A child’s Social Security number is a crucial piece of inforation that parents need to keep track of. It is required for various reasons, including tax purposes, opening bank accounts, enrolling in school, applying for government benefits, and more. However, sometimes parents may misplace or forget their child’s Social Security number. In this article, we’ll explore how to find your child’s Social Security number and what steps you can take to keep it safe.

If you had your child as a dependent on a previous tax return, you can find their Social Security number there. Look for the form 1040, 1040A, or 1040EZ from the previous year. Your child’s Social Security number should be included in the form. If you can’t find the form, you can request a copy from the Internal Revenue Service (IRS).

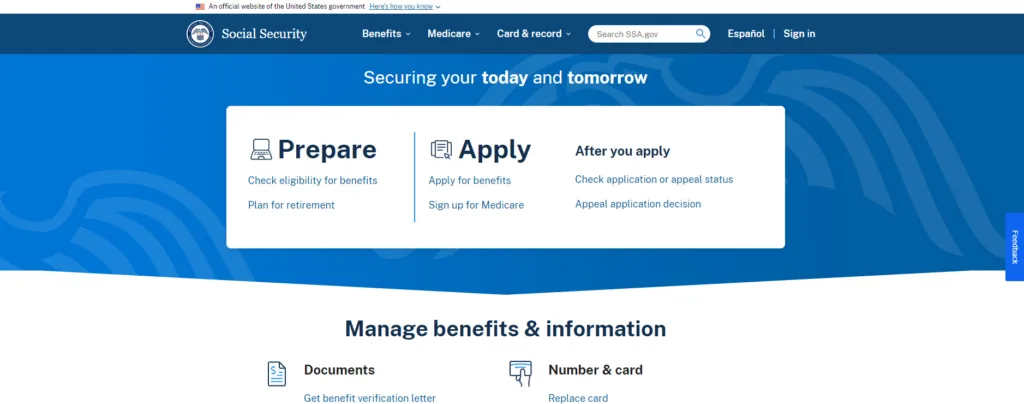

If you didn’t have your child as a dependent in the previous tax year, there are other ways to look up their Social Security number. One way is to contact the Social Security Administration (SSA) directly. You can visit their website at www.ssa.gov and request your child’s Social Security number online. You’ll need to provide some information to verify your identity, such as your name, address, and date of birth, as well as your child’s full name, date of birth, and place of birth.

If you prefer, you can also request your child’s Social Security number by mail. You’ll need to fill out Form SS-5, which is available on the SSA website, and provide the necessary documentation, such as your child’s birth certificate or passport. Once the SSA verifies the information, they will send you a letter with your child’s Social Security number.

It’s important to keep your child’s Social Security number safe and secure. Don’t carry it around with you in your wallet or purse, and don’t share it with anyone who doesn’t need it. Be cautious when giving out your child’s Social Security number, especially online or over the phone. Monitor your child’s credit report regularly to make sure there are no unauthorized accounts or activities.

Finding your child’s Social Security number is not difficult if you have the right information and documentation. You can look it up on a previous tax return or contact the Social Security Administration directly. However, it’s important to keep your child’s Social Security number safe and secure to prevent identity theft and other forms of fraud. By taking the necessary precautions, you can protect your child’s financial future and ensure their peace of mind.

Finding My Daughter’s Social Security Number

As a parent, you may need to know your child’s Social Security Number (SSN) for various reasons such as filing taxes, opening a bank account, or applying for government benefits. If you have previously listed your child as a dependent on your tax return, then you can find their SSN on that return. However, if you don’t have access to that return or if your child has never been listed as a dependent, you can still obtain their SSN by contacting the Social Security Administration (SSA).

To obtain your child’s SSN, you will need to visit the SSA’s website at www.ssa.gov and follow the steps for requesting a replacement Social Security card. You will need to provie proof of your identity and your relationship to the child, such as a birth certificate or adoption decree. Once you have submitted the necessary documentation, the SSA will provide you with a new Social Security card that includes your child’s SSN.

It’s important to keep your child’s SSN confidential and secure, as it can be used for identity theft if it falls into the wrong hands. Be sure to store their SSN and other personal information in a safe and secure location, and only share it with trusted individuals or organizations when necessary.

Finding Your Social Security Number

You can look up your Social Security number. However, it is important to keep in mind that your Social Security number is a very sensitive piece of information, and you should always handle it with care.

There are a few diffeent ways that you can look up your Social Security number. One of the easiest ways is to check your tax documents. Your Social Security number should be listed on your W-2 form, which you should receive from your employer at the end of each year. You can also find your Social Security number on your tax returns or other tax-related documents.

Another place to look for your Social Security number is on your bank or financial statements. Many financial institutions will include your Social Security number on your account statements or other correspondence.

If you don’t have any documentation that includes your Social Security number, you can request a new Social Security card from the Social Security Administration. You can do this online, by mail, or in person at a local Social Security office. You will need to provide some personal information, such as your name, date of birth, and address, to verify your identity before you can receive a new card.

It is important to keep your Social Security number private and secure, as it can be used to steal your identity or commit other types of fraud. You should never share your Social Security number with anyone unless you are absolutely sure that it is necessary and that the person or organization requesting it is legitimate.

Finding a Family Member’s Social Security Number

If you need to find a family member’s Social Security number, there are a few options available to you. However, it’s important to note that accessing someone else’s Social Security number without their consent is illegal and can result in serious consequences. It’s crucial to have a valid reason for needing the number and to obtain it through legal means.

Here are some ways to obtain a family member’s Social Security number:

1. Ask the family member directly: If you have a good reason for needing the Social Security number, such as for inheritance or insurance purposes, you can ask the family member for it directly. They may be wlling to provide it to you if they trust you and understand the reason for your request.

2. Check their documents: If the family member has passed away, you can check their personal documents, such as their tax returns, bank statements, or any other official records where their Social Security number might be listed.

3. Contact the Social Security Administration: If you need the Social Security number for legal or official purposes, you can contact the Social Security Administration (SSA) to request it. However, you must have a valid reason for needing the number, such as for a court order or to settle an estate.

To request a family member’s Social Security number from the SSA, you can make an electronic request through their website or print and complete Form SSA-711 and send it to them along with a check or money order for the appropriate fee.

It’s important to remember that accessing someone else’s Social Security number without their consent is illegal and can result in serious consequences. Always obtain the number through legal means and have a valid reason for needing it.

Conclusion

Obtaining your child’s Social Security number can be crucial for various reasons, such as claiming them as a dependent on your tax return or opening a bank account in their name. If you have previously claimed your child as a dependent, their SS number will be on that tax return. Alternatively, you can contact the Social Security Administration to obtain their SS number. It is essential to keep this informtion secure and only share it with trusted individuals or organizations. By taking the necessary steps to obtain your child’s Social Security number, you can ensure that they are protected and have access to the benefits that they are entitled to.