Inventoriable costs, also known as product costs, are an essential part of a business’s accounting process. These costs are directly assoiated with a company’s products, and they can be inventoried and included in the valuation of inventory. On the other hand, period costs are expenses that cannot be associated with a specific product and are treated as expenses in the period in which they are incurred.

Inventoriable costs are incurred by both retailers and manufacturers. For retailers, these costs include the cost of goods purchased for resale, as well as any additional cost incurred to get the goods ready for sale. These additional costs may include transportation costs, import duties, and any other costs associated with getting the goods to their final destination.

For manufacturers, inventoriable costs include the direct costs associated with producing goods for sale. These costs may include the cost of direct materials, direct labor, and manufacturing overhead. Direct materials are the raw materials that are used in the manufacturing process, while direct labor refers to the wages and salaries paid to employees who are directly involved in the production process. Manufacturing overhead includes all other costs associated with manufacturing, such as rent, utilities, and depreciation.

It is important to note that inventoriable costs are only recognized as expenses when the associated products are sold. Until the products are sold, these costs are considered as assets and are included in the company’s inventory valuation. Once the products are sold, the costs are recognized as expenses and are included in the cost of goods sold in the income statement.

Inventoriable costs are an essential part of a company’s accounting process. They are costs that can be directly associated with a company’s products and can be inventoried and included in the valuation of inventory. Understanding inventoriable costs is crucial for businesses that want to accurately track their costs and make informed decisions about their operations.

Inventory Cost: Understanding Product Costs

Product costs are the expenses that are directly related to the production of goods. These costs include the cost of raw materials, labor costs, and manufacturing overheads. When a company produces goods, these costs are initially recorded as part of the inventory. This is why product costs are also known as inventoriable costs.

The reason why product costs are considered inventoriable is that they are used to value the inventory. The total cost of the inventory is the sum of all the product costs. This means that the cost of the inventory reflects the cost of producing the goods, including the cost of the raw materials, labor, and overheads.

When the goods are sold, the product costs are no longer inventoriable. Instead, they become part of the cost of goods sold. The cost of goods sold reflects the cost of the inventory that has been sold during a particlar period. This cost is subtracted from the revenue earned from the sale of the goods to calculate the gross profit.

Product costs are considered inventoriable costs because they are used to value the inventory. These costs include the cost of raw materials, labor, and overheads. When the goods are sold, the product costs become part of the cost of goods sold.

Source: corporatefinanceinstitute.com

What Is the Meaning of ‘Inventoriable’?

Inventoriable is an adjective that describes an item or asset that is capable of being included in an inventory or its valuation. It is a term commonly used in accounting and finance to describe goods or products that a company has on hand for sale or use in its operations. Essentially, any item that a company can physically count and assign a value to can be considered inventoriable. This includes raw materials, finished goods, and oter inventory items that are held for sale or use in production.

Inventoriable items are important for several reasons, including determining the value of a company’s assets, calculating the cost of goods sold, and assessing profitability. By keeping track of inventory levels and the value of inventory items, companies can make more informed decisions about their operations and financial health.

It’s worth noting that not all items are considered inventoriable. For example, expenses like rent, salaries, and advertising costs are not inventoriable because they are not physical items that can be counted and valued.

The term inventoriable is a useful way to describe the physical assets that a company has on hand and their value. By understanding the concept of inventoriable items, businesses can better manage their inventories, make informed financial decisions, and achieve greater success in their operations.

The Difference Between Inventoriable Cost and Period Cost

In the world of accounting, there are two types of costs that businesses must consider: inventoriable costs and period costs. Inventoriable costs are those costs that can be directly associated with a business’s products. These costs include the cost of materials, labor, and overhead that are required to produce a product. These costs are considered to be assets of the business beause they are directly tied to the production of the product. They are recorded on the balance sheet as part of the inventory account and are only expensed when the product is sold.

On the other hand, period costs are those costs that a business incurs regardless of whether it produces a product or not. These costs are not directly tied to the production of a product, and they include things like rent, utilities, salaries, and advertising. These costs are expensed in the period in which they are incurred and are recorded on the income statement as expenses. They are not considered to be assets of the business because they are not tied to the production of a specific product.

It is important for businesses to understand the difference between inventoriable costs and period costs because they affect the way that the business’s financial statements are prepared. Inventoriable costs are only expensed when the product is sold, while period costs are expensed in the period in which they are incurred. By properly categorizing costs as either inventoriable or period costs, businesses can ensure that their financial statements accurately reflect the true cost of producing and selling their products.

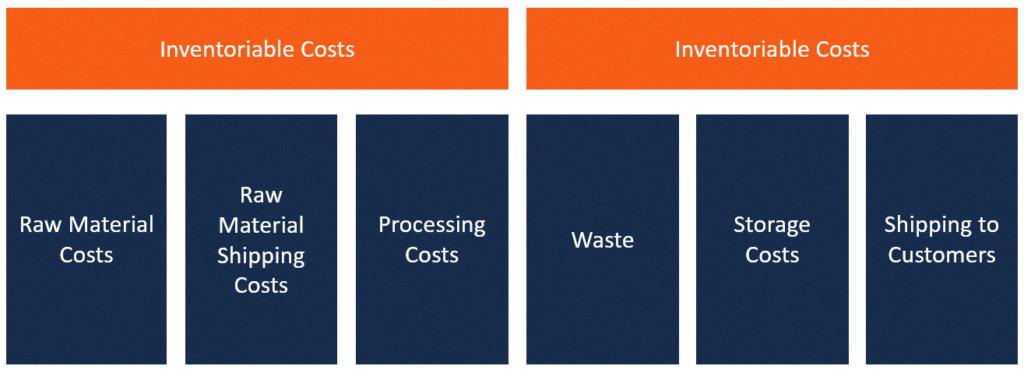

Is Selling Cost an Inventoriable Cost?

Selling cost is not an inventoriable cost. Inventoriable costs are the costs incurred in the production or purchase of goods that are intended for sale. These costs are added to the cost of inventory and are expensed when the inventory is sold.

Selling costs, on the othr hand, are the costs incurred to promote and sell the goods. These costs are expensed in the period that they are incurred and are not added to the cost of inventory. Examples of selling costs include advertising expenses, sales commissions, and shipping costs to customers.

It’s important to distinguish between inventoriable costs and selling costs because they are treated differently for accounting purposes. Inventoriable costs are part of the cost of goods sold and are deducted from revenue to calculate gross profit. Selling costs are part of operating expenses and are deducted from gross profit to calculate net income.

To summarize, selling costs are not inventoriable costs because they are expensed in the period that they are incurred and are not added to the cost of inventory.

Conclusion

Inventoriable costs are a crucial aspect of any business that deals with inventory. These costs are used to value the inventory and are often treated as assets unil the products are sold. The main types of inventoriable costs include the cost of goods purchased for resale, as well as a manufacturer’s costs to produce goods that will be sold. These costs can include direct materials, direct labor, and manufacturing overhead.

It is important for businesses to carefully track their inventoriable costs in order to accurately value their inventory and calculate their cost of goods sold. This information can be used to make informed decisions about pricing, production, and inventory management.

Inventoriable costs are an essential concept for businesses to understand in order to effectively manage their inventory and maximize profitability. By properly tracking and valuing these costs, businesses can make informed decisions that will help them succeed in today’s competitive marketplace.