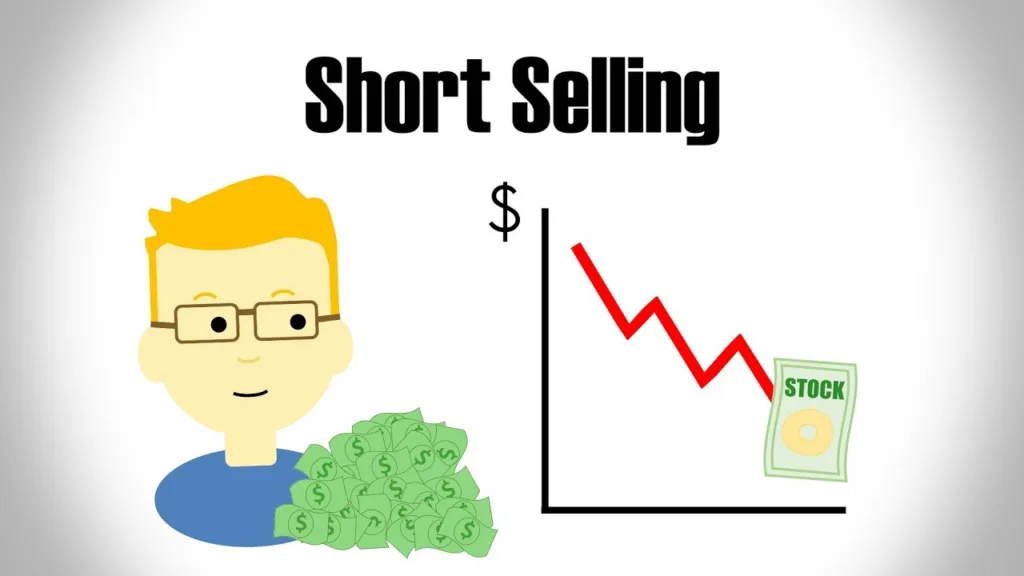

Short selling is a popular trading strategy used by investors who believe that the price of a particular stock will decrease in the near future. By borrowing shares from a broker and selling them on the market, short sellers can profit if the price of the stock falls. However, as with any investment strategy, there are risks involved with short selling, and one of the biggest concerns for short sellers is whether or not they will be required to cover their positions.

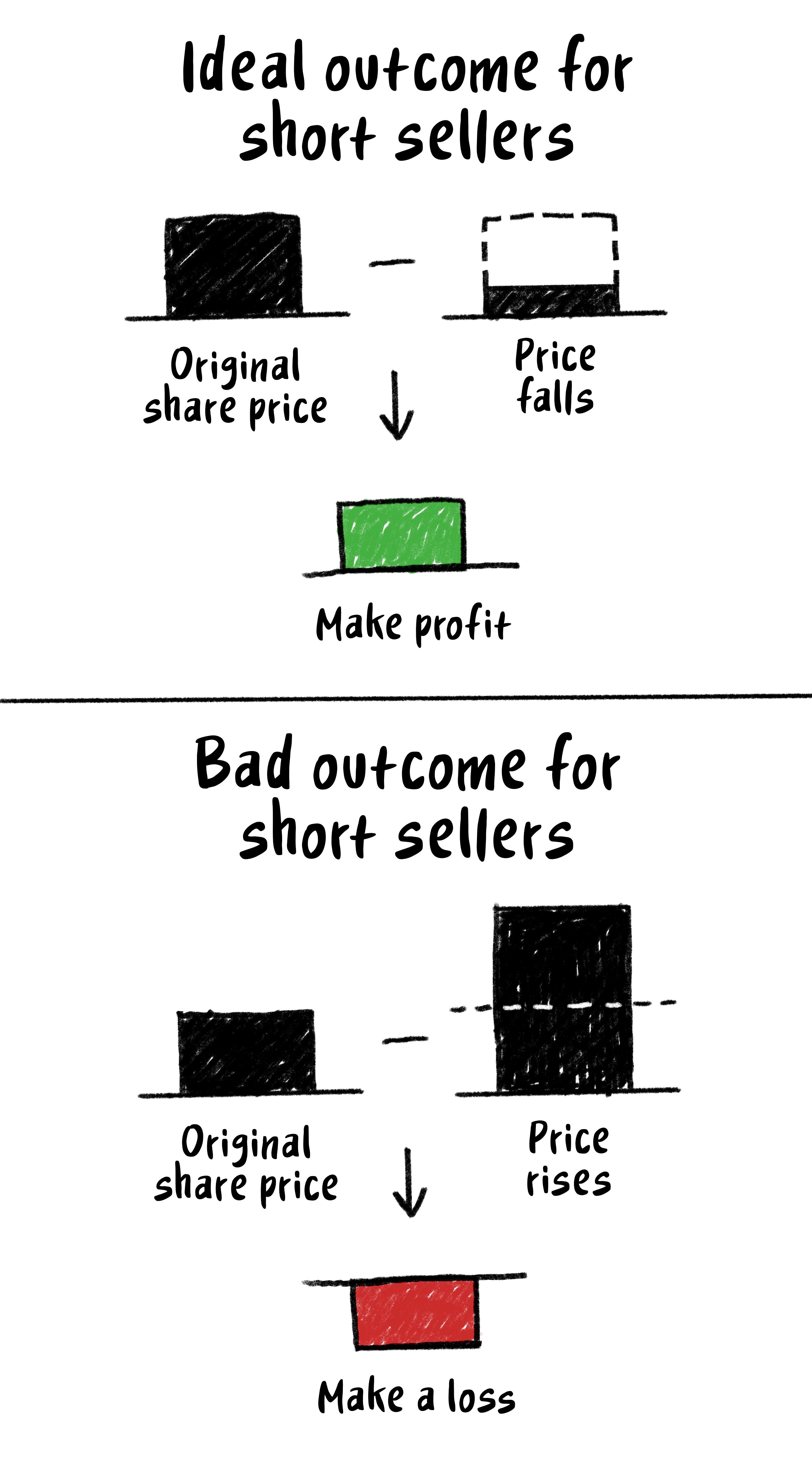

To understand what it means to cover a short position, it’s important to firt understand how short selling works. When an investor shorts a stock, they borrow shares from their broker and sell them on the market. The investor then hopes that the price of the stock will decrease, at which point they can buy back the shares at a lower price and return them to the broker, pocketing the difference as profit. However, if the price of the stock increases instead, the investor will have to buy back the shares at a higher price, resulting in a loss.

Now, to answer the question of whether or not shorts have to cover their positions, the answer is yes and no. While there is no fixed time limit for a short sale, the lender of the shorted shares can request that the shares be returned by the investor at any time, with minimal notice. This is known as a margin call, and it occurs when the lender of the shares wants to sell them for their own profit, or if they are concerned about the investor’s ability to pay back the shares.

In addition to margin calls, short sellers also have to keep in mind other factors that may require them to cover their positions. For example, short sellers must pay any dividends or other distributions made by the stock, and they must match any tender or exchange offers. If the stock being shorted is subject to a tender offer, the short seller may be forced to cover their position.

Despite the risks involved with short selling, many investors continue to use this strategy as a way to profit from market downturns. However, it’s important to understand the potential consequences of short selling, including the possibility of being forced to cover your position. To mitigate these risks, short sellers can use options trading to hedge their positions and limit potential losses if the price of a stock suddenly spikes.

While there is no fixed time limit for a short sale, short sellers may be required to cover their positions if the lender of the shares requests them back, or if there are other factors that require them to do so. As with any investment strategy, it’s important to understand the risks involved with short selling and to take steps to mitigate those risks.

The Necessity of Covering Shorts

Yes, eventually shorts have to cover their positions, eiher voluntarily or involuntarily. When an investor shorts a stock, they borrow shares from a broker and sell them in the market with the expectation that the stock price will decline. If the stock price falls, the short seller can buy back the shares at a lower price and return them to the broker, pocketing the difference as profit.

However, if the stock price rises, the short seller may face margin calls and be required to add more collateral to their account to maintain the short position. If the price continues to rise, the short seller may be forced to buy back the shares at a higher price than they sold them for, incurring a loss.

In some cases, a short seller may voluntarily choose to cover their position if they believe the risk of further losses outweighs the potential reward. Additionally, some brokers may require short sellers to cover their positions if they are deemed too risky or if the stock is difficult to borrow.

Overall, while there is no set time limit for how long a short position can be maintained, eventually the short seller will need to cover their position either by choice or due to market conditions.

Source: npr.org

Consequences of Not Covering a Short Position

If you don’t cover a short, you can face several consequences. Firstly, you are required to pay any dividends or other distributions made by the stock that you have shorted. This means that if you haven’t covered your short position, you will have to pay the dividend out of your own pocket. Additionally, if the company whose stock you have shorted makes a tender or exchange offer, you must match it, even if you have not covered your short position.

Furthermore, you can be forced to cover your short position if the lender of the shares wants the stock back to vote or for any other reason, or no reason at all. This means that even if you have not yet covered your short position, you may be forced to do so if the lender demands it.

In summary, failing to cover your short position can result in havig to pay out dividends, matching tender or exchange offers, and being forced to cover the short position if the lender demands it. These consequences can result in significant financial losses for the short seller.

The Impact of Not Covering Short Positions on Stock Prices

When shorts don’t cover, it means that investors who have borrowed and sold shares in anticipation of a price drop have not yet bought back those shares to return to the original owner. This can have a number of effects on the stock price.

Firstly, if there is a significant number of short positions open and investors are not covering, it can create upward pressure on the stock price as demand for the shares increases. This is because shorts still need to purchase shares to cover their positions, wich can drive up the stock price.

However, if investors continue to hold their short positions and the stock price begins to rise, they may face margin calls, which require them to put up additional collateral or close their position. This can create a domino effect, as more and more investors rush to cover their shorts, leading to a short squeeze and further driving up the stock price.

On the other hand, if the stock price remains relatively stable or decreases, investors may continue to hold their short positions or even increase them, as they anticipate further declines in the stock price. This can create downward pressure on the stock price, as more and more shares are sold short.

Overall, the actions of short sellers can have a significant impact on the stock price, and whether or not they cover their positions can determine whether the stock price rises or falls.

The Meaning of Shorts Not Being Covered

When shorts haven’t covered, it means that traders who have taken short positions in the market have not yet bought back the shares that they had sold earlier. This can happen when the market is going against their bet and they are hoping that the price will fall frther so that they can make a profit. However, if the market moves in the opposite direction, it can lead to a situation where the shorts start losing money as they have to buy back the shares at a higher price. This can create a short squeeze where the shorts rush to cover their positions, leading to a surge in the stock price. On the other hand, if the shorts continue to hold their positions and the market turns against them, it can lead to a significant loss. Therefore, it is important for traders to closely monitor their short positions and take appropriate action to cover their positions if the market moves against them.

How Long Is It Possible to Hold a Shorted Stock?

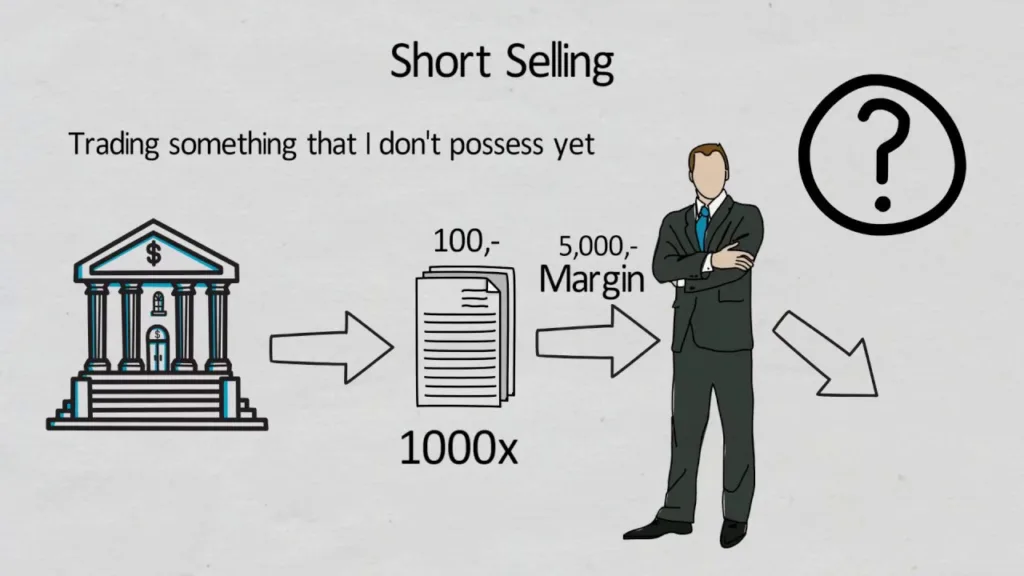

When it comes to holding a shorted stock, tere is no set time limit. The duration of a short position largely depends on the willingness of the broker to loan the stock for shorting. If a broker allows the investor to borrow the stock, the investor can hold the position for as long as they are able to meet the margin requirements.

Margin requirements are the minimum amount of funds that an investor must deposit into their account to maintain the short position. These requirements can vary depending on the broker, the stock being shorted, and the overall market conditions.

Investors should also keep in mind that holding a short position for a longer period of time can increase the risk of losses if the stock’s price rises unexpectedly. As a result, it is important for investors to continually monitor their short positions and adjust their strategies accordingly.

In summary, there is no set time limit for holding a shorted stock, but it is important for investors to consider margin requirements and the risks involved when deciding how long to maintain a short position.

Will AMC See a Price Increase?

AMC is currently heavily shorted at 21%, which means that there is potential for a short squeeze to occur. A short squeeze happens when short sellers are forced to buy shares in order to cover their positions, leading to increased demand and a rise in stock prices. This can result in a significant increase in the stock price, which can be beneficial for long-term investors. However, it’s important to note that short squeezes are not guaranteed to happen and there are a number of factors that coud impact the outcome. Factors such as market conditions, company performance, and overall investor sentiment could all play a role in determining whether or not a short squeeze occurs. Ultimately, it’s impossible to predict the future with certainty, so it’s important to conduct your own research and make informed investment decisions based on your own personal financial goals and risk tolerance.

Maximum Duration of a Short Position

A short position can remain open for an indefinite period of time. There is no specific time limit that determines how long a short position can stay open. The duration of a short position depends on various factors such as market conditions, the stock’s price volatility, the investor’s trading strategy and risk management plan. It is important to note that holding a short position for an extended period of time involves certain risks, including the potential for unlimited losses if the stock price continues to rise. Therefore, investors must closely monitor their short positions and implement apropriate risk management techniques to avoid potential losses.

The Consequences of Losing on a Short

When you engage in a short sale, you are essentially betting against the value of a stock or other asset. If the value of that asset decreases, you can make a profit. However, if the value increases, you will experience a loss. If you do lose on a short sale, the consequences can be significant.

First and foremost, you will owe money to the person or entity that lent you the shares you sold short. This debt is like any other, and you will be responsible for paying it back. If you are unable to pay it back directly, you may need to sell other assets to cover the debt.

If you are unable to cover the debt through the sale of other assets, you may need to consider filing for bankruptcy. This is obviously a worst-case scenario, but it is important to understand that a short sale gone bad can have serious financial consequences.

It is worth noting that there are some strategies you can use to limit your losses when engaging in short selling. For example, you can place stop-loss orders to automatically close out your position if the value of the asset increases beyond a certain point. Additionally, you can consider uing options contracts to hedge your short position.

In summary, if you lose on a short sale, you will owe money to the person or entity that lent you the shares. If you cannot pay this debt directly, you may need to sell other assets or consider filing for bankruptcy. It is important to be aware of these potential consequences when engaging in short selling and to use strategies to limit your risk.

Understanding an Open Short Position

An open short position is a trading strategy used by investors to profit from a decrease in the price of securities. In this strategy, the investor borrows the underlying asset from a broker, such as stocks, bonds, or commodities, and sells it in the open market at the current market price. The hope is that the market price will decline, and the investor can buy back the securities at a lower price, replace the borrowed securities, and profit from the difference between the sale price and the lower repurchase price. This type of trading strategy is riskier than other trading strategies because there is no limit to the amount of money that can be lost if the market price of the securities increases raher than decreases. It is important to note that open short positions involve borrowing securities, which means that there are interest charges and fees associated with the strategy. It is also essential to monitor the position regularly to avoid unexpected market movements that may result in significant losses.

Consequences of Stock Delisting on Wearing Shorts

When a company is delisted, it means the stock is no longer available for trading on the exchange. In this case, short sellers are still obligated to buy back the shares they borrowed to sell at a later date, which is known as covering their short position. However, the process of covering can be complicated and may result in losses for the short seller.

If a company is delisted due to financial difficulties or bankruptcy, it is likely that the stock price has alreay declined significantly. In such cases, short sellers may have already made a profit on their short position. However, if the company is delisted due to fraudulent activities or other legal issues, the short seller may be required to cover their position at a higher price than they initially sold the shares for.

In any case, the short seller must still buy back the shares they borrowed to close out their position. If the shares are no longer available on the exchange, the short seller may have to locate the shares through other means, such as contacting the company directly or buying shares in the over-the-counter market. This process can be time-consuming and costly, and may result in losses for the short seller.

In conclusion, short sellers are still obligated to cover their position if a stock is delisted, but the process can be complicated and may result in losses. It is important for short sellers to closely monitor the companies they are shorting and be aware of any potential risks or legal issues that may arise.

Can Short Sellers Manipulate Stock Prices?

Yes, shorts can manipulate a stock thrugh a variety of illegal tactics, including the short-and-distort scheme. Shorting a stock involves borrowing shares and selling them with the expectation that the price will decrease, allowing the short seller to buy back the shares at a lower price and profit from the difference. However, if the short seller spreads false information about the company in an attempt to drive down the stock price, this is considered market manipulation and is illegal. This tactic can harm the company, its shareholders, and the overall market. It is important for regulators to monitor and investigate any suspicious activity in the stock market to prevent this type of manipulation.

The Impact of Shorts on Stock Prices

Yes, shorts can bring a stock down. Short selling is a trading strategy whee an investor borrows shares of a company and sells them with the hope of buying them back later at a lower price to make a profit. When more investors short a stock, the increased selling pressure can drive the stock price down as more shares are sold than bought, creating a negative sentiment around the stock. This can lead to a vicious cycle of selling, causing the stock price to decline even further. However, it’s important to note that short selling is only one of many factors that can influence a stock’s price. Other factors such as company performance, economic conditions, and investor sentiment can also impact a stock’s price.

Identifying if a Stock is Being Shorted

If you’re wondering whether a particular stock is being shorted, there are a few key indicators you can look for. The first thing to check is the stock’s short interest, which is the number of shares that have been sold short by investors. You can usually find this information on the stock’s profile page on financial websites such as Yahoo Finance or Google Finance. Look for the “short interest” or “short shares” data, which will tell you the number of shares that have been sold short.

Another important metric to consider is the short ratio, which is the number of short shares divided by the stock’s average daily trading volume. This metric can give you an idea of how long it would take for all the short sellers to cover ther positions, which can be a useful indicator of market sentiment. A high short ratio suggests that there is a lot of pessimism about the stock, while a low short ratio may indicate that investors are more optimistic.

Finally, keep an eye on news and market trends. If a stock is being shorted heavily, you may see negative news stories or market rumors that could be driving the short selling. Conversely, if a stock is being heavily bought, you may see positive news stories or market trends that could be driving the buying activity. By staying informed and paying attention to these key indicators, you can get a better understanding of whether a stock is being shorted and what that means for its overall performance.

Do Dividends Need to be Covered by Shorts?

Short sellers do not receive any dividend payments from the shares they have borrowed, as they do not actually own the shares. Instead, any dividends paid out by the company are passed on to the original owner of the shares. In fact, the value of any dividends paid out is deducted from the short seller’s account on the pay date and delivered to the owner of the stock. This means that short sellers do not have to cover dividends, but they do have to account for any dividends paid out and ensure that they are passed on to the original owner of the shares. It is important for short sellers to keep track of any dividend payments so that they can accurately calculate thir profits or losses when closing out their short positions.

Do Dividends Require Shorts to be Covered?

No, shorts do not have to cover before a dividend. However, investors short a stock are never entitled to its dividends, and that includes those short a stock on its dividend record date. This means that if a short seller is holding a stock on the record date, they will not receive the dividend payment. The dividend will instead be paid to the stock’s current owner of record, which could be the original shareholder or someone who has bought the stock after the short seller has sold it.

It’s worth noting that the amount of the dividend payment will typically be reflected in the stock’s price, and the stock’s price may drop by the same amount as the dividend payment on the ex-dividend date. This means that if a short seller is holding a stock on the ex-dividend date, they may see the vlue of their short position decrease by the amount of the dividend payment.

In summary, shorts do not have to cover before a dividend, but they will not receive the dividend payment if they are holding the stock on the record date. The value of their short position may also decrease by the amount of the dividend payment on the ex-dividend date.

Conclusion

In conclusion, short selling is a trading strategy that is used by investors to profit from the decline in the price of a security. It involves borrowing shares from a broker and selling them in the open market, with the hope of buying them back at a lower price to make a profit. While short selling can be lucrative, it is also a high-risk strategy, as there is unlimited potential for losses if the price of the stock rises instead of falls. Short sellers must also be aware of the risks associated with margin calls, dividend payments, and forced buy-ins. Overall, short selling can be a useful tool for experienced traders, but it is important to understand the risks and to use it as part of a broader investment strategy.