If you need to make a payment but have run out of checks, you may be wondering if you can get a single check from the bank. The answer is yes! Most banks offer counter checks that can be printed in minutes and used as an immediate way to pay for goods and services.

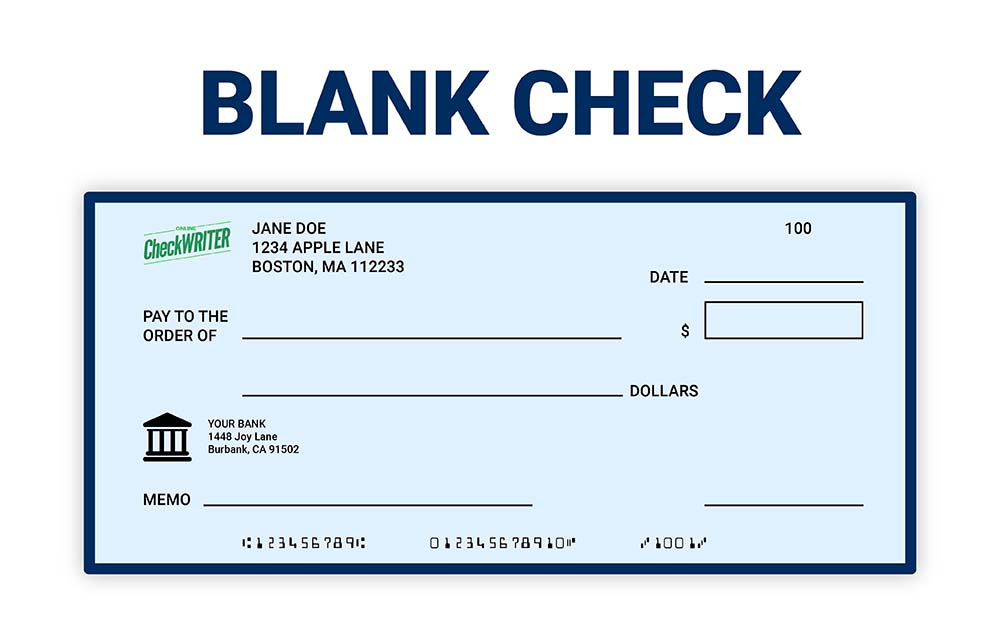

Counter checks are temporary checks that can be issued by your bank at any time. They typically come with your name, address, account number and routing number already printed on them. All you need to do is fill in the date, payee, amount and sign the check. This makes them an ideal solution for situations when you don’t have enough time to order new checks or wait for them to arrive in the mail.

In order to get a single check from your bank, simply visit a local branch and speak with a teller or personal banker about printing one for you. You may need to show some form of identification in order to verify your identity beore they will print the check for you.

Prices can vary between banks but generally range from 3-20 cents per check depending on whether it is a single or duplicate copy. Duplicate copies have carbon paper behind them which makes it easier to keep track of payments made via bank checks.

Most banks also offer same day printing services so if you are in a pinch and need a single check quickly, this would be the best option for you. Overall, getting a single check from the bank is an easy process that requires minimal effort on your part.

Can I Receive a Check Directly From a Bank?

Yes, you can get a check directly from the bank. Most banks offer counter checks that can be printed on demand by a teller or personal banker. These checks are usually similar to regular checks and contain the same information, such as your name, address, account number, and routing number. Counter checks are typically used as a temporary solution when you’ve run out of regular checks before your new ones arrive.

Obtaining a Check From a Bank

To get a check from your bank, you will need to visit your local branch and speak to a teller. Make sure to bring your photo ID with you such as a driver’s license or passport. Explain that you would like to get a certified check and ask for any specific instructions. You will then need to write the check in front of the teller, who will verify the information and process the request. Once complete, you will be given the certified check from your bank.

Cost of a Single Check

The cost of a single check varies depending on where you get it. Generally, non-banks charge between 3 and 20 cents per check. When purchasing checks, it is important to compare prices and services offered by different vendors to ensure you are getting the best deal.

Can Banks Issue Same-Day Checks?

Yes, most banks offer same day check printing services for a variety of purposes. Typically, customers can request counter checks that are printed on the spot at the bank’s location. These checks are usually small in size and provide a convenient payment option for customers who need immediate access to funds. For larger check amounts, some banks may offer same day printing services through third-party vendors. These checks will typically require additional processing time and fees may be associated with their production.

Do Banks Offer Free Checks?

Yes, many banks offer customers free checks. Some banks have deals for customers who open a new checking account, while others may require certain minimum balances or deposit amounts to qualify. Additionally, many credit unions provide free checks as part of their membership benefits. It’s important to shop around and compare the different offers from different banks to find the best deal that meets your needs.

The Possibility of Printing a Check

Yes, you can print checks with almost any printer. However, if you want to be able to deposit the check into your bank account, you must use a printer that is compatible with magnetic ink. This is because the bank machines need to be able to read the check in order to process it. To make sure your printer is compatible with magnetic ink, it is best to check with the manufacturer or your local office supply store.

What is a Counter Check at a Bank?

A counter check is a convenient and secure way to access funds from your bank account without haing to use a personal check. Counter checks are typically provided at the teller’s counter when you request them. They consist of plain, printed checks with your account information and the bank’s routing number pre-printed on them. Counter checks can be used just like personal checks to pay for goods and services or to transfer funds between accounts. In addition, they are often used as a form of payment when you don’t have access to traditional forms of payment such as cash or debit cards.

Obtaining Checks Immediately

Yes, you can get checks immediately. Many banks offer same-day check printing services, which allow you to obtain the printed checks on the same day. To do this, you need to approach a local bank branch and apply for counter checks or starter checks. These checks are printed by the bank and provided to you on the same day.

What Is the Definition of a Single Check?

A single check is a printed document used to make a payment from an account that only appears on one page. It does not include any additional carbon copies underneath the original check, making it unique from a duplicate check. Single checks can be used to make payments in person or through the mail and are often used for smaller amounts of money. They are typically printed with the name of the payer and payee, the date of payment, and the amount being paid.

Cost of a Bank Check

The cost of a check from the bank can vary depending on the type of check you need. Certified checks typically cost around $15, while cashier’s checks are usually between $10 and $20. In some cases, banks may not charge for certified checks at all. It’s always best to contact your bank directly for the most accurate pricing information.

How Long Does It Take to Get a Bank Check?

A bank check can be obtained relatively quickly, depending on the type of check you need. If you need a personal check, you can usually get one from your bank within one to two business days. For cashier’s checks, it can take up to five business days for your bank to process the request and mail the check to you. However, if you need a certified check, it may take up to 10 business days for your bank to process the request and mail the check out to you. It is important to note that cashier’s checks must be deposited within 90-120 days afer they are issued, so make sure the recipient is aware of this when they receive their check.

Can I Obtain a Blank Check From Bank of America?

At Bank of America, we don’t offer blank checks. However, you can order checks and deposit tickets through our Online Banking or Mobile Banking app. After selecting the style of check you’d like to order, you can have them shipped to you quickly and securely. If you are a current Bank of America customer, you may be eligible for discounted prices on check orders.

Obtaining a Blank Check from Chase

If you need a blank check from Chase, you have several options. You can log into your Chase account online and order the check through their website. Another option is to visit a local Chase branch and purchase a book of blank checks. Additionally, you can also order both personal and business checks by calling 1-888-560-3939 or visiting the Deluxe website. Whichever method you choose, make sure to keep your checkbook in a safe place when not in use to prevent fraudulent activity.

Conclusion

In conclusion, banks are a great resource for all your financial needs. They offer a variety of services, such as check printing and banking services, as well as access to loans and investments. Banks also provide important safety measures to protect your money and identity. When it comes time to make a payment or deposit funds, you can trust your bank to handle the transaction safely and securely. With so many options available, it is easy to find the right bank for your needs.