EFS checks are a popular payment method among trucking companies and thir drivers. These checks are issued by Electronic Funds Source LLC, a leading provider of payment solutions for the transportation industry. In this blog post, we will explore what EFS checks are, how they work, and how you can order them.

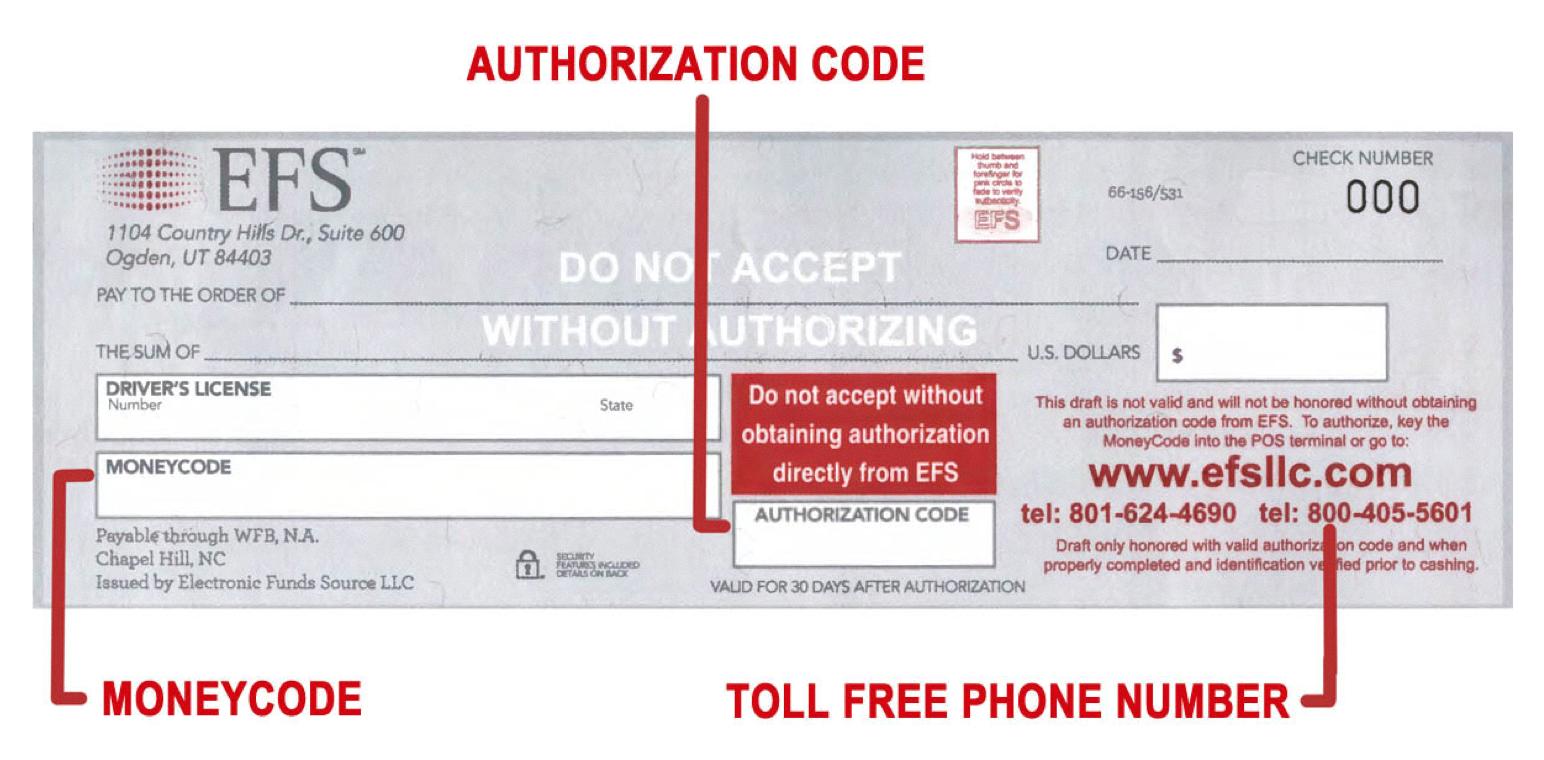

Simply put, an EFS check is a physical payment that looks and functions much like a personal check. An EFS check will have several blank fields, such as the recipient of the payment and the date of the transaction. It also has several identifying labels so that the recipient knows the EFS check is authentic.

Typically, an EFS code will be given to a fleet owner or directly to a driver. The code varies in length, but is usually 10 digits. Once received, the trucking company has several options to redeem their money.

Express Codes can be cashed at most truckstops or any bank as long as EFS is accepted. Walmart Money Centers offer a wide range of different financial services. This is a quick and convenient way of cashing a range of different types of checks. Unfortunately, Walmart Money Centers cannot process EFS Checks.

One of the main advantages of using EFS checks is that they are a secure and reliable payment method. EFS checks are backed by Electronic Funds Source LLC, which has a strong reputation in the transportation industry. Additionally, EFS checks can be cashed at a wide range of locations, making them a convenient payment option for trucking companies and their drivers.

If you are interested in ordering EFS checks, you can contact EFS Customer Service at (888) 824-7378. EFS offers their checks at no cost to you, making it an affordable payment solution for your trucking company.

Obtaining an EFS Check

Getting an EFS check is easy! To order your EFS checks, simply contact EFS Customer Service at (888) 824-7378. Their friendly and knowledgeable representatives will be happy to assist you in placing your order for EFS checks at no cost to you. Once you provide the necessry information, your checks will be printed and mailed directly to you. It’s that simple! Additionally, if you have any questions or concerns about EFS checks or their usage, the customer service team is always available to provide you with the answers and support you need. So, don’t hesitate to reach out to EFS Customer Service to order your checks and start enjoying the convenience and benefits of this payment method.

Source: factorloads.com

Understanding How an EFS Check Works

An EFS check, also known as an Electronic Funds Transfer (EFT) check, is a digital payment method that allows businesses to send and receive payments electronically. The process of using an EFS check involves sevral steps. First, the business initiating the payment creates an EFS check by entering the payment details into their accounting software. This includes the recipient’s name, payment amount, and payment date.

Once the EFS check has been created, it is sent to the recipient’s bank for processing. The bank verifies the authenticity of the EFS check and then transfers the funds to the recipient’s account. The recipient can then deposit the EFS check into their bank account like a regular paper check.

One of the benefits of using an EFS check is that it eliminates the need for physical checks, which can be lost or stolen. Additionally, EFS checks are processed much faster than traditional paper checks, reducing the time it takes for payments to be received and cleared.

An EFS check is an electronic payment method that allows businesses to send and receive payments quickly and securely. It offers several advantages over traditional paper checks and is becoming an increasingly popular payment option for many businesses.

Cashing an EFS Check

If you have received an EFS check or Express Code, there are several ways to cash it. The first option is to visit any truckstop that accepts EFS and present your check or code to the cashier. They will then provde you with the cash value of the check or code, minus any applicable fees.

Another option is to visit a bank that accepts EFS checks. You will need to provide the check or code to a teller and provide identification. The teller will then process the check and provide you with the cash value, minus any applicable fees.

It is important to note that fees may vary depending on the location and method of cashing the check or code. Additionally, it is recommended to cash the check or code as soon as possible to avoid any potential expiration dates or fees.

Cashing EFS Checks at Walmart

While Walmart Money Centers offer a diverse range of financial services, including check cashing for various types of checks, EFS checks are not accepted. It’s important to note that Walmart does have some restrictions on the types of checks that they can cash, and EFS checks are one of them. However, if you need to cash other types of checks, such as payroll checks, personal checks, or government checks, Walmart Money Centers can usually accommodate those transactions. It’s always a good idea to call ahead to confirm the types of checks that Walmart Money Centers can cash before you visit.

Are EFS Checks and T Checks the Same?

EFS checks and T checks are the same thing. T-Chek is a payment system that is commonly used in the transportation industry, and it is owned by Electronic Funds Source LLC (EFS). Therefore, T-Chek is often referred to as an EFS check. Both terms are used interchangeably to describe the same payment system. T-Chek or EFS checks are typically used by carriers to pay for expenses such as fuel, maintenance, and other operational costs. The payment system provides a convenient and secure way for carriers to manage their finances and for vendors to receive payment quickly and efficiently.

Source: youtube.com

Can You Withdraw Money From an ATM Using EFS?

You can use EFS at an ATM. In fact, you and your drivers can access funds from more than 600,000 ATM locations using your EFS debit card. This means that you can withdraw cash from an ATM whenever you need it, making it a convenient option for managing your finances on-the-go. Additionally, most store front locations also accept EFS debit cards, so you can use your card to make purchases at a variety of retail locations. EFS debit cards provide a flexible and convenient way to access and manage your funds.

Paying With EFS

To pay with EFS, you have a few different options depending on your specific situation. If you are a driver who has been issued an EFS card, you can use it to make purchases and withdraw cash at participating merchants and ATMs. When you’re ready to make a purchase, simply swipe your EFS card and enter your PIN. If you’re withdrawing cash, you’ll need to find an EFS-approved ATM and follow the prompts to withdraw the desired amount.

If you’re an EFS customer looking to make a payment on your account, you can do so through the EFS website or mobile app. Simply log in to your account and navigate to the “Make a Payment” section. From there, you can enter your payment information and submit your payment.

If you’re an EFS customer who needs to make a payment on behalf of a driver, you can use the Select Funds Transfer feature. This allos you to transfer funds from your account to an EFS cardholder’s account, which they can then use to make purchases or withdraw cash.

There are a few different ways to pay with EFS depending on your specific needs. Whether you’re a driver, a customer, or both, EFS provides flexible payment options to help you manage your finances efficiently and effectively.

Transferring EFS Funds to a Bank Account

Transferring funds from your EFS card to your bank account is a straightforward process that can be done in two ways. The first method is to use the EFS online portal. To do this, you need to log in to your EFS account, navigate to the transfer funds section, and enter the amount you want to transfer and the bank account details. Once you have provided all the necessary information, click on the transfer button, and the funds will be transferred to your bank account.

The second method involves calling the EFS automated phone system at 888-824-7378. Press #3 for cardholder and enter your card number followed by the # sign, then enter your PIN followed by the # sign. After this, you will enter option 4 to transfer funds. Follow the prompts to enter the amount you want to transfer and the bank account details, and the funds will be transferred to your bank account.

It is essential to note that thre may be fees associated with transferring funds from your EFS card to your bank account. It is also advisable to check with your bank to ensure that they accept transfers from EFS cards. transferring funds from your EFS card to your bank account is a convenient way to access your funds and manage your finances.

Voiding an EFS Check

To void an EFS check, you will need to follow a few simple steps. First, locate the check in question and make sure it has not been cashed or deposited yet. Then, fill out a voided check form, which can be obtained from the EFS website or by contacting their customer service department.

On the voided check form, you will need to provide your account information, including your name, address, and account number. You will also need to provide the check number and the amount of the check that you wish to void.

Once you have completed the voided check form, you will need to email it to efs.checks@wexinc.com. Your request will be reviewed withn 3-5 business days, and you will receive confirmation once the check has been voided.

It is important to note that this process is not required for T-Chek Drafts if the draft is over 30 days old. In this case, you should call the number on the draft to have it voided or re-issued.

Transferring Funds from EFS to Bank Account: How Long Does It Take?

When transferring funds from your EFS account to an external bank account, it typically takes 1-3 business days for the funds to appear in your bank account. It’s important to note that funds are transferred once daily, so the timing of your transfer submission can impact the length of time it takes for the funds to be processed. Additionally, if a transfer is still in “pending” status, it can be cancelled at any time. whie the transfer process may take a few days, EFS strives to ensure that your funds are securely and efficiently transferred to your desired external bank account.

How Long Does It Take for EFS Funds to Transfer to a Bank Account?

When you initiate a transfer from EFS to your bank account, it typically takes 1-4 business days for the transfer to process through the banking system and be available in your external account. It is important to keep in mind that the exact timing of the transfer may vary depending on vrious factors such as weekends, holidays, and any potential delays within the banking system. Additionally, it is always a good idea to double-check with your bank to confirm their specific processing times for incoming transfers from EFS. EFS strives to process transfers as quickly and efficiently as possible, while also ensuring the security and accuracy of each transaction.

Can Banks Cash EChecks?

Banks do cash eChecks just like any other type of check. You can deposit eChecks at a bank or credit union, through an ATM or by using your branch’s Remote Deposit Capture. The process for depositing eChecks is similar to that of traditional paper checks, and the funds are typically made available to you wihin a few business days. Patented technology allows companies and banks to help reduce fraud by easily verifying the authenticity of each eCheck. It’s important to note that each bank may have its own policies and procedures regarding eCheck deposits, so it’s always a good idea to check with your bank or financial institution for specific instructions.

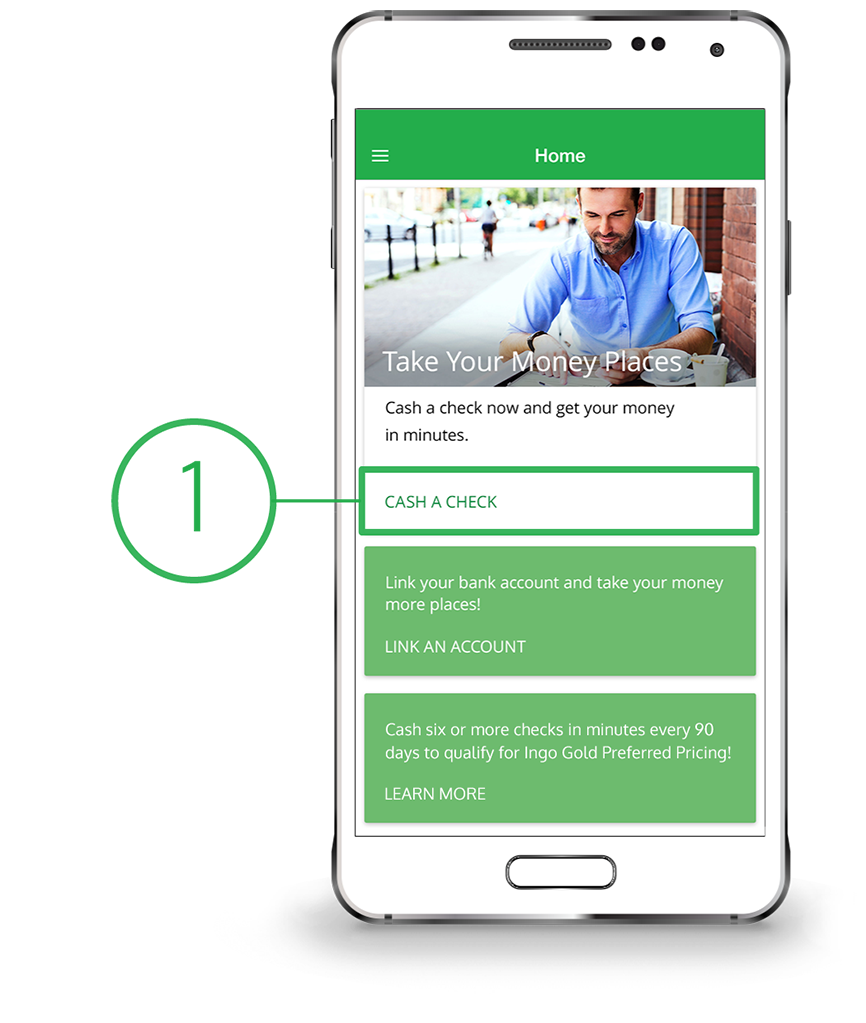

Using Apps to Cash Checks Immediately

If you’re looking for an app that can cash a check immediately, the Ingo® Money App might be a good option for you. With this app, you can cash almost any type of check, including personal, business, and payroll checks, and get your money in minutes. Once you’ve downloaded the app, you simply take a picture of the front and back of your endorsed check, select the account you want the funds deposited to, and submit the transaction for approval. In some cases, you may need to pay a fee for the service, but the app’s website provides a fee estimator tool to help you determine what the cost will be. the Ingo® Money App is a convenient and efficient way to cash checks quickly without havng to visit a physical location.

Cost of Cashing a $1000 Check at Walmart

If you have a $1000 check that you need to cash at Walmart, you can do so for a fee of up to $4. This fee may vary depending on the specific location and state where the Walmart store is located. It is important to note that if you are cashing a check for more than $1000, the fee may increase up to $8. Additionally, durig tax refund season, Walmart may offer a higher cashing limit of up to $7,500, but the fee may still be up to $8. Walmart provides a convenient option for cashing payroll or government checks, including tax refund checks, with reasonable fees.

Can Walmart Cash an E Check?

Walmart does cash eChecks. However, it’s important to note that Walmart uses a third-party check cashing service, called Certegy, to handle their check cashing transactions. So, before you head to Walmart to cash your eCheck, you’ll want to confirm that Certegy can process eChecks from your bank. Additionally, Walmart charges a fee for check cashing services, which varies depending on the amount of the check. It’s always a good idea to call ahead and confirm the fees and requirements before heading to Walmart to cash your eCheck.

Conclusion

EFS checks are a secure and convenient payment method for trucking companies and their drivers. With its unique identifying labels and blank fields, it functions much like a personal check but is tailored to meet the specific needs of the trucking industry. EFS checks can be redeemed at most truckstops and banks that accept EFS or through other payment options such as direct deposit. Though Walmart Money Centers do not accept EFS checks, there are still many alternatives available. EFS checks proide a reliable payment option for the trucking industry, ensuring that drivers and companies can easily access and manage their funds.