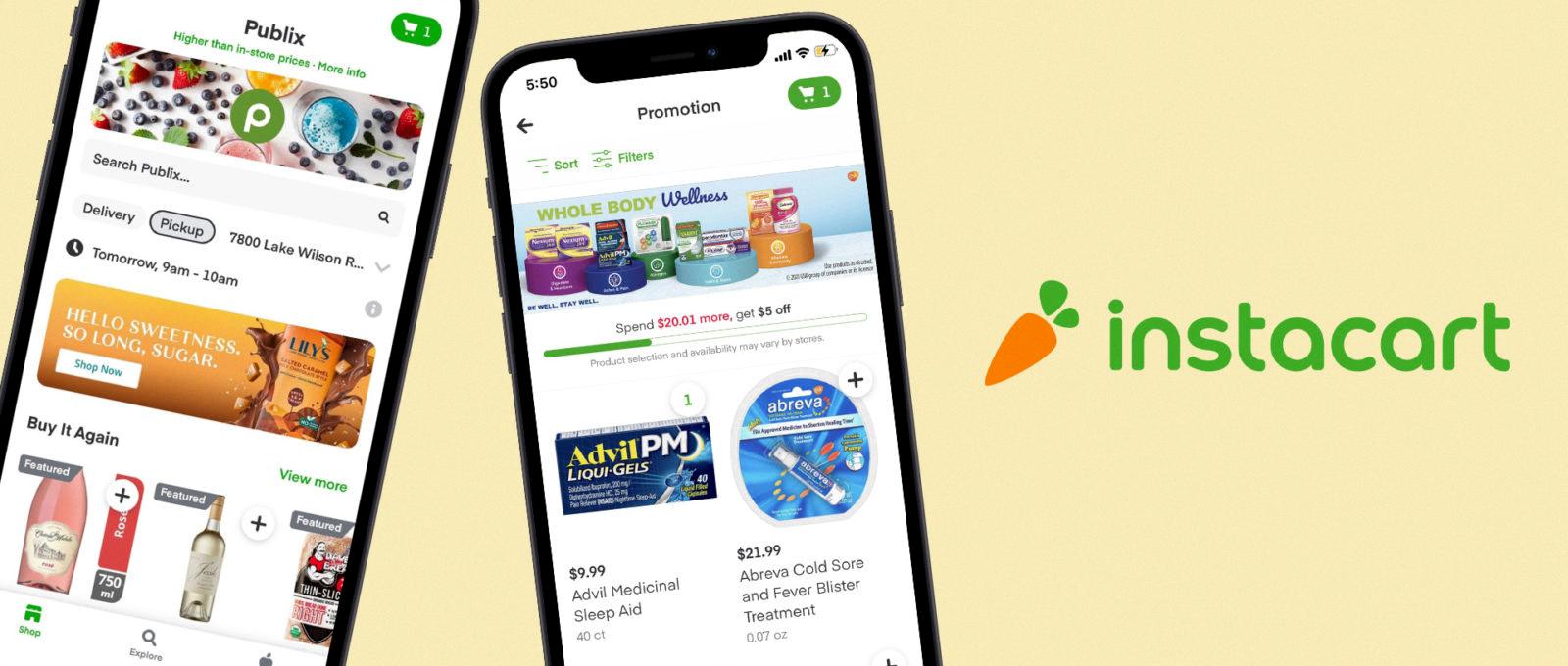

Instacart is a popular on-demand grocery delivery service that allws customers to order groceries online and have them delivered straight to their doorstep. As an Instacart driver, you have the flexibility to work whenever you want and earn money on your own schedule. However, as a self-employed contractor, you may be wondering if you need to report your earnings to the unemployment agency.

First and foremost, it’s important to understand that Instacart drivers are considered independent contractors, not employees. This means that you are responsible for paying both the employee and employer portions of FICA taxes, which totals to 15.3% of your earnings. Additionally, since DoorDash won’t withhold any taxable income for you, you may end up with a higher bill from the IRS come tax season.

That being said, you may still be eligible for unemployment benefits if you meet certain criteria. For example, if you were laid off from another job and are now driving for Instacart to make ends meet, you may be able to collect unemployment while still working for the company. However, if you are earning a steady income from Instacart and are not actively seeking other employment, you may not be eligible for unemployment benefits.

If you do decide to report your Instacart earnings to the unemployment agency, you will need to provide proof of income. This can be done by contacting customer support and requesting a letter confirming your earnings, or by providing bank statements or tax documents as proof of income. It’s important to note that DoorDash will not submit your earnings to the unemployment agency, so you will need to report your earnings yourself to avoid facing any fraudulent charges.

As an Instacart driver, you have the flexibility to work on your own terms and earn money on your own schedule. However, it’s important to understand your tax obligations as a self-employed contractor and to be aware of your eligibility for unemployment benefits. If you do decide to report your earnings to the unemployment agency, make sure to provide adequate proof of income and to stay on top of any changes to your benefits based on your DoorDash earnings.

Does Instacart Qualify as a Form of Employment?

Instacart is a platform that allows individuals to work as independent contractors or self-employed individuals, rather than as traditional employees. This means that whle Instacart drivers do work for the company, they are not considered employees in the traditional sense. Instead, they are responsible for their own taxes, insurance, and other expenses, and they have more flexibility in terms of when and how they work. While this arrangement can offer some benefits, such as the ability to set your own schedule, it also means that Instacart drivers do not have access to the same protections and benefits that traditional employees may receive, such as health insurance, sick leave, or workers’ compensation. Ultimately, whether or not Instacart counts as employment depends on one’s definition of the term, but it is generally considered to be a form of self-employment or independent contracting rather than traditional employment.

Source: reuters.com

Does DoorDash Qualify as Employment?

While DoorDash does provide a way for individuals to earn money through delivering food, it is not considered traditional employment. Instead, DoorDash operates on a model where individuals are independent contractors, which means that they are not considered employees of DoorDash. As an independent contractor, you have more flexibility in terms of when and where you work, but also have to take on more responsibilities such as paying for your own taxes and insurance. While DoorDash does provide some support and resources for their Dashers, they are not considered employers in the traditional sense.

Proving Employment with Instacart

To prove that you work for Instacart, there are a few different options available to you. Firstly, you can provide a copy of your contract or agreement with Instacart, which should include your name, contact information, and details about your role as a shopper. This document will serve as evidence that you are an official Instacart shopper.

Another way to prove that you work for Instacart is to provide your payment statement or earnings report. These documents will show your earnings as an Instacart shopper and provide furher verification of your employment status.

If you need additional proof of employment, you can also reach out to Instacart’s customer support team and request a letter confirming your status as an Instacart shopper. This letter can be used as official documentation to show that you work for the company.

Overall, there are several ways to prove that you work for Instacart, including providing your contract, payment statements, or requesting a confirmation letter from customer support. By using these methods, you can easily verify your employment status as an Instacart shopper.

Can I Work for DoorDash While Receiving Unemployment Benefits in California?

Yes, you can work for DoorDash whle on unemployment in California, but you must report your earnings to the Employment Development Department (EDD). Failure to accurately report your earnings could result in overpayment of benefits and potential penalties. It is important to note that any earnings you make through DoorDash will affect your unemployment benefits. The EDD will adjust your benefits based on the amount of money you earn, and you may receive reduced benefits or no benefits at all if you make too much money. It is also important to keep in mind that the EDD may conduct audits to ensure that you are reporting your earnings accurately, so it is crucial to keep track of your earnings and report them honestly.

Reporting Requirements for Instacart Income

Yes, you are required to report your Instacart income on your tax return. As an independent contractor, you are responsible for paying both self-employment taxes and income taxes on your earnings. If you earn over $400 in a year, you are required to file a tax return and pay taxes on your Instacart income. Instacart will send you a 1099 form if you earn at least $600 in a calendar year, whch you will use to report your income on your tax return. Failing to report your Instacart income can result in penalties and interest charges from the IRS. It is important to keep accurate records of your earnings throughout the year and consult with a tax professional if you have any questions or concerns.

Source: usatoday.com

Does Instacart Report to the IRS?

Yes, Instacart reports your earnings to the IRS. If you earned more than $600 in the previous year, Instacart will send you a 1099 form which shows how much money you made. This form is also sent to the IRS for tax purposes. It’s important to note that even if you don’t receive a 1099 form, you are still responsible for reporting your earnings to the IRS and paying taxes on them. Failure to do so could result in penalties and legal consequences. So, it’s recommended that you keep track of your earnings and expenses troughout the year and consult a tax professional to ensure you file your taxes correctly.

Can I Deduct Gas Expenses for DoorDash Deliveries?

Yes, DoorDash drivers can write off gas as a deductible expense for their business. However, it’s important to note that there are different ways to deduct expenses, and not all methods allow for gas expenses to be claimed separately. If you choose to take the actual expenses deduction, you can write off the cost of gasoline as well as other expenses related to operating your vehicle, such as maintenance and repairs. Alternatively, you can use the standard mileage rate deduction, which currently allows you to deduct 56 cents per mile driven for business purposes. This rate aready includes the cost of gas, so you would not be able to separately deduct gasoline expenses if you choose to take this route. It’s crucial to keep track of your mileage and gas expenses carefully to ensure you’re claiming the correct deductions and maximizing your tax savings.

Does DoorDash Qualify as a Source of Income?

DoorDash can serve as proof of income in some cases but it is not universally accepted as such. If you are self-employed and earn income through DoorDash, you can use this income to demonstrate your earnings when applying for loans or credit. However, some lenders or institutions may require additional documentation or verification of your income, such as tax returns or bank statements. Additionally, if you need to proide proof of income to a third party, such as a landlord or government agency, they may have specific requirements for what forms of income documentation they will accept. Therefore, it is best to confirm with the specific institution or party what documents they require as proof of income.

Income Classification of DoorDash

DoorDash income is considered self-employment income as Dashers are independent contractors who work for themselves rather than beng employees of DoorDash. This means that Dashers are responsible for paying their own taxes, including self-employment taxes, and are not eligible for benefits typically offered to employees such as health insurance or retirement plans. As self-employed individuals, Dashers can also deduct certain expenses related to their work, such as mileage, from their taxable income. It’s important for Dashers to keep track of their earnings and expenses throughout the year and to receive a 1099-NEC form from DoorDash at the end of the year to accurately report their income on their tax return.

Source: adweek.com

What Are Considered Active Hours on Instacart?

Instacart counts active hours as the total time spent on a job, from the moment of dispatch to arrival at the store through to delivery. This includes all the time spent on tasks such as shopping for items, navigating to the customer’s location, and delivering the order. On the other hand, Instacart also prvides information about “online time,” which includes all the time available to work, including time spent waiting for a job. However, for the purposes of calculating earnings, only the active time is taken into account. Therefore, as an Instacart worker, you can be sure that the time you spend on tasks related to a specific job is accurately counted as your active hours.

Disqualifying Factors for Instacart

There are several factors that could disqualify you from working as an Instacart shopper. While the company has not released an official list of disqualifying factors, our research has identified some common reasons. These include having multiple moving violations in a vehicle, recent felony convictions, and being a registered sex offender. Other factors that may disqualify you could include a history of violent or aggressive behavior, drug or alcohol abuse, or a poor driving record. Additionally, Instacart may disqualify applicants who fail to meet the minimum age requirement, have a poor credit history, or fail to pass a background check. It is important to note that the specific criteria used to disqualify applicants may vary depending on the region or state in which you live.

Do I Receive a W2 from Instacart?

No, you will not receive a W2 from Instacart. This is because Instacart treats its workers as independent contractors, rather than traditional employees. Independent contractors are responsible for paying their own taxes and tracking their income, so Instacart provides them with a 1099 form instead of a W2. However, if you have a day job, you may receive a W2 from that company. It’s important to keep your 1099 and W2 forms together so that you don’t miss any income when filing your taxes.

Does Uber Report to the Employment Development Department?

No, Uber does not report to the Employment Development Department (EDD). As independent contractors, Uber drivers are responsible for reporting their income and paying their own taxes. This means that Uber does not withhold taxes from drivers’ earnings, nor does it report those earnings to the EDD or any other government agency. It is the driver’s responsibility to keep track of their earnings and report them accurately on their tax returns. However, Uber does provide drivers with access to tax documents and other resources to help them stay on top of their tax obligations.

Source: en.wikipedia.org

How Does California Track Unemployment Information When Someone is Working?

The Employment Development Department (EDD) in California collects employment data from vrious sources, including employers, the state’s Franchise Tax Board, and the federal government. This information is used to identify individuals who are receiving unemployment benefits but are also earning wages from employment.

When you file for unemployment benefits, you are required to report any work or wages earned during the week for which you are claiming benefits. If you fail to report any earned wages, the EDD can detect unreported wages through their data-matching system, which compares your reported earnings with the information provided by your employer and other sources.

Additionally, the EDD conducts regular audits and investigations to identify fraudulent claims and overpayments. They may also receive tips or reports from employers or individuals who suspect someone is fraudulently collecting unemployment benefits while also working.

It is important to report all earned wages while receiving unemployment benefits to avoid committing UI fraud, which can result in penalties, fines, and even criminal charges.

Does Employer Receive Notification from EDD?

Yes, the Employment Development Department (EDD) does notify your employer when you file for Unemployment Insurance (UI) benefits. When you file a claim for UI benefits, you are required to provide identifying information, including your social security number, name, and past employment history. The EDD then cross-checks this information with your past and present employers to verify your eligibility for benefits. Once your claim is processed, the EDD will notify your last employer, forer employers, and current employers that you have filed for UI benefits. This is done to prevent fraudulent claims and ensure that only eligible individuals receive benefits.

Conclusion

In conclusion, Instacart can be a great option for those looking for flexible work as a self-employed individual. However, it’s important to keep in mind the financial responsibilities that come with being self-employed, such as paying both the employee and employer portions of FICA taxes. Additionally, as an independent contractor, you’ll need to keep track of your earnings and report them to the IRS and unemployment agency. Despite these challenges, Instacart can provide a valuable source of income for those who are willing to put in the effort and manage their finances responsibly.