As a DoorDash Dasher, you may wonder how to access your pay stubs and other financial information. Unfortunately, DoorDash doesn’t provide pay stubs, but they do offer a way for you to access your earnings and payment information.

If you are on Daily Pay, you will receive an email on weekdays with details about your payment for that day. On Thursdays, if you are on Weekly Pay, you will receive an email with the same information. These emails will provide you with the details of the payments you have received, including the amount, date, and any fees that were deducted.

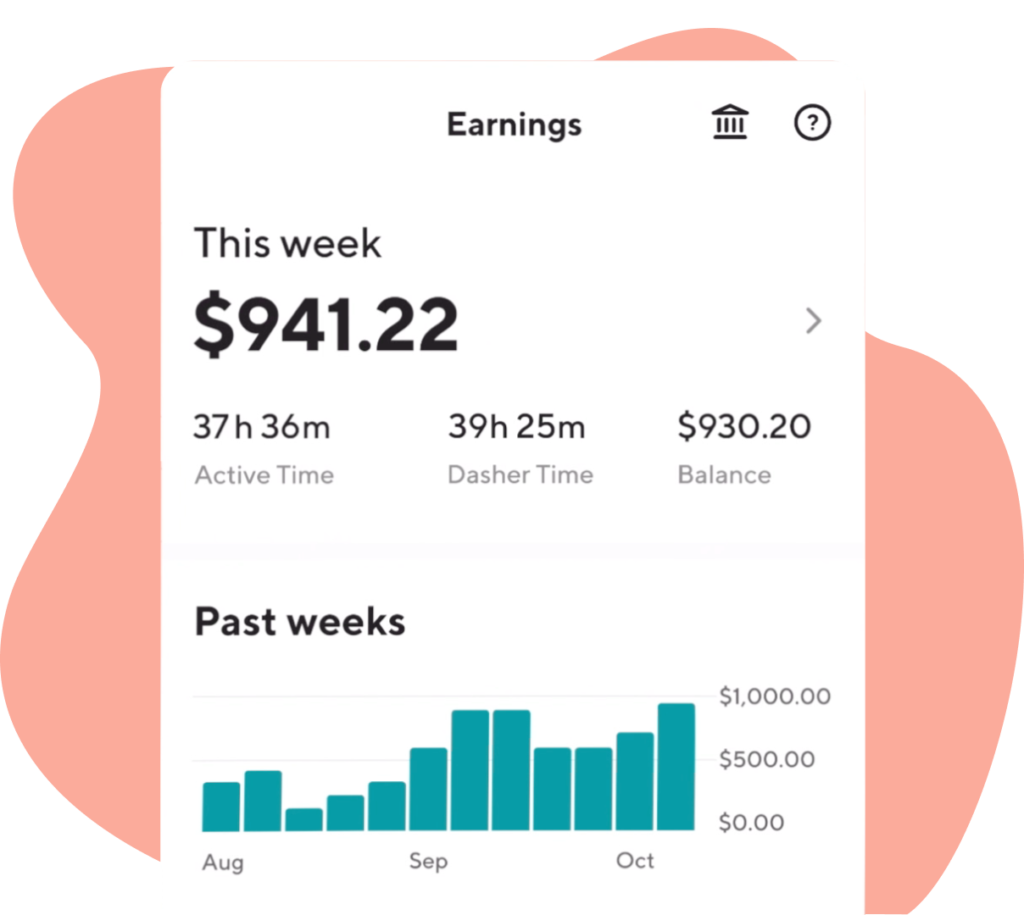

To access your earnings information, you can log into your DoorDash account and go to the ‘Financials’ tab in the Portal. Here, you will be able to view a detailed breakdown of your earnings, including tips and bonuses, as well as any fees that were deducted.

While DoorDash doesn’t provide pay stubs, you can stil use their earnings information to provide proof of income. If you need to provide income verification to a third-party, such as a lender or landlord, you can use DoorDash’s Dasher Income Verification service.

To use this service, you must instruct the third party requiring income verification to submit a request through TrueWork. Once the request is received, DoorDash will verify your income and employment status and provide the necessary documentation to the third party.

DoorDash doesn’t provide pay stubs, but they do offer a way for you to access your earnings and payment information. You can view this information in the ‘Financials’ tab of the Portal, and you can use DoorDash’s Dasher Income Verification service to provide proof of income to third parties.

Accessing DoorDash Pay Stubs

Getting your DoorDash pay stub is a simple process that can be done trough the DoorDash Dasher app or online portal. Here are the steps to follow:

1. Open the DoorDash Dasher app or go to the DoorDash Dasher website and log in to your account.

2. Click on the ‘Earnings’ tab, which is located on the bottom right corner of the screen.

3. Scroll down to the ‘Earnings Summary’ section and click on the ‘View Details’ button.

4. This will take you to your payment history, where you can view your earnings for each delivery you’ve completed.

5. To view your pay stub, click on the ‘Export’ button located at the top right corner of the screen.

6. Select the time period for your pay stub and choose the format in which you want to receive it (PDF or CSV).

7. Once you’ve made your selections, click on the ‘Export’ button and your pay stub will be downloaded to your device.

It’s important to note that DoorDash only provides pay stubs for the current and previous year. If you need pay stubs from previous years, you’ll need to contact DoorDash support for assistance. With these simple steps, you can easily access your DoorDash pay stub and keep track of your earnings.

Source: entrecourier.com

Obtaining Proof of Employment with DoorDash

As an independent contractor with DoorDash, you may not have the same traditional employment documentation as you would with a traditional employer. DoorDash does not provide pay stubs or W-2 forms sine you are not considered an employee. However, there are a few ways you can provide proof of employment with DoorDash.

First, you can provide potential lenders or landlords with your 1099 form, which is a tax document that shows your earnings and expenses as an independent contractor with DoorDash. This document can be downloaded from your DoorDash account under the Tax Information section.

Alternatively, you can provide bank statements that show your regular deposits from DoorDash as proof of income. You can access your bank statements through your banking app or by logging into your online banking portal.

Lastly, you can request a letter of verification from DoorDash that confirms your status as an independent contractor and includes basic information such as your name, the dates you’ve worked with DoorDash, and your earnings. You can request this letter by contacting DoorDash support and providing them with the necessary information.

While DoorDash may not provide traditional employment documentation, there are still ways to provide proof of your income and employment status as an independent contractor with the company.

Using DoorDash as Proof of Income

DoorDash can be used as proof of income, but only if a third-party organization requires income verification. In such cases, you can instruct the third-party organization to submit a request for income verification through TrueWork, which is DoorDash’s income verification service. Once the request is submitted, TrueWork will verify your income with DoorDash and provide the necessary documentation to the requesting organization. However, if you are simply looking for a record of your DoorDash earnings for personal use, you can access your earnings statements through the DoorDash app or website.

Does DoorDash Count as Employment?

Doing DoorDash does not count as being employed in the traditional sense. DoorDash drivers are considered independent contractors rather than employees. This means that they are not entitled to employee benefits such as health insurance, paid time off, or workers’ compensation, and they are responsible for paying their own taxes. As an independent contractor, DoorDash drivers have more control over their work schedule and the way that they complete their deliveries, but they also have less job security and fewer protections than traditional employees.

Tracking Requirements for DoorDash Drivers

As a DoorDash driver, it’s important to keep track of several things to ensure you’re maximizing your earnings and staying organized. First and foremost, you’ll need to track your mileage. This means recording the distance you drive from the moment you accept a delivery to the time you drop it off. Keeping track of your mileage is essential because it is one of your deductible expenses come tax season. You can use a mileage tracker app or simply write down your mileage manually.

You’ll also need to keep track of your earnings. DoorDash provides you with an earnings statement, but it’s alwas a good idea to keep your own record of your earnings. This will help you keep track of how much you’re making and ensure you’re getting paid accurately. You can use a spreadsheet or a financial tracking app to keep track of your earnings.

In addition to mileage and earnings, you should also keep track of your expenses. As an independent contractor, you’re responsible for your own expenses, including gas, car maintenance, and any necessary supplies (e.g., insulated delivery bags). Keeping track of your expenses is crucial because you can deduct many of them from your taxes to reduce your taxable income.

Lastly, it’s a good idea to keep a record of your schedule. This will help you stay organized and ensure you don’t miss any deliveries. You can use a calendar app or a planner to keep track of your schedule.

As a DoorDash driver, you need to keep track of your mileage, earnings, expenses, and schedule. By doing so, you’ll ensure you’re maximizing your earnings, staying organized, and reducing your tax liability.

Is DoorDash an Employer?

DoorDash does not count as an employer since they classify their drivers as independent contractors. This means that DoorDash does not provide benefits or withhold taxes from a driver’s earnings. Instead, drivers are responsible for keeping track of their earnings and paying taxes on their own. However, DoorDash does have certain requirements and expectations for its drivers, such as maintaining a certain rating and completing orders in a timely manner.

Does the IRS Track Income from DoorDash?

The IRS is aware of your earnings as a DoorDash driver. DoorDash is required by law to report the income of its drivers to the IRS. This means that any money you earn as a DoorDash driver is subject to taxation, and you are responsible for reporting your earnings on your tax return. You will receive a 1099-NEC form from DoorDash that will detail your earnings for the year. It is important to keep accurate records of your earnings and expenses as a DoorDash driver to ensure that you pay the correct amount of taxes and avoid any penalties or fines from the IRS. So, it’s essential to report your earnings accurately and timely to the IRS to maintain your financial records clean and avoid any discrepancies with the IRS.

Does DoorDash Get Reported to the IRS?

DoorDash gets reported to the IRS. If you earn more than $600 duing the calendar year as a DoorDash driver, you will likely receive Form 1099-NEC from DoorDash. This form will report your earnings and will also be sent to the IRS. It is important to accurately report this income on your tax return to avoid potential penalties or audits. The IRS may review your financial records to ensure that your income is reported correctly and matches what you’ve submitted on your tax return. If you have any questions or concerns about reporting your DoorDash income, it is recommended that you consult with a tax professional.

Paying Taxes to the IRS for DoorDash Earnings

As a DoorDash driver, you are considered a self-employed independent contractor and are responsible for paying federal and state taxes on your earnings. This means that DoorDash will not withhold taxes from your earnings, and you will need to calculate and pay the taxes yourself. You will need to file an annual tax return and make estimated tax payments throughout the year to avoid penalties or interest charges. It is important to keep track of all your earnings, expenses, and receipts related to your DoorDash work to accurately calculate your tax liability.

Conclusion

DoorDash does not provde its Dashers with traditional pay stubs. Instead, Dashers receive their earnings through direct deposit and are able to access their financial information on the DoorDash app or website. Daily Pay Dashers receive an email with details about their earnings each weekday, while Weekly Pay Dashers receive this email on Thursdays. If a Dasher needs to provide proof of income to a third party, they can direct the party to submit a request through TrueWork. While DoorDash may not provide traditional pay stubs, they do offer ways for Dashers to access and verify their earnings when needed.