Cash dividends are a common way for companies to distribute profits to their shareholders. When a company declares a cash dividend, it must follow a series of steps to properly account for the distribution of funds. In this blog post, we will explore the process of declaring a cash dividend and the necessary journal entries that must be made.

The first step in declaring a cash dividend is for the board of directors to calculate the cash amount to be paid to the shareholders. This involves determining how much money the company has available to distribute while still maintaining appropriate levels of working capital and investment in the business. Once this amount has been determined, the board of directors will fix a record date for determining the stockholders who will be entitled to receive the dividend, based on the laws of their state.

Once the record date has been established, the company must make the necessary journal entries to account for the cash dividend. The first entry is made on the date of declaration, which is the date that the board of directors officially announces the dividend. This entry involves debiting the retained earnings account for the amount of the dividend and crediting the dividends payable account for the same amount.

The retained earnings account is a balance sheet account that represents the accumulated profits of the company that have not been distributed to shareholders. When a cash dividend is declared, the retained earnings account is reduced to reflect the distribution of funds to shareholders. The dividends payable account is a liability account that represents the amount of the dividend that the company owes to its shareholders.

The scond journal entry is made on the date of payment, which is the date that the company actually distributes the funds to its shareholders. This entry involves debiting the dividends payable account for the amount of the dividend and crediting the cash account for the same amount. This entry reflects the fact that the company has now fulfilled its obligation to pay the dividend to its shareholders.

It is important for companies to properly account for cash dividends to ensure accurate financial reporting and compliance with accounting standards. Cash dividends do not affect a company’s income statement, but they do reduce the company’s shareholders’ equity and cash balance by the same amount. Companies must report any cash dividend as payments in the financing activity section of their cash flow statement.

Declaring a cash dividend involves several important steps, including calculating the amount to be paid, fixing a record date, and making the necessary journal entries. By following these steps, companies can ensure accurate financial reporting and maintain the trust of their shareholders.

Declaring Cash Dividends: Requirements

The declaration of cash dividends involves several steps that the board of directors must follow. Firstly, the board must calculate the cash amount to be paid to the shareholders, both individually and in the aggregate. This calculation takes into account the company’s financial performance, cash reserves, and any other factors that may impact the dividend payout.

Secondly, the board must fix a record date for determining the stockholders who will be entitled to receive the dividend. This date is typically based on the laws of the state in which the company is incorporated and is typically set a few weeks afer the dividend declaration.

Once these steps have been completed, the company can then announce the dividend to shareholders and make the necessary arrangements for payment. It’s worth noting that the declaration of cash dividends is an important decision that affects both the company and its shareholders, and it’s important for the board of directors to carefully consider all relevant factors before making any decisions.

Source: pix4free.org

Recording Cash Dividends

Cash dividends are recorded in the financing activity section of a company’s cash flow statement. This is because cash dividends do not affect a company’s income statement, but they do decrease the company’s shareholders’ equity and cash balance by the same amount. Therefore, companies must report any cash dividend as payments in the financing activity section of their cash flow statement. This section tracks a company’s cash inflows and outflows relatd to financing activities, such as issuing or repurchasing stock, paying dividends, or borrowing and repaying debt. So, if a company pays cash dividends, it will be recorded in the financing activity section of their cash flow statement.

The Entries for Cash Dividends: What is a Cash Dividend?

A cash dividend is a payment made by a company to its shareholders, usully in the form of cash, as a distribution of profits. This payment is typically made on a per-share basis, with each shareholder receiving a certain amount of money for each share they own.

As for the entries for cash dividends, they involve the company’s retained earnings and dividends payable accounts. When a company declares a cash dividend, the retained earnings account is debited for the amount of the dividend, reducing the balance of the accumulated profits that have been kept instead of distributed to shareholders. At the same time, the dividends payable account is credited for the same amount, indicating the amount of money that the company owes to its shareholders.

Once the payment is made to the shareholders, the dividends payable account is debited for the amount paid, and the cash account is credited for the same amount, reflecting the decrease in the company’s cash balance.

Cash dividends are an important way for companies to reward their shareholders and distribute profits. Properly accounting for these payments is crucial to maintaining accurate financial records and ensuring compliance with accounting standards.

Do Cash Dividends Require a Journal Entry?

Cash dividends require a journal entry. When a corporation declares a cash dividend, it is considered a distribution of profits to its shareholders. The journal entry on the date of declaration involves debiting the retained earnings account and crediting the dividends payable account. This records the liability of the corporation to its shareholders for the declared dividends.

On the date of payment, a seond journal entry is required to record the actual payment of cash to the shareholders. This involves debiting the dividends payable account and crediting the cash account. This journal entry reduces the liability of the corporation to its shareholders for the declared dividends and records the actual outflow of cash from the corporation to its shareholders.

It is important to note that the journal entries for cash dividends may vary depending on the specific circumstances of the corporation. However, in general, cash dividends require at least two journal entries to properly account for the distribution of profits to shareholders.

Recording Cash Dividends on Balance Sheet

When a company declares a cash dividend, it primarily impacts two accounts on the balance sheet: cash and shareholder equity. Initially, the company records the dividend declaration in a temporary account knon as dividends payable. This creates a liability on the balance sheet, as the company owes the dividend payments to its shareholders.

Once the dividend is actually paid out, the balance in the dividends payable account is reduced, and the cash account is decreased by the amount of the dividend payment. This results in a decrease in the company’s total assets and a decrease in shareholder equity.

It’s important to note that there is no separate balance sheet account for dividends after they are paid. Instead, the impact of the dividend is reflected in the cash and shareholder equity accounts. cash dividends can have a significant impact on the balance sheet and provide valuable insights into a company’s financial health and performance.

Reporting Cash Dividends on Financial Statements

Cash dividends declared by a company are typically reported as a deduction from retained earnings on financial statements. This means that the amount of cash distributed to shareholders as dividends is subtracted from the company’s accumulated profits or earnings that have been kept within the business. The statement of stockholders’ equity is where dividends declared or paid are usually presented, specifying the amount per share and the total for each class of shares as required by S-X 3-04. This information is crucial for investors and analysts to understand the financial health and performance of the company, as dividends play an important role in determining the value of its shares and overall shareholder return. Therefore, it is essential for companies to accurately report ther cash dividends on their financial statements.

Recording Dividends

Dividends are recorded in a company’s financial statements through a process called journal entry. When a company declares a dividend, it must debit its retained earnings account and credit its dividends payable account. This journal entry reflects the company’s obligation to pay the dividend to its shareholders.

Once the dividend is paid to the shareholders, the company must debit its dividends payable account and credit its cash account. This journal entry reflects the actual payment of the dividend to the shareholders.

It is also worth noting that there are different types of dividends, such as cash dividends and stock dividends. Cash dividends are paid in cash to the shareholders while stock dividends are paid in the form of additional shares of stock. The recording process for stock dividends is different as the fair value of the shares issued is transferred from retained earnings to the reated equity accounts.

Dividends are recorded through journal entries that reflect the company’s obligation to pay the dividend and the actual payment of the dividend. The type of dividend issued will determine the specific recording process.

Including Dividends on the Balance Sheet

Dividends payable is a liability account that appears on the balance sheet of a company. This account represents the amount of after-tax profit that a company has authorized for distribution to its shareholders, but has not yet paid in cash. When a company declares a dividend, it creates a legal obligation to pay it to the shareholders, resulting in an increase in the dividends payable account. Once the dividend payment is made, the dividends payable account is reduced, and the correspnding amount is reflected in the cash account. It is essential to include dividends payable in the balance sheet as it provides investors with valuable information about the company’s financial health and its commitment to rewarding shareholders.

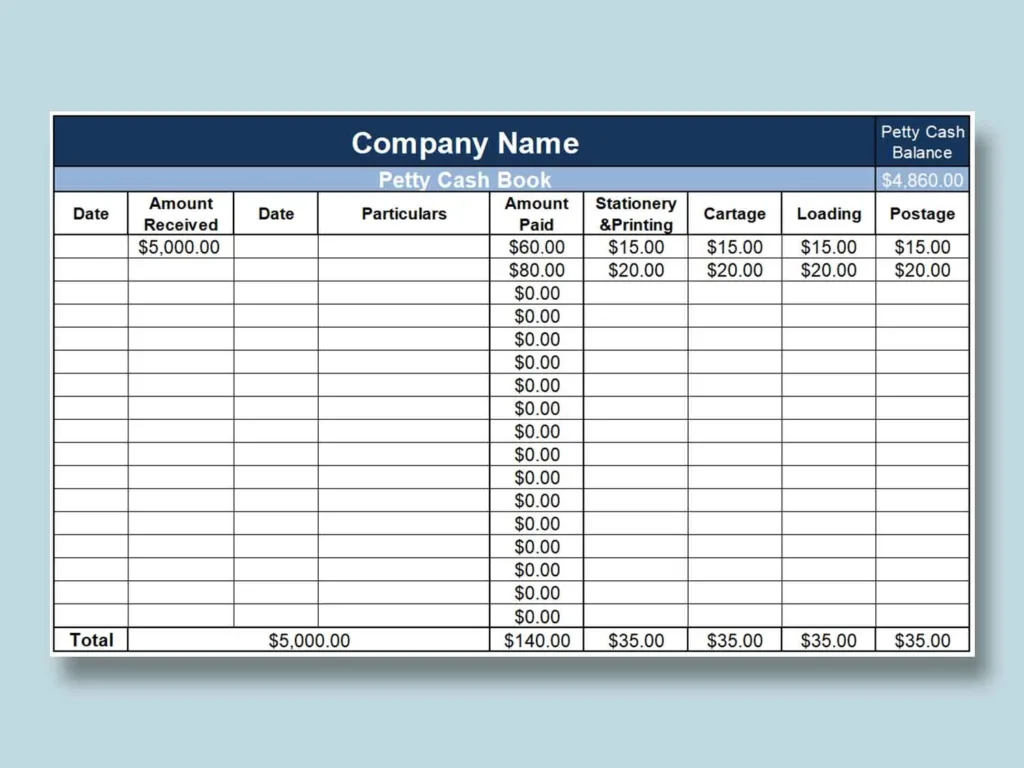

Recording Dividends in Cash Book

Dividends are recorded in a company’s cash book. When a company declares a cash dividend, it represents a cash outflow to the shareholders. This means that the company’s cash balance will decrease by the amount of the dividend paid.

The cash dividend is recorded in the cash account of the company’s general ledger. The account will be debited for the amount of the dividend paid. The retained earnings account will also be reduced by the same amount, as the company is distributing a portion of its earnings to the shareholders.

Cash dividends are recorded in a company’s cash book as a reduction in the cash and retained earnings accounts. This accounting entry accurately reflects the outflow of cash to the shareholders and the resulting decrease in the company’s retained earnings.

Do I Need To Make A Journal Entry For Declaring A Stock Dividend?

A journal entry is required for the declaration of a stock dividend. While the total amount of stockholders’ equity remains unchanged, a stock dividend involves the issuance of additional shares to existing shareholders. As a result, an amount must be transferred from the retained earnings section to the paid-in capital section to reflect the issuance of thee additional shares. This transfer is recorded through a journal entry. The specific details of the journal entry will depend on the size and type of stock dividend being issued, as well as the accounting method being used by the company. However, regardless of these specifics, a journal entry is always necessary to properly account for the issuance of a stock dividend.

Conclusion

Cash dividends are a popular way for corporations to distribute profits to teir shareholders. The process begins with the board of directors calculating the cash amount to be paid to each shareholder and determining the record date. While cash dividends do not affect a company’s income statement, they do reduce the shareholders’ equity and cash balance by the same amount. Companies must report cash dividends as payments in the financing activity section of their cash flow statement. The correct journal entry post-declaration is a debit to the retained earnings account and a credit to the dividends payable account. Cash dividends are an important consideration for both companies and investors, and understanding their impact on financial statements is crucial for making informed investment decisions.