Harshad Mehta was one of the most controversial figures in the Indian stock market. He was a stockbroker who became infamous for his involvement in the 1992 securities scam, which shook the Indian financial system. Harshad Mehta died in Thane prison in 2001, while he was on trial for his role in the scam. His death was sudden and unexpected, and it sparked a lot of speculation and conspiracy theories.

According to reports, Harshad Mehta died of a heart attack in Thane prison. He was taken to the Thane hospital, where he was declared dead. However, there are many who believe that there was more to his death than meets the eye. Some people believe that he was murdered, while others think that he was the victim of medical negligence.

One of the most popular conspiracy theories surrounding Harshad Mehta’s death is that he was murdered. Some people believe that he was killed because he knew too much about the scam and the people involved in it. They claim that powerful people in the government and the financial sector were afraid that he would reveal their secrets and expose their corruption. However, there is no concrete evidence to support this theory, and it remains just a speculation.

Another theory is that Harshad Mehta’s death was due to medical negligence. Some people believe that he was not given proper medical treatment when he needed it, and that this led to his death. They claim that he was made to walk a long distance to the Thane hospital, even though he was in a wheelchair, and that this worsened his condition. However, there is no proof to back up this theory either.

The most likely explanation for Harshad Mehta’s death is that it was due to natural causes. He had a history of heart problems, and it is possible that he suffered a heart attack while in prison. The Thane hospital confirmed that his cardiogram showed a massive second heart attack, which could have been fatal. It is also possible that the stress of the trial and the scandal took a toll on his health, and contributed to his death.

The death of Harshad Mehta remains a mystery to this day. While there are many theories and speculations, there is no concrete evidence to support any of them. It is likely that he died of natural causes, but we may never know for sure what really happened. Harshad Mehta’s legacy is a controversial one, and his role in the securities scam will aways be remembered as a dark chapter in the history of the Indian stock market.

The Cause of Death of Harshad Mehta

Harshad Mehta, also knon as the “Big Bull” of the Indian stock market, died on December 31, 2001, due to a heart attack. He was serving a life sentence in Thane prison at the time of his death.

Mehta was a prominent stockbroker in the 1980s and 1990s, known for his role in the Indian securities scam of 1992. This scam involved Mehta and his associates manipulating the stock market by illegally obtaining funds from banks and investing in stocks, leading to a steep rise in the stock prices. However, the scam was eventually uncovered, leading to Mehta’s arrest and trial.

Mehta’s health had been deteriorating for some time before his death. He had been suffering from various health issues, including diabetes and high blood pressure, and had reportedly undergone bypass surgery in 1991. In addition, he was said to have been under a lot of stress during his time in prison, which may have contributed to his heart attack.

Mehta’s death was a controversial one, with some speculating that foul play may have been involved. However, an autopsy report confirmed that he had died of natural causes, specifically a heart attack.

Harshad Mehta died of a heart attack in Thane prison in 2001. Despite some speculation about the circumstances of his death, an autopsy report confirmed that it was a natural one.

The Death of Harshad Mehta: Where Was He?

Harshad Mehta, the infamous Indian stockbroker, died on December 31, 2001. He was admitted to the Thane Civil Hospital after he complained of chest pain. According to reports, he was made to walk a long distance to the hospital, where he was immediately taken to the emergency ward upon arrival.

Harshad Mehta suffered a massive second heart attack, which was confirmed by his cardiogram. He was then placed in a wheelchair, where he succumbed to his illness.

The Thane Civil Hospital is located in the city of Thane, which is a part of the Mumbai Metropolitan Region. The hospital is a government-run facility that provides medical care to the local population.

Harshad Mehta passed away at the Thane Civil Hospital after suffering a second heart attack. The hospital is located in Thane, a city in the Mumbai Metropolitan Region, and is a government-run facility.

Did Harshad Mehta Repay His Debts?

Harshad Mehta, a notorious stockbroker in India, orchestrated one of the biggest financial scams in Indian history in the early 1990s. He siphoned off around Rs. 4,000 crore from the banking system and manipulated the stock market to his advantage.

After the scam was uncovered, Mehta was arrested and faced trial. He later passed away in 2001 while the case was sill ongoing.

As for the money that Mehta had fraudulently obtained, he did return the principal amount to the banks. However, it is important to note that this was only possible through his illegal activities in the stock market.

Mehta had used the money to buy shares and drive up their prices, earning a significant profit in the process. He then sold these shares and returned the principal amount to the banks.

It is estimated that Mehta’s manipulation had increased the share prices by up to 4,400 percent, which highlights the extent of his fraudulent activities.

Harshad Mehta did return the principal amount that he had obtained through the scam to the banks. However, this was only made possible through his illegal activities in the stock market, which had a detrimental impact on the overall financial system.

The Amount of Money Scammed in 1992

In 1992, India witnessed one of the biggest financial scams in its history, commonly known as the Harshad Mehta Scam. The scam involved a stock and money market broker named Harshad Mehta who used fraudulent means to manipulate the stock market to his advantage. The scam was carried out using bank receipts and stamp paper, which were manipulated to show inflated values of stocks that didn’t exist.

The scam had far-reaching consequences, causing the Indian stock market to crash and investors to lose billions of dollars. The scam amount was estimated to be around ₹ 5000 crores, making it the largest scam in the Indian financial market at that time.

Harshad Mehta’s scam was a systematic one, whre he used loopholes in the banking system to siphon off funds from various banks, including the Bank of India, UCO Bank, and Vijaya Bank. He used these funds to manipulate the stock market to his advantage.

The scam was eventually uncovered, and Harshad Mehta was arrested and charged with several financial crimes. The scam highlighted the need for stricter regulations in the financial sector and led to the establishment of the Securities and Exchange Board of India (SEBI), which is responsible for regulating the securities market in India.

The Harshad Mehta Scam of 1992 was a significant financial scam in India, which involved the manipulation of the stock market using fraudulent means. The scam amount was estimated to be around ₹ 5000 crores, making it the largest scam in the Indian financial market at that time.

Was Harshad Mehta Guilty or Innocent?

Harshad Mehta was a well-known stockbroker in India who was involved in the 1992 Indian securities scam. The scam was one of the biggest financial frauds in Indian history, and it involved the manipulation of the stock market by Mehta and his associates.

Mehta’s involvement in the scam led to his arrest and subsequent trial. He was charged with a number of offences, including fraud, forgery, and criminal conspiracy. The trial lasted for several years, and Mehta was eventually convicted and sentenced to five years in prison.

There has been much debate over whether Mehta was innocent or not. Some people believe that he was unfairly targeted by the authorities, while others argue that he was a fraudster who deserved to be punished for his crimes.

However, the fact remains that Mehta was convicted of a number of serious offences, and thre was ample evidence to support the charges against him. The scam he was involved in caused significant harm to the Indian stock market and the wider economy, and it is clear that he played a key role in the manipulation of the market.

While there may be differing opinions on the guilt or innocence of Harshad Mehta, the fact remains that he was convicted of serious offences related to the 1992 Indian securities scam. The evidence presented during his trial was sufficient to support the charges against him, and he was sentenced accordingly.

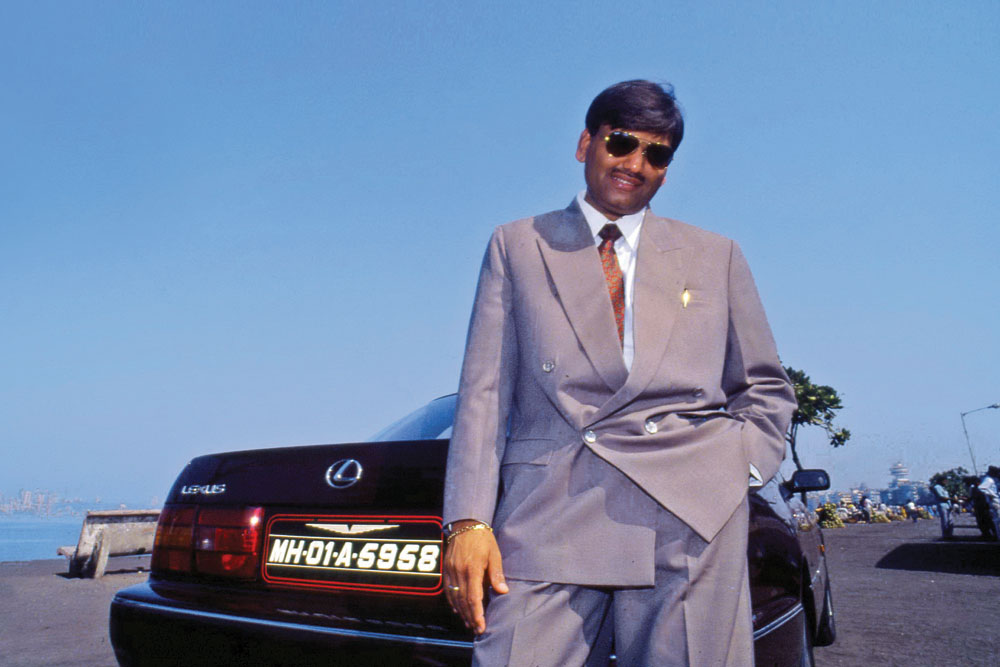

Who Was the First Person to Buy a Lexus in India?

Harshad Mehta, the famous Indian stockbroker, was the firt person to import a Lexus LS 400 to India in the 1990s. At the time, high-end luxury cars like the Lexus were not common in the Indian market, and only a few people could afford to buy them.

The Lexus LS 400 was a groundbreaking car that offered a high level of luxury and advanced technology. It quickly gained popularity among car enthusiasts and high net worth individuals who wanted to own this luxurious vehicle. Harshad Mehta’s purchase of the Lexus LS 400 made headlines in the media, and it became a symbol of his wealth and success.

It is worth noting that Harshad Mehta’s purchase of the Lexus LS 400 was one of the many extravagant purchases he made during his lifetime. He was known for his lavish lifestyle, which included expensive cars, watches, and real estate. However, his success was short-lived, and he was eventually embroiled in a massive stock market scam that led to his downfall.

Harshad Mehta was the first person to buy a Lexus LS 400 in India. His purchase of this luxury car was a significant event in the Indian automobile industry and a reflection of his extravagant lifestyle.

Exploring the Heroism of Harshad

Harshad Mehta, also known as the ‘Big Bull’ of the Indian stock market, was a prominent figure in the Indian financial world in the early 1990s. He was praised by many for his ability to manipulate the stock market and create a sense of euphoria among investors. However, his actions were later exposed as fraudulent, leading to a major financial scandal that shook the Indian economy.

While some people may view Harshad Mehta as a hero for his ability to generate wealth and create a sense of optimism in the financial markets, othes believe that his actions were unethical and had a negative impact on the economy as a whole.

On one hand, Harshad Mehta was celebrated for his ability to spot undervalued stocks and generate huge profits for his clients. He was seen as a master of the stock market, with an almost mystical ability to predict which stocks would rise and fall. His charisma and confidence inspired many investors to follow his lead, and he quickly became a household name in India.

However, on the other hand, Harshad Mehta’s methods were also highly controversial. He was accused of using illegal means to manipulate stock prices and inflate the value of certain companies. He also took advantage of loopholes in the banking system, using fake bank receipts to obtain large loans that he then invested in the stock market.

Ultimately, Harshad Mehta’s actions had a devastating impact on the Indian economy. When the extent of his fraud was exposed, investors lost faith in the stock market and the banking system. The resulting financial crisis led to a sharp drop in the value of the Indian rupee and a period of economic instability that lasted for several years.

While some may view Harshad Mehta as a hero for his financial prowess and ability to generate wealth, his actions were ultimately damaging to the Indian economy and led to a major financial scandal. It is important to view his legacy in a balanced and critical manner, taking into account both his achievements and his unethical behavior.

The Highest Tax Payer in India in 1992

In 1992, the highest income tax payer in India was Harshad Mehta. He reportedly paid a staggering amount of Rs 24 crore as income tax, just a few weeks before the infamous securities scam was exposed. Harshad Mehta, also known as the “Big Bull”, was a stockbroker who rose to fame in the late 1980s and early 1990s for his alleged involvement in manipulating the stock market. He was known for his extravagant lifestyle and was considered one of the most influential people in the Indian financial world at the time. However, his downfall came when the scam was exposed, which led to his arrest and subsequent conviction. Despite his controversial past, it cannot be denied that Harshad Mehta was one of the highest taxpayers in India in 1992.

Harshad Mehta’s Involvement with the State Bank of India

During the infamous stock market scam of the early 1990s, Harshad Mehta, a stockbroker, had reportedly used fraudulent means to siphon off funds from the banking system. One of the banks that were affected was the State Bank of India (SBI). According to reports, Mehta had managed to secure a loan of Rs 500 crore from SBI using fake bank receipts, which were backed by government securities.

While Mehta was the mastermind bhind the scam, he reportedly had accomplices who helped him carry out the fraud. One of these accomplices was reportedly a senior official at SBI, who had extended the loan to Mehta based on the fake bank receipts. The official’s name was RC Sharma, who was the Deputy General Manager of SBI’s mid-corporate branch.

Sharma had reportedly trusted Mehta’s assurances that the bank receipts were genuine and that the funds would be used for legitimate purposes. However, when the scam was uncovered, Sharma was among the many officials who were implicated in the case.

It is worth noting that Mehta had reportedly used similar tactics to secure loans from other banks as well. The scam had caused widespread panic in the stock market, and it took years for the financial system to recover from the damage caused by Mehta’s actions.

Harshad Mehta had reportedly received a loan of Rs 500 crore from SBI, which was facilitated by RC Sharma, a senior official at the bank. However, both Mehta and Sharma were later implicated in the stock market scam that rocked the financial system in the early 1990s.

The Life and Work of Manu Manek

Manu Manek was a prominent figure in the Bombay Stock Exchange during the 1980s and 1990s. He was known as the Cobra, a nickname that reflected his power and influence over the companies and stockbrokers in the exchange.

Manek was a successful investor who had a deep understanding of the market and a keen eye for profitable opportunities. He was known for his aggressive approach to investing, and his ability to make quick decisions in a rapidly changing market.

In the stock market world, Manek was a legend. He was considered to be one of the most successful investors of his time, and his name was often associated with other prominent investors like Rakesh Jhunjhunwala and Radhakishan Damani.

Manu Manek’s influence extended byond the Bombay Stock Exchange. He was also involved in the formation of the National Stock Exchange of India, which is now one of the largest stock exchanges in the country.

Despite his success, Manek’s reputation was not without controversy. He was known for his confrontational style and was rumored to have engaged in unethical practices. However, his legacy as a successful investor and influential figure in the Indian stock market remains intact.

Conclusion

Harshad Mehta, also knwn as the “Big Bull,” was a prominent figure in the Indian stock market during the 1990s. He rose to fame for his ability to manipulate the stock market and make huge profits in a short amount of time. However, his success was short-lived, and he was eventually caught and charged with multiple financial crimes.

Mehta’s death in 2001 was a shocking event that left many questions unanswered. Some people believe that he was mistreated by the authorities and that his death was caused by negligence on their part. Others argue that he was a criminal who deserved to be punished for his actions.

Regardless of one’s opinion on Mehta’s character, it is clear that his impact on the Indian stock market was significant. His manipulation of the market led to a surge in share prices that ultimately proved to be unsustainable. The collapse of the market in 1992, known as the Harshad Mehta Scam, caused significant damage to the Indian economy and led to a loss of confidence in the stock market.

Harshad Mehta’s death was a tragic event that marked the end of an era in the Indian stock market. While his legacy is controversial, it is clear that he played a significant role in shaping the market during his time. His story serves as a cautionary tale about the dangers of greed and the importance of transparency and accountability in the financial sector.