Spy options are a popular trading instrument that allow investors to speculate on the future price movements of the SPDR S&P 500 ETF (SPY). One of the advantages of trading Spy options is that they are available for trading during extended hours, outside of regular trading hours. This can provide traders with an opportunity to respond to news events or market developments that occur outside of the normal trading day.

So, how long can you trade Spy options after hours? The answer is that it depends on your broker and the specific platform that you are using. Some brokers offer extended hours trading sessions that allow traders to place orders outside of regular trading hours. These sessions typically begin at 4:00 PM EST and end at 8:00 PM EST.

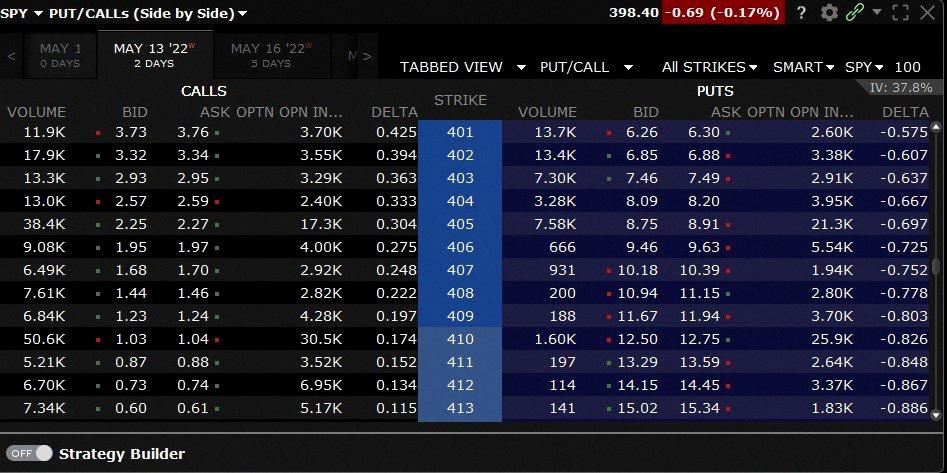

It is important to note that trading during extended hours can be riskier than trading during regular hours. The lack of liquidity during these sessions can lead to wider bid-ask spreads, which can make it more difficult to get a good price on your trade. Additionally, the after-hours market can be more volatile, with larger price swings than during regular trading hours.

Despite these risks, many traders find after-hours trading to be a useful tool in their trading arsenal. By being able to trade Spy options outside of regular trading hours, they are able to react more quickly to market-moving news or events, which can give them an edge over other traders who are limited to trading during regular hours.

While the availability and trading hours of Spy options can vary depending on your broker and trading platform, it is possible to trade them during extended hours. However, it is important to be aware of the risks associated with after-hours trading and to exercise caution when placing trades during these sessions. By doing so, traders can take advantage of the opportunities presented by after-hours trading whle managing their risk effectively.

Trading Hours for Spy Options

SPY options are tradable during the extended hours trading sessions, which take place before and afer regular market hours. Specifically, Spy options trading hours for the pre-market session starts at 4:00 AM Eastern Standard Time (EST) and ends at 9:30 AM EST, while the after-hours session lasts from 4:00 PM EST to 8:00 PM EST.

It is important to note that trading during these extended hours sessions may come with certain limitations, such as lower liquidity and wider bid-ask spreads. This is because participation from market makers and electronic communication networks (ECNs) is voluntary during these sessions, which can lead to less efficient pricing.

Despite these limitations, many traders and investors find value in being able to trade options during these extended hours sessions, as it allows them to react to news and events that may occur outside of regular market hours. It is important for traders to understand the risks and opportunities that come with trading options during these extended hours sessions and to have a solid understanding of the mechanics of options trading before participating.

Source: tradeproacademy.com

Trading Options After Hours

In the past, investors could only trade options during regular trading hours. However, with the advent of technology, it is now possible to trade options after hours. After-hours trading refers to the time period after the market closes, during which traders can buy and sell securities.

For options trading, the after-hours session typically lasts from 4:00 p.m. to 4:15 p.m. Eastern Time (ET). During this time, traders can place orders to buy or sell options on certain stocks or ETFs (Exchange-Traded Funds). It is important to note that not all stocks or ETFs have after-hours trading available, so it is crucial to check with your broker to confirm which options are available for after-hours trading.

It is worth noting that after-hours trading can be more volatile and have wider bid-ask spreads than regular trading hours. As a result, investors shuld exercise caution when trading during this time and be aware of the potential risks involved.

Options trading is available for a limited time after the regular trading hours, typically from 4:00 p.m. to 4:15 p.m. ET. However, not all options are available for after-hours trading, and investors should be aware of the potential risks involved in trading during this time.

Trading SPY Options After Hours on TOS

It is possible to trade SPY options after hours on the thinkorswim platform. The 24/5 trading feature allows for extended trading hours beyond the regular market hours of 9:30 AM to 4:00 PM EST. This means that traders have access to trading SPY options from 5:00 PM EST on Sunday until 4:00 PM EST on Friday.

It is important to note that trading after hours may involve greater risks due to lower liquidity and wider bid-ask spreads. Additionally, not all options may be available for trading during extended hours. Therefore, it is recommended that traders exercise caution and perform thorough research before engaging in after-hours trading.

The 24/5 trading feature on thinkorswim provides traders with increased flexibility and opportunities to manage their positions outsde of regular market hours.

Closing Options Contracts After Hours

It is possible to close options contracts after hours. In fact, after-hours trading has become increasingly popular among retail investors who want to take advantage of market opportunities outside of regular trading hours.

To close an options contract after hours, you will need to access an electronic trading platform that offers after-hours trading. Many brokers, including some of the larger online brokers, offer access to after-hours trading.

It is important to note that after-hours trading can be more volatile and less liquid than regular trading hours, which can affect the prices of options contracts. Additionally, the prices of options contracts can fluctuate significantly durng after-hours trading, so it is important to be aware of the risks involved and to have a solid trading plan in place.

Here are some key points to keep in mind when trading options contracts after hours:

– After-hours trading typically takes place between 4:00 PM and 8:00 PM Eastern Time, although the exact hours and availability may vary depending on the broker and the exchange.

– After-hours trading can be more volatile and less liquid than regular trading hours, which can affect the prices of options contracts.

– The prices of options contracts can fluctuate significantly during after-hours trading, so it is important to be aware of the risks involved and to have a solid trading plan in place.

– To close an options contract after hours, you will need to access an electronic trading platform that offers after-hours trading. Many brokers, including some of the larger online brokers, offer access to after-hours trading.

It is possible to close options contracts after hours, but it is important to be aware of the risks involved and to have a solid trading plan in place. Additionally, traders should make sure they have access to an electronic trading platform that offers after-hours trading.

Conclusion

Trading Spy Options during after-hours is now accessible to anyone with an online brokerage account. This provides traders with more opportunities to take advantage of market movements and potentially increase profits. However, it is important to note that after-hours trading can be less liquid and offer inferior prices, so traders should exercise caution and carefully consider their strategies before participating in after-hours trading. Spy Options can be a valuable addition to any trader’s portfolio, but it is crucial to stay informed and up-to-date on market trends and news to make informed trading decisions.