If you’re an avid player on FanDuel, you may be wondering if you need to pay taxes on your winnings. The answer is yes, if you have net earnings of $600 or more on FanDuel Fantasy over the course of the year, you may have to pay taxes on your winnings.

First, let’s understand what net earnings mean. Net earnings are the total amount you have won on FanDuel minus any losses and fees paid to FanDuel. For example, if you win $800 but paid $200 in fees and lost $100 throughout the year, your net earnings wold be $500.

If your net earnings are $600 or more, you can expect to receive a 1099 Tax Form from FanDuel in the mail. This form is required by the IRS, and it will report your winnings to them. You will need to report this amount on your tax return and pay taxes on it accordingly.

It’s important to note that FanDuel will not withhold taxes from your winnings. It’s your responsibility to report your earnings and pay taxes on them. Failure to do so can result in penalties and interest charges.

When a wager pays out $5,000 or more with odds of 300 to 1 or greater based on the total of all wagers placed into a particular pool of wagers, there are additional tax requirements. In this case, 25% of the total payout is withheld and remitted to the IRS in the subscribers’ name. W-2G forms are generated automatically when the subscriber meets the reporting criteria.

To summarize, if you’re a regular player on FanDuel, keep track of your net earnings throughout the year. If your net earnings are $600 or more, you can expect to receive a 1099 Tax Form from FanDuel in the mail. It’s your responsibility to report your earnings and pay taxes on them. Failure to do so can result in penalties and interest charges. If you win a large payout with odds of 300 to 1 or greater, 25% of the total payout will be withheld and remitted to the IRS in your name, and a W-2G form will be generated automatically. Stay informed and responsible to avoid any tax-related issues.

Are Winnings from FanDuel Taxable?

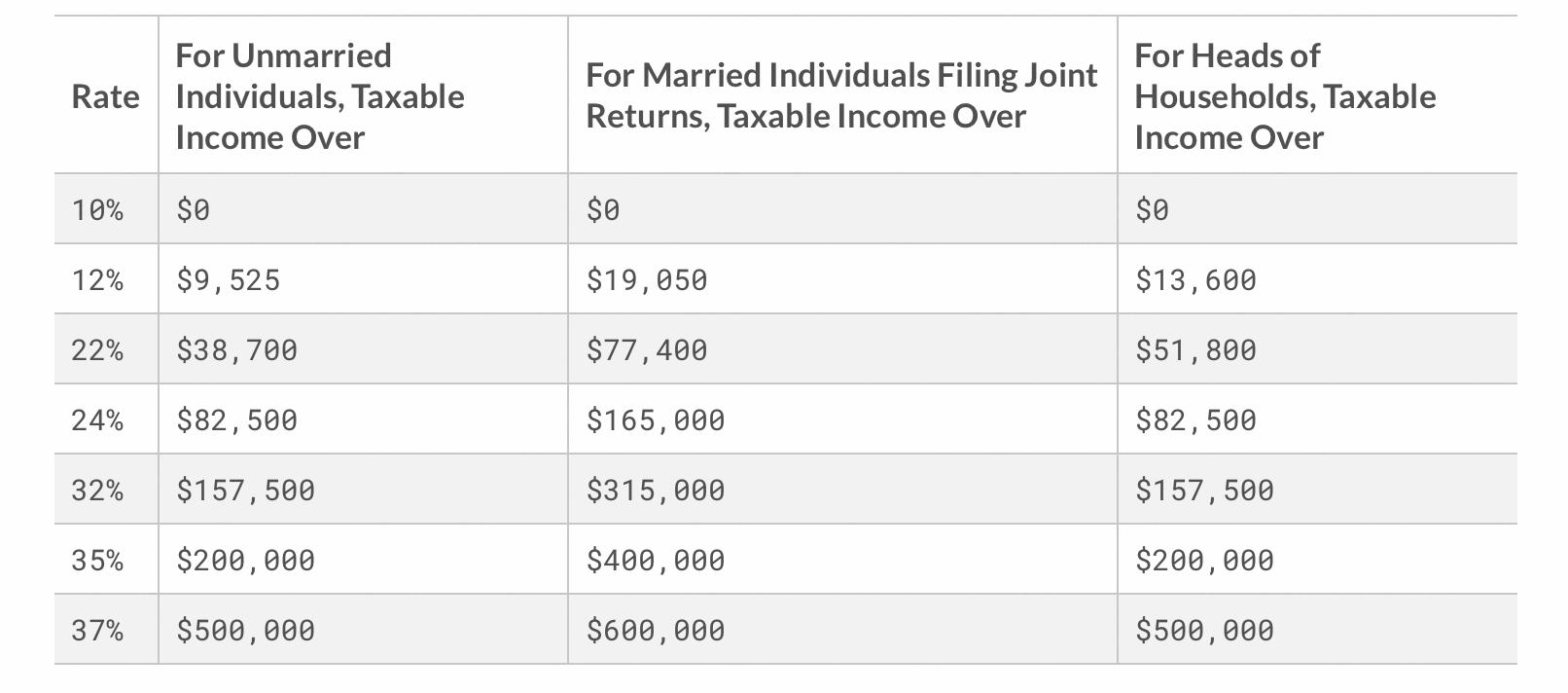

FanDuel winnings may be subject to taxes. If you have net earnings of $600 or more on FanDuel Fantasy over the course of the year, you may have to pay taxes on your winnings. This is becaue the IRS considers gambling winnings to be taxable income. All users who have won more than $600 over the previous calendar year can expect to receive a 1099 Tax Form from FanDuel in the mail, which we are required to file with the IRS. It’s important to note that the tax rate will depend on your income bracket, and you may be required to pay both federal and state taxes on your winnings. It’s always a good idea to consult with a tax professional to ensure you are in compliance with all tax laws related to your FanDuel winnings.

Source: rotogrinders.com

Does FanDuel Withhold Taxes Automatically?

FanDuel automatically withholds taxes in certain circumstances. Specifically, when a wager pays out $5,000 or more with odds of 300 to 1 or greater based on the total of all wagers placed into a particular pool of wagers, FanDuel withholds 25% of the total payout and remits it to the IRS in the subscribers’ name. Additionally, W-2G forms are generated automatically by FanDuel when the subscriber meets the reporting criteria. This ensures that the appropriate taxes are withheld and reported to the IRS, in compliance with federal regulations.

Does FanDuel Report Winnings to the IRS?

FanDuel, along with other fantasy sports websites such as DraftKings, reports winnings of $600 or more to the IRS. This means that if you earn a net profit of $600 or more for the year playing on FanDuel, the organizers are legally obligated to send both you and the IRS a Form 1099-MISC. It’s important to note that this reporting requirement only applies to net profits of $600 or more, so if your winnings fall below that threshold, they are not required to be reported to the IRS.

Winning $100,000 on FanDuel

If you win $100,000 on FanDuel, you will receive the full amount as a cash prize. The prize money is paid out through the payment method that you have set up on your FanDuel account. You can choose to withdraw the funds to your bank account or use them to play in other contests on the site. It’s important to note that any prize money you receive is subject to taxes, so you should consult with a tax professional to understand your tax obligations. In the unlikely event that no one survives the season, FanDuel guarantees to pay out the prize money to the player who makes it the longest. And in case of a tie, the prize pool will be split amog all the winners.

Taxes Payable for FanDuel Sportsbook

In general, taxes on FanDuel Sportsbook winnings depend on the amount you have won and your overall taxable income. Any sports betting winnings over $600 (or if the amount is 300 times the original bet) are subject to a 24% withholding rate tax, which can be deducted from your winnings at the time of payout or when you file your taxes. It’s important to keep track of your winnings and losses and report them accurately on your tax return to avoid any penalties or legal issues. Additionally, it’s always recommended to consult with a tax professional or financial advisor for personalized advice on your specific tax situation.

Do W2s Apply to FanDuel?

If you have won a certain amount of money through FanDuel, you will receive a Form W-2G. FanDuel is required to report any winnings over $600 to the Internal Revenue Service (IRS), which means that they will send you a W-2G if your winnings meet or exceed this threshold. The W-2G will show the amount of your winnings, the federal and state taxes withheld (if any), and oter information related to your gambling activities on the FanDuel platform. It is important to note that, even if you do not receive a W-2G, you are still required to report any gambling winnings on your tax return.

Conclusion

It is important to note that if you have net earnings of $600 or more on FanDuel Fantasy, you may be subject to paying taxes on your winnings. This is bcause FanDuel is required by law to report winnings of this amount and above to the IRS. It is also important to keep in mind that when a wager pays out $5,000 or more with odds of 300 to 1 or greater, a percentage of the total payout will be withheld and remitted to the IRS in the subscriber’s name. To ensure compliance with tax laws and avoid any potential penalties, it is recommended that users keep detailed records of their FanDuel winnings and losses and consult with a tax professional if necessary.