When it comes to managing a business, one of the most important metrics to keep an eye on is your financial performance. One way to measure this is through variance analysis, which compares your actual financial results to your budgeted or expected results. By doing this, you can identify areas where you are doing well and areas where you need to improve.

Variance analysis is typically split into two categories: favorable and unfavorable variances. As the names suggest, favorable variances refer to instances where your actual results are better than your expected results, while unfavorable variances refer to instances where your actual results fall short of your expectations. Let’s take a closer look at each category.

Favorable Variances

A favorable variance occurs when your actual results are better than your budgeted or expected results. This can happen in a few different ways:

1. Increased Revenue: If you generate more revenue than expected, this is a favorable variance. This could be due to increased sales, higher prices, or more customers.

2. Decreased Costs: If you incur fewer costs than expected, this is also a favorable variance. This could be due to lower material costs, improved efficiencies, or better inventory management.

3. Improved Margins: If your profit margin is higher than expected, this is a favorable variance. This means that you are generating more profit per sale than you anticipated, which is always a good thing.

Unfavorable Variances

On the oher hand, an unfavorable variance occurs when your actual results are worse than your budgeted or expected results. This can happen in a few different ways:

1. Decreased Revenue: If you generate less revenue than expected, this is an unfavorable variance. This could be due to lower sales, lower prices, or fewer customers.

2. Increased Costs: If you incur more costs than expected, this is also an unfavorable variance. This could be due to higher material costs, inefficiencies, or unexpected expenses.

3. Decreased Margins: If your profit margin is lower than expected, this is an unfavorable variance. This means that you are generating less profit per sale than you anticipated, which can be a warning sign for your business.

As a business owner, it’s important to keep a close eye on your variance analysis to identify trends and make adjustments as needed. If you consistently experience unfavorable variances, you may need to reevaluate your budget or make changes to your operations. Conversely, if you consistently experience favorable variances, you may want to consider investing in growth opportunities or expanding your product line.

Variance analysis is a valuable tool for any business owner who wants to stay on top of their financial performance. By understanding the difference between favorable and unfavorable variances, you can make informed decisions and adjust your strategy as needed to achieve your business goals.

Identifying Favorable and Unfavorable Variances

A variance can be determined as favorable or unfavorable by comparing the actual results to the budgeted or estimated figures. If the actual revenue exceeds the budgeted revenue or the actual expenses are less than the budgeted expenses, then it is considered a favorable variance. On the other hand, if the actual expenses are higher than the budgeted expenses, then the variance is considered unfavorable. In essence, favorable variances inicate that a business performed better than expected, while unfavorable variances suggest that a business performed worse than expected. It is important to note that identifying and analyzing variances can provide valuable insights into a company’s financial performance and aid in making informed decisions for the future.

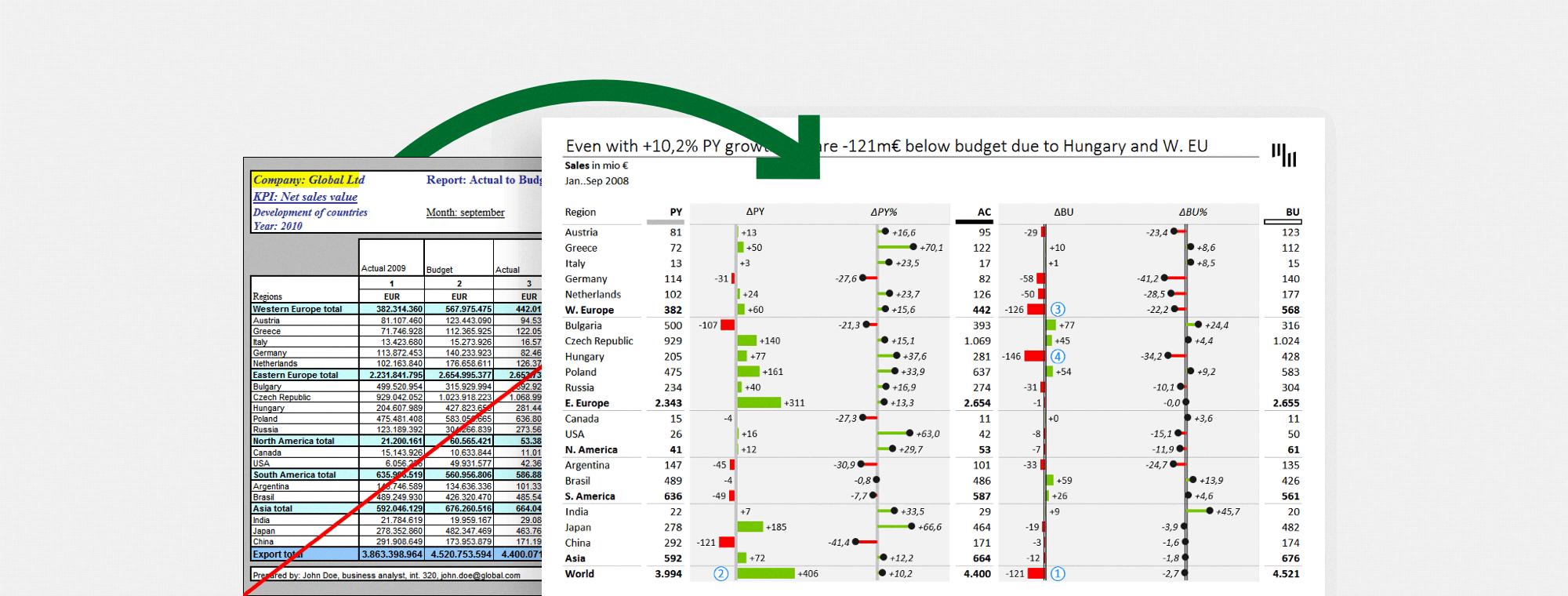

Source: zebrabi.com

The Meaning of an Unfavorable Variance

An unfavorable variance signifies that the actual costs incurred by a company are higher than the standard or projected costs. This can indicate to management that the company’s profitability will be lower than anticipated, which can have significant implications for the business. An unfavorable variance can arise due to a range of factors, including unexpected increases in expenses, inefficiencies in production processes, or changes in market conditions. As such, it is crucial for companies to regularly monitor and analyze their financial performance to identify unfavorable variances early and take approprite actions to mitigate their impact. By doing so, businesses can optimize their operations, enhance their profitability, and ensure their long-term success.

The Impact of Favorable and Unfavorable Variance on a Company

Both favorable and unfavorable variances can have different impacts on a company depending on the situation. In general, favorable variances are considered good for a company because they generate more revenue than expected or incur fewer costs than budgeted, which can lead to higher profits. However, it’s important to note that favorable variances can also indicate that the budget was too conservative, and the company could have potentially earned even more if it had set higher targets.

On the oher hand, unfavorable variances are generally considered bad for a company because they generate less revenue than expected or incur more costs than budgeted, which can lead to lower profits or even losses. However, unfavorable variances can also provide valuable information to the company about inefficiencies or unexpected challenges in its operations, which can help management make adjustments to improve performance and profitability in the future.

Ultimately, whether favorable or unfavorable, variances are a tool for companies to monitor their financial performance and make informed decisions about how to allocate resources and improve their operations.

Understanding Favorable Variance

A favorable variance occurs when the actual cost to produce a product or service is less than the budgeted cost. In other words, the cost of production is lower than what was originally estimated or planned. This is generally considered a positive outcome for a business, as it means they are making more profit than anticipated. Favorable variances can result from various factors, such as increased efficiencies in manufacturing processes, reduced material costs, or higher sales volumes. Essentially, anything that leads to a decrease in the cost of production can result in a favorable variance. favorable variances are a desirable outcome for businesses as they help to improve thir bottom line and increase profitability.

Determining Favorable or Unfavorable Sales Price Variance

A sales price variance can be categorized as favorable or unfavorable depending on whether the actual selling price of a product is higher or lower than the previously predicted price. If a product is sold at a higher price than the predicted price, then it is considered as a favorable sales price variance. On the other hand, if a product is sold at a lower price than the predicted price, then it is considered as an unfavorable sales price variance. In simple terms, a favorable sales price variance is a positive deviation from the expected selling price, while an unfavorable sales price variance is a negative deviation from the expected selling price. It is crucial for businesses to monitor their sales price variance to identify areas whre they can improve their pricing strategy and increase their profitability.

Favorable and Unfavorable Conditions

Favorable conditions refer to thoe environmental or situational factors that are conducive to the growth, survival, and reproduction of an organism. These conditions may include factors such as optimal temperature, availability of food and water, and absence of predators or competitors. Organisms thrive and reproduce when they are exposed to such favorable conditions.

On the other hand, unfavorable conditions are those that are not conducive to the survival or reproduction of an organism. These conditions may include factors such as extreme temperatures, lack of food or water, presence of predators or competitors, or exposure to harmful chemicals or pollutants. When organisms are exposed to unfavorable conditions, they may struggle to survive or may need to adapt in order to cope with the challenge.

It is important to note that what is considered favorable or unfavorable conditions can vary depending on the specific organism in question. For example, an organism that is adapted to living in hot, dry environments may thrive in conditions that would be unfavorable for other organisms. Additionally, conditions that are favorable for one stage of an organism’s life cycle may be unfavorable for another stage. Therefore, it is important to consider the specific needs and adaptations of the organism when determining what constitutes favorable and unfavorable conditions.

Is Favourable Variance Always Beneficial?

A favorable variance is not alwas good. While a favorable variance suggests that actual results have exceeded budgeted or standard amounts, it does not necessarily indicate good performance. The budgeted or standard amount may not be an accurate reflection of what should be expected, and there may be other factors at play that have contributed to the favorable variance. For example, a company may have achieved a favorable variance in sales revenue, but it may have done so by cutting prices, which could negatively impact profitability in the long run. Similarly, a company may have achieved a favorable variance in expenses, but it may have done so by cutting back on necessary investments or resources that could hinder future growth. Therefore, while a favorable variance is generally seen as a positive outcome, it is important to consider the underlying reasons for the variance and the potential implications for future performance.

Importance of Identifying Favorable and Unfavorable Variances

The identification of favorable and unfavorable variances is crucial for a company for several reasons. Firstly, it helps the management to evaluate the financial performance of the company and determine wether it is meeting its financial goals or not. A favorable variance indicates that the company has exceeded its expectations while an unfavorable variance indicates that the company is not performing as expected.

Secondly, analyzing variances can help the management to identify areas of the business that are performing well and areas that require improvement. This enables the company to make informed decisions on where to allocate resources, make changes to the budget, or adjust their operations to improve performance.

Thirdly, understanding favorable and unfavorable variances can help the company to identify trends in its financial performance over time. This enables the management to make more accurate forecasts and develop more effective strategies for the future.

The identification of favorable and unfavorable variances is essential for a company as it provides insights into the financial performance of the business, helps to identify areas for improvement, and enables better decision-making for the future.

Conclusion

Understanding the concepts of favorable and unfavorable variances is crucial for any business owner or manager who wants to make informed decisions about their company’s financial performance. A favorable variance occurs when revenue is higher than the budget or when actual expenses are less than the budgeted amount. This can be a positive sign for a business, indicating increased efficiency, cheaper materials, or greater sales. On the othr hand, unfavorable variances occur when actual costs are higher than the budgeted amount, leading to lower profits than expected. While unfavorable variances may seem negative, they can also provide crucial information to management, allowing them to identify areas for improvement and take corrective action. monitoring variances is an essential aspect of financial management, helping businesses stay on track and make informed decisions about their future.