Are you looking for a way to buy that big-ticket item without havng to pay for it all upfront? Best Buy, one of the largest electronics retailers in the US, may have the solution for you. But the question is, does Best Buy have layaway?

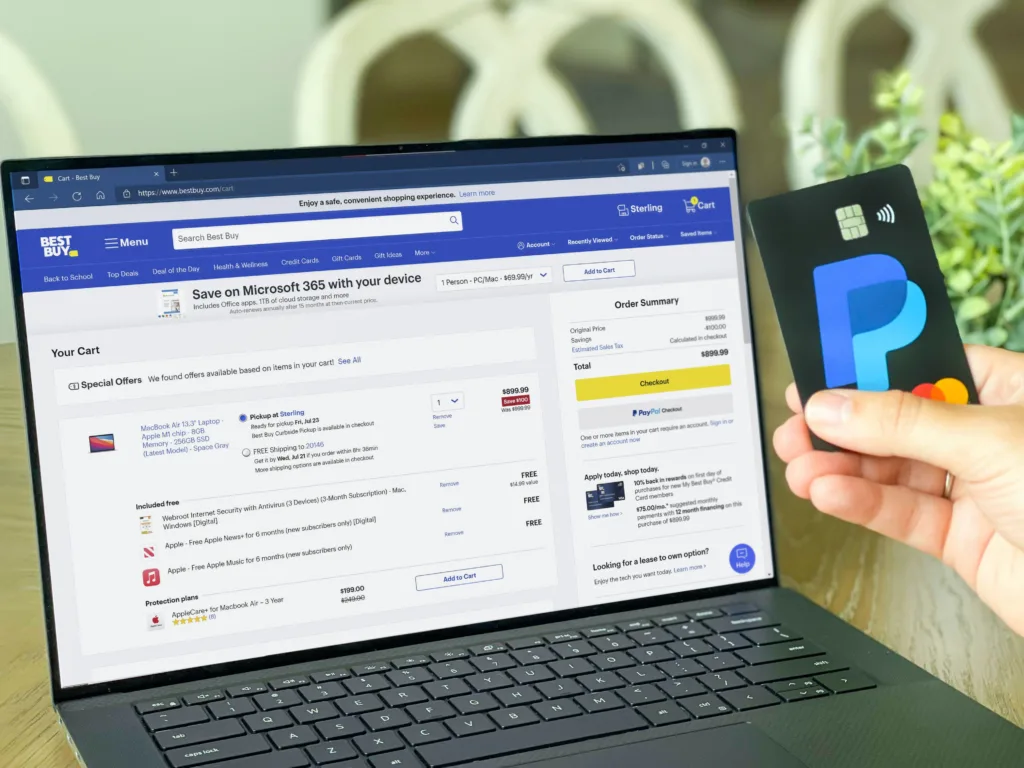

The short answer is no, Best Buy does not offer a traditional layaway program. However, that doesn’t mean you have to pay for your purchase in full upfront. Best Buy has alternative payment options that may work for you.

One popular payment option at Best Buy is their financing program. Best Buy offers financing through their branded credit card, the My Best Buy Credit Card. With this card, you can make purchases at Best Buy and pay them off over time with no interest if paid in full within a promotional period. The promotional period varies based on the amount of your purchase and can range from six to 24 months.

If you don’t want to open a credit card or don’t qualify for one, Best Buy also partners with third-party financing companies. These companies offer installment loans that allow you to pay for your purchase over a set period of time with a fixed interest rate. Some of the third-party financing companies that Best Buy works with include Affirm, Progressive Leasing, and Citibank.

Another payment option at Best Buy is their price match guarantee. If you find a lower price on an identical item at a competitor’s store or website, Best Buy will match the price. This can help you save money upfront and avoid having to finance or pay for the full cost of the item.

While Best Buy does not offer a traditional layaway program, they have alternative payment options that may work for you. From financing through their branded credit card or third-party financing companies to their price match guarantee, Best Buy makes it easy for you to buy what you need without breaking the bank.

Does Target Offer a Layaway Plan?

Unfortunately, Target doesn’t offer a layaway plan as part of its payment options. This means that you won’t be able to reserve an item by making a down payment and then paying for it in installments over a certan period of time. However, Target has other payment options that allow customers to buy items and pay for them over an extended period. For instance, you can use a Target REDcard credit or debit card to make purchases and enjoy a 5% discount on all Target purchases. You can also use a third-party financing option such as Affirm, which allows you to split your purchases into monthly payments with interest. Additionally, Target accepts major credit cards, cash, and checks as payment methods.

Source: seekingalpha.com

Does Walmart or Target Offer Layaway?

Both Walmart and Target have offered layaway programs in the past, but as of 2021, Walmart has discontinued their layaway program and has partnered with Affirm, a buy now pay later program. Target, on the other hand, still offers layaway services for eligible items during the holiday season. However, it’s important to note that the availability of layaway programs may vary by location and season, so it’s best to check with your local Walmart or Target store for the most up-to-date information on their layaway policies.

Can Layaway Be Used Without Credit?

Yes, you can do layaway with no credit. Layaway programs do not require good credit or even any credit at all. Layaway programs allow you to make payments over time for an item you want to purchase, and once you have made all the payments, you can take the item home. Unlike credit cards, layaway programs do not charge interest, so you can avoid paying extra fees. However, it is important to note that some stores may require a down payment or a fee to use their layaway program. So, while you do not need good credit to use a layaway program, you may need to have some money upfront.

Does TJ Maxx Offer Layaway?

Yes, TJ Maxx does offer a layaway plan. The minimum payment they require is $10 or 10% of the purchase – whichevr is greater. TJ Maxx will hold your items for a 30 day period and you can pay on your items at the store – there is no set payment schedule. This can be a helpful option for customers who may not be able to pay for their purchases in full at the time of purchase, but still want to secure their desired items. Keep in mind that TJ Maxx’s layaway plan may vary by location, so it’s best to check with your local store for specific details and requirements.

Does Walmart Offer Layaway?

Yes, Walmart does allow layaway. Layaway is a program that allows customers to make a purchase by paying a deposit and then paying off the balance over time. Walmart’s layaway program allows customers to select items in-store or online, make a down payment of at least $10 or 10% of the total purchase amount, whichever is greater, and then make payments over a period of time. The layaway program is available for select items, including electronics, toys, furniture, and jewelry, among others. Walmart also offers a holiday layaway program that typically starts in September and runs through December. Customers can choose to pay off their layaway balance at any time or make regular payments util the balance is paid in full. Walmart also partners with Affirm to offer financing options for customers who prefer to make payments with interest over a longer period of time.

Source: muskogeephoenix.com

Does Burlington Offer Layaway?

Yes, Burlington offers layaway for merchandise. The layaway program holds items for 30 days with a minimum deposit of $10 or 20%, whichever is greater, and a non-refundable $5 service fee. If the layaway is not completed on time or cancelled, all items will be returned to stock and an additional $10 fee will be charged. This program allows customers to reserve and pay for items over time, making it a convenient option for those who may not have the full amount upfront.

Does Best Buy Offer a Pay Later Option?

Yes, Best Buy does offer a pay later option through their financing plans. Customers can apply for a Best Buy credit card and take advantage of various financing options, including a 12 month deferred financing offer and a 36 month reduced rate credit plan on select products. With the deferred financing offer, customers can purchase eligible items and pay no interest for 12 months, as long as the balance is paid in full by the end of the promotional period. The reduced rate credit plan allows customers to make monthly payments at a lower interest rate for up to 36 months. These financing options provide customers with flexibility and convenience when making purchases at Best Buy.

Does Marshalls Offer Layaway?

Yes, Marshalls does offer a layaway program. This program allows customers to pay for their purchases over time by making small payments until the item is paid for in full. Layaway is available at many Marshalls stores, and you can check if your local store offers this service by checking the store locator on the Marshalls website or by calling the store directly. Layaway is a great option for customers who want to purchase items but may not have the funds to pay for them all at once.

Walmart’s New Layaway Plan

Walmart has announced that it is discontinuing its layaway plan just before the holiday shopping season. Instead, the company will now be offering a new buy now, pay later plan in partnership with a lending company, Affirm. This new plan will allow customers to purchase items at Walmart and pay for them over time in installments. Affirm will be responsible for providing the financing for these purchases, and customers will be able to choose how long they want to take to pay off their purchases, with options ranging from thre to 24 months. This new plan is designed to make shopping at Walmart more affordable and accessible for customers who may not have the funds to pay for purchases outright.

Does Gamestop Offer Layaway?

Yes, Gamestop offers a layaway program for customers who prefer to pay for their purchases over time. With layaway, you can reserve an item by making a down payment and then pay off the remaining balance in installments over a set period of time. Gamestop’s layaway program allows customers to make payments over six weeks with bi-weekly payments using either QuadPay or Klarna. Additionally, with layaway, you can ensure that the item you want is reserved for you, even if you cnnot pay for it in full at the time of purchase. It is important to note that Gamestop’s layaway program may not be available for all items or at all stores, so it is best to check with your local Gamestop for more information.

The Unavailability of Amazon Layaway Items

There are a few reasons why you may not be able to find Amazon Layaway items. Firstly, Amazon Layaway is currently not available to all customers and may not be available on all products. This means that not all items on Amazon are eligible for purchase thrugh the Layaway program. Additionally, Layaway is not available for orders shipping to certain states, such as CT, DC, IL, MD, OH, and PA, as well as for orders shipping outside of the US.

It’s also worth noting that Amazon is constantly working to expand its Layaway program in order to make it available to more customers and on more products. However, the company has not yet announced a specific timeline for when this will happen. In the meantime, you can check the product details of items you’re interested in to see if Layaway is an available payment option, or you can contact Amazon customer service for more information.

Source: forbes.com

Understanding Lazy Pay Credit

LazyPay credit is a fast and convenient way to access credit online. By simply entering your mobile number, you can avail yourself of a personalised credit limit that can be used to confirm online purchases. This credit limit can be used to buy now and pay later when shopping online across a wide range of popular apps and websites, including Swiggy, Zomato, BookMyShow, Airtel and many more. The process of using LazyPay credit is simple and hassle-free, making it an ideal solution for anone looking for a quick and easy way to access credit online. With LazyPay credit, you can enjoy the convenience of shopping online without having to worry about upfront payment, making it an excellent option for those who want to manage their finances in a more flexible way.

What Credit Score is Required to Shop at TJMaxx?

To be approved for the TJX Rewards Credit Card, you typically need a credit score of arond 620 or higher. This means that having fair credit or better is usually required to qualify for the card. It’s worth noting that credit score requirements may vary depending on the lender and other factors, but in general, a credit score of 620 or higher is a good benchmark to aim for if you’re interested in applying for the TJX Rewards Credit Card. You can apply for the card at any TJX-branded location, such as T.J. Maxx, and the application process typically involves a credit check and other approval requirements.

Does Target Offer Layaway for Christmas Shopping?

No, Target doesn’t have a layaway program for Christmas or any other time. Target used to offer layaway services in the past, but it discontinued the program in 2013. Currently, Target doesn’t offer any layaway options on its website or in its stores. However, Target does offer other flexible payment options, including its REDcard, which offers a 5% discount on purchases and the ability to make payments over time. Target also accepts a variety of payment methods, such as credit cards, debit cards, gift cards, and PayPal, to help customers manage their holiday shopping expenses.

Can Online Shopping at Walmart Include Layaway?

Yes, Walmart offers online layaway for eligible items. To use the online layaway service, customers must select the layaway option at checkout and make a down payment of at least $10 or 10% of the total purchase price, whichever is greater. Customers must also make payments every two weeks util the final payment is made, which must be done by the deadline given at checkout. Some items are not eligible for layaway, such as clearance items, groceries, and some electronics. It’s important to note that Walmart may cancel the layaway order if payments are not made on time or if the item becomes unavailable.

Source: flickr.com

The End of Walmart Layaway: An Analysis

Walmart discontinued its year-round layaway program in 2006 for a couple of reasons. One of the main reasons was to reduce costs associated with managing the program. Despite being popular with people with limited disposable income or no credit, the program required a lot of administrative work such as processing payments, managing stock, and tracking layaway items. Additionally, the program was taking up valuable floor space that the retailer wanted to use for oher purposes.

Another reason behind Walmart’s decision to stop layaway was to make room for the ship-to-store service it was starting. This service allowed shoppers to order products online and have them shipped to a Walmart store for pickup, which offered a more convenient and flexible option for customers with busy schedules.

In summary, Walmart discontinued its layaway program to reduce costs, free up space, and make way for a more convenient and flexible service that would better meet the needs of its customers.

Can You Use Affirm to Purchase Groceries?

Unfortunately, groceries are not eligible to be purchased using Affirm. Affirm is a financing option that can be used for select items such as electronics, home appliances, travel, and more. However, groceries fall under the category of everyday essentials and are not currently included in the list of eligible items. If you’re interested in using Affirm for your purchases, it’s important to note that it’s already available at Walmart Inc., where you can use it to buy a variety of products, including electronics, furniture, and more.

When Does Walmart Begin Offering Layaway?

Walmart usually starts its layaway program in late August. The program typically runs through mid-December, giving customers ample time to pay off their items before the holiday season. During this period, customers can put items on hold with a small deposit and make regular payments until the total amount is paid off. However, it’s worth noting that Walmart has announced that it will not be offering its layaway program for the 2021 holiday season.

Comparing Prices at Kohls and Burlington

After comparing the prices of Kohl’s and Burlington, it was found that Burlington was slightly less expensive. However, it is important to note that Kohl’s offered a better shopping experience overall with a wider selection of electronics, order-pickup lockers, and frequent sales to keep prices low. Additionally, Kohl’s has a rewards program that allws customers to earn discounts and cash back on their purchases. While Burlington may have lower prices on some items, the added value and convenience of shopping at Kohl’s may outweigh the slightly higher prices. Ultimately, the answer to whether Kohl’s or Burlington is cheaper may depend on individual shopping priorities and the specific items being purchased.

Conclusion

In conclusion, Best Buy offers a range of payment options for customers who want to make large purchases, including financing, credit cards, and gift cards. The store does not offer a layaway plan, but its financing options can provide customers with the flexibility they need to pay for their items over an extended period. Best Buy’s credit card program offers rewards and benefits for frequent shoppers, and its gift card program is a convenient way to make purchases withut the need for cash or credit. Overall, Best Buy is a great option for those looking to buy electronics and appliances, with a variety of payment options to suit different needs and preferences.