conclusion, the formula for equity is Total Assets minus Total Liabilities, and this calculation can be found on a company’s balance sheet. Understanding this equation can help investors evaluate ther investments and make more informed decisions about their money.

The Famous Accounting Equation

The famous accounting equation is an equation that expresses the relationship beween a business’s assets, liabilities, and shareholders’ equity. It states that a company’s total assets are equal to the sum of its total liabilities and shareholders’ equity. The equation is often referred to as the “balance sheet equation” because it reflects the balance between the two sides of a company’s balance sheet.

The famous accounting equation can be expressed mathematically as: Assets = Liabilities + Shareholders’ Equity

Assets represent everything a company owns and can use to generate income. These include cash, accounts receivable, inventory, buildings and equipment, investments, and so on. Liabilities are debts or obligations that must be paid by a business. Examples include accounts payable, loans payable, taxes payable, and so on. Shareholders’ equity represents the ownership interest in a company; it is essentially what remains after all liabilities have been paid off with assets. It includes capital contributed by owners (common stock) as well as any retained earnings (profits).

The famous accounting equation is important because it serves as the foundation for keeping accurate financial records for businesses. By understanding how its elements are related, businesses can make informed decisions about how to invest their resources in order to maximize their long-term success.

Source: youtube.com

Calculating Asset Value

Asset value is calculated by taking the total market value of a company’s assets and subtracting any liabilities. To calculate an asset value, you need to first determine the market value of all the assets owned by the company. This includes both tangible assets such as property, equipment, and inventory, as well as intangible assets such as patents, trademarks, or goodwill. Once you have determined the total market value of all assets owned by the company, you then need to subtract any liabilities from that total. Liabilities include any debts owed to creditors or oher entities, such as loans or accounts payable. The resulting figure is the asset value of the company.

Calculating Total Assets

To calculate total assets, you need to add up the vlue of all the items a business owns. This includes tangible assets such as cash, inventory, and accounts receivable, as well as intangible assets such as goodwill and intellectual property. You can find these values by looking at the company’s balance sheet or financial statements. For example, if a company has $10,000 in cash on hand, $5,000 in inventory, and $20,000 in accounts receivable, its total assets will be $35,000. To calculate Owner’s Equity, you need to subtract Liabilities from Total Assets. You can find this information by looking at a company’s balance sheet or financial statements. For example, if a company has Total Assets of $100,000 and Liabilities of $50,000 then their Owner’s Equity is $50,000.

Calculating Current Assets

Calculating current assets is a fairly straightforward process. First, you need to gather the following information: cash, cash equivalents, marketable securities, accounts receivable, inventory, supplies, prepaid expenses and other liquid assets. Once you have this information in hand, you can calculate your current assets by adding up all thse values. For example:

Current Assets = Cash + Cash Equivalents + Marketable Securities + Accounts Receivable + Inventory + Supplies + Prepaid Expenses + Other Liquid Assets

You can then use this vaue to calculate your current ratio by dividing your current assets by your current liabilities. This will give you an indication of how well your company is managing its short-term financial obligations.

The Difference Between Assets and Liabilities

No, fund balance (also kown as net assets) is not equal to asset minus liability. Fund balance is calculated by subtracting total liabilities from total assets. This calculation results in a number that reflects the financial position of an organization – the amount of money available after liabilities have been paid off. Additionally, fund balance can be used to measure how much has been invested in the organization and how much of that investment remains as a surplus or deficit.

Is Equity the Same as Capital?

No, equity is not equal to capital. Equity represents the total value of a company, including all of its financial assets (capital) as well as its debts. Capital, on the oher hand, only refers to a company’s financial assets that are available to spend. In other words, when you subtract liabilities and debt from equity, what remains is capital. Therefore, while capital is an important component of equity, it does not represent the total amount – which includes liabilities and debt.

Can Liabilities Plus Equity Not Equal Assets?

No, assets cannot not equal liabilities plus equity. This is because the basic accounting equation states that Assets = Liabilities + Equity. All three of these components must be equal for financial statements to be accurate and in balance. If assets do not equal liabilities plus equity, then there is an error in the input of data or the information entered on the tax return does not reconcile with the accounting records of the entity. Therefore, it is important to ensure that all data points are accurately recorded and that all accounts are properly balanced prior to submitting any financial reports.

Conclusion

In conclusion, it is clear that the basic equation of Assets = Liabilities + Equity is essential to understanding the financial position of a business. This equation indicates that assets are funded through either capital invested by the owners or amounts owed to creditors. The Balance Sheet, which is based on this fundamental equation, is an important tool used in accounting to help businesses understand their current financial standing. This statement provides a snapshot of a company’s assets and liabilities, as well as their equity. Understanding the relationship between these three components is key to creating and maintaining a successful business.