If you’re a business owner, you may have heard of a DUNS number and an EIN, but you might not be sure what they are or how they differ. Understanding the difference between these two numbers is essential to properly managing your business’s finances and credit history.

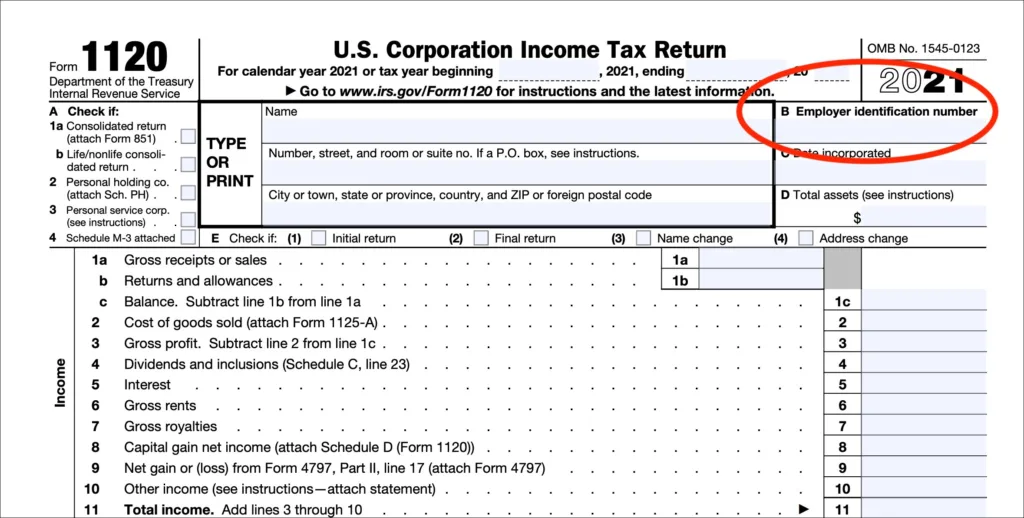

First, let’s define what each of these numbers is. A DUNS number is a unique nine-digit identifier issued by Dun & Bradstreet, a credit reporting agency that specializes in business data. This number is used to track a business’s credit history and creditworthiness. On the other hand, an EIN, or employer identification number, is a nine-digit number issued by the Internal Revenue Service (IRS) to identify a business entity for tax purposes.

While they may seem similar, a DUNS number and an EIN serve different purposes. A DUNS number is primarily used for credit reporting purposes and is often required when applying for business credit or loans. It’s also required for businesses that contract with government agencies. An EIN, on the other hand, is used for tax purposes and is required for most businesses that have employees, as well as for businesses that operate as partnerships, corporations, or LLCs.

One common misconception is that a DUNS number can be used in place of an EIN or Social Security number (SSN) for lending and application purposes. However, this is not the case. While a DUNS number is an important identifier for your business’s creditworthiness, it canot be used to file taxes or pay employees.

So, do you need a DUNS number for your small business? If you plan on seeking financing or growing your business, it’s highly recommended. Establishing a DUNS number can help lenders better understand your business’s credit history and creditworthiness, which can make it easier to secure loans or credit. Additionally, if you plan on contracting with government agencies, a DUNS number is required.

While a DUNS number and an EIN may seem similar, they serve different purposes. A DUNS number is used for credit reporting purposes, while an EIN is used for tax purposes. It’s important to understand the difference between these two numbers to properly manage your business’s finances and credit history. If you’re a small business owner, it’s recommended that you obtain a DUNS number to help secure financing and contracts with government agencies.

Do I Need a DUNS Number if I Have an EIN?

Obtaining a DUNS number is still necessary even if you already have an EIN. While an EIN is used for tax identification purposes, a DUNS number is used for business credit reporting. Many lenders, suppliers, and other business partners use the DUNS number to assess the creditworthiness of a company. Without a DUNS number, your business may be at a disadvantage when it comes to securing financing, establishing trade credit, or bidding on contracts. Therefore, it is recommended that all businesses obtain a DUNS number in addition to their EIN.

Can I Use a DUNS Number in Place of an EIN Number?

A DUNS number and an EIN number serve differet purposes and cannot be used interchangeably. A DUNS number is a unique 9-digit identifier issued by Dun & Bradstreet to identify businesses, while an EIN number is a 9-digit tax identification number issued by the IRS for tax purposes.

A DUNS number is primarily used for credit reporting purposes and is often required by lenders and vendors when applying for credit or financing. On the other hand, an EIN number is required by the IRS for tax purposes, such as filing tax returns or opening a business bank account.

Therefore, a DUNS number cannot be used instead of an EIN number for tax purposes, and vice versa. It is important to have both a DUNS number and an EIN number to ensure that your business is properly identified and can access the various benefits and services associated with each number.

Do I Need a DUNS Number for My Business?

If you are a small business owner, you may be wondering if you need a DUNS number for your business. The answer to this question depends on a few factors.

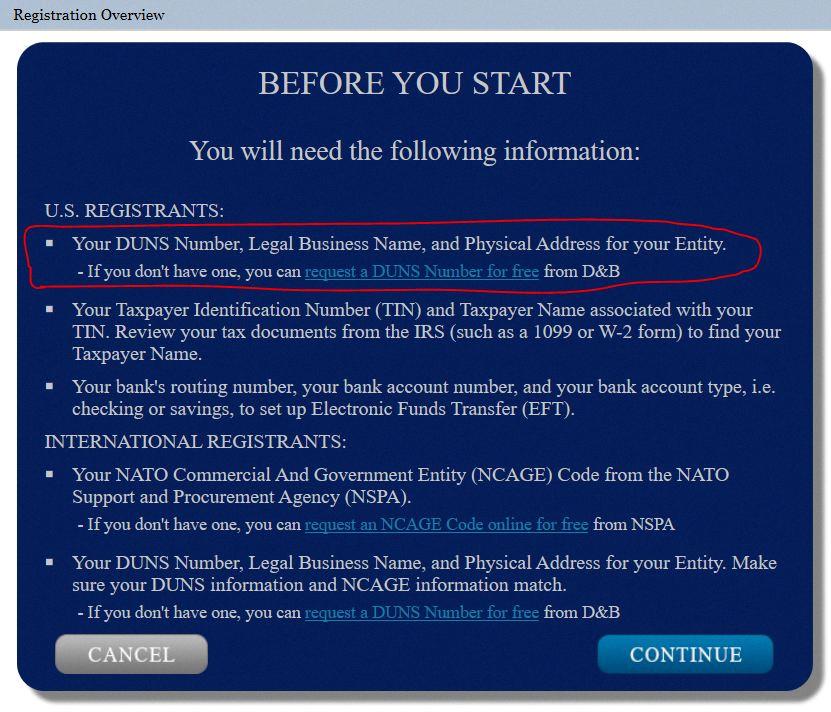

Firstly, if your business plans to contract with government agencies, then you will need a DUNS number. This is because government agencies use the DUNS number as a unique identifier for businesses that they work with. Therefore, if you want to do business with the government, a DUNS number is a must-have.

Secondly, if you plan to seek financing or grow your business, having a DUNS number can be useful. This is because lenders and oher financial institutions often use the DUNS number to understand a business’s credit history. By having a DUNS number, these institutions can easily access your business’s credit history and make informed decisions about whether or not to lend to you.

Whether or not you need a DUNS number for your small business will depend on your plans for growth and whether or not you plan to contract with government agencies. If you do plan to do business with the government or seek financing, then obtaining a DUNS number is highly recommended.

Benefits of Having a DUNS Number

A DUNS number is a unique nine-digit identification number that is assigned to businesses by Dun & Bradstreet. The primary benefit of having a DUNS number for your small business is that it establishes your business’s credit history and creditworthiness. This is because anyone seeking to understand your business’s creditworthiness will likely look to Dun & Bradstreet to find this information.

In addition to establishing your business’s creditworthiness, having a DUNS number can also help your business to qualify for loans and other forms of financing. This is because lenders often use Dun & Bradstreet’s reports to evaluate a business’s creditworthiness and determine wheter or not to extend credit.

Another benefit of having a DUNS number is that it can help your business to win contracts with government agencies. In fact, businesses that contract with the government are required to have a DUNS number. This is because government agencies use Dun & Bradstreet’s reports to evaluate potential contractors and determine whether or not they are qualified to bid on government contracts.

Having a DUNS number is an important step in establishing your business’s credit history and creditworthiness, and can help your business to qualify for financing and win contracts with government agencies.

Using a DUNS Number for Credit

You can use your DUNS number for credit. DUNS numbers are often used by vendors, suppliers, and financial institutions to assess a business’s creditworthiness. By using your DUNS number, these entities can access your business’s credit file and make informed decisions about extending credit to your business. It’s important to note that your DUNS number alone does not establish credit for your business; you’ll need to actively use credit accounts and make timely payments to establish a positive credit history. However, havng a DUNS number can be a valuable tool in building your business’s credit profile and establishing a strong credit history.

Source: govconchamber.com

Do Small Businesses Have A DUNS Number?

Not all small businesses have a DUNS number. However, if a small business intends to apply for a Federal grant or cooperative agreement, they are required to have a DUNS number. Additionally, some private organizations may require a DUNS number for business transactions. A DUNS number can be obtained for free from Dun & Bradstreet, the company responsible for assigning them. It is a unique nine-digit identifier used to track and verify the creditworthiness and financial stability of a business entity. While it is not mandatory for all small businesses to have a DUNS number, it is recommended as it can help establish credibility with potential partners, customers and lenders.

Can an EIN Be Used to Obtain a Loan?

It is possible to use your Employer Identification Number (EIN) to get a loan, but it largely depends on the lender and the type of loan you are seeking. An EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity, and it is often used to file tax returns and open business bank accounts.

When applying for a loan, most lenders will consider a variety of factors, including your personal credit score, business credit score, financial statements, and other relevant information. However, there are some lenders that will only look at your business’s creditworthiness, and may not consider your personal credit score at all.

If you have a strong business credit score and financial history, you may be able to secure a loan usig your EIN alone. Keep in mind, though, that lenders will still need to verify your business’s financial information and may require you to provide additional documentation, such as tax returns, financial statements, and business plans.

It’s also worth noting that some lenders may require a personal guarantee, which means you will be personally responsible for repaying the loan if your business is unable to do so. This is particularly common for newer or riskier businesses that don’t have a strong credit history.

While it is possible to use your EIN to get a loan, it is important to do your research and find a lender that is willing to work with you based on your business’s creditworthiness and financial history.

Does Bank Use Dun & Bradstreet?

Banks do use Dun and Bradstreet (D&B) to check the creditworthiness and financial stability of businesses. D&B is a leading provider of business credit reports, and their ratings are widely used by banks and othr lenders to assess the risk of lending money to a business. When a business applies for a loan, the bank may request a D&B report to evaluate the company’s credit history, payment behavior, and other financial information. The D&B rating is based on a variety of factors, including payment history, financial statements, and business size, and can have a significant impact on a business’s ability to secure financing. Therefore, it’s important for businesses to maintain a good D&B rating by paying bills on time, managing finances effectively, and monitoring their credit history regularly.

Using an EIN to Purchase a Vehicle

You can use your EIN (Employer Identification Number) to buy a car. An EIN is a tax identification number used by businesses to file taxes, open business accounts, and apply for credit. When purchasing a car using your EIN, it is important to inform the sales team that you are making a business purchase rathr than a personal one. This will affect the credit application you need to fill out. Additionally, it is important to keep in mind that the car must be used for business purposes in order to qualify for certain tax deductions. using your EIN to buy a car is possible, but it requires careful consideration and planning to ensure that you are making the right decision for your business needs.

Do I Need a DUNS Number for an SBA Loan?

Having a DUNS number is highly recommended when applying for Small Business Administration (SBA) loans. In fact, it is often required by the SBA. The DUNS number is a unique nine-digit identifier that is issued by Dun & Bradstreet, a leading business data provider. It is used to track the creditworthiness and financial stability of businesses.

When you apply for an SBA loan, the lender will request your DUNS number as part of the application process. This information allows the lender to review your company’s credit history and financial performance. Having a DUNS number can make the loan application process smoother and faster, as it prvides the lender with the necessary data to make a more informed lending decision.

If you do not have a DUNS number, you can apply for one through Dun & Bradstreet. The process is free and typically takes a few business days to complete. Once you have a DUNS number, be sure to include it in all future loan applications and other business dealings, as it will help establish your business’s creditworthiness and financial stability.

Building Business Credit with a DUNS Number

Building business credit with a DUNS number requires a few key steps. First, it’s important to establish your business as a separate entity. This means obtaining any necessary licenses and permits, and registering your business with the appropriate state and local agencies.

Once you have established your business, the next step is to register for a Dun & Bradstreet D-U-N-S® number. This unique identifier is used by lenders and other businesses to evaluate your creditworthiness, so it’s important to ensure that your informaion is accurate and up-to-date.

With your DUNS number in hand, you can then apply for an Employer Identification Number (EIN) from the IRS. This number is used to identify your business for tax purposes, and is often required when you apply for credit.

Next, you’ll want to open a business bank account and make on-time payments on any credit you have. This will help establish a positive payment history, which is a key factor in building business credit.

You can also ask your vendors to supply your payment history to Dun & Bradstreet, which can help boost your credit rating. it’s important to monitor your business credit scores and ratings regularly, so you can identify any issues or errors and take steps to address them. By following these steps and being diligent about your credit management, you can build a strong business credit profile that will help you secure financing and grow your business over time.

What Documents Are Needed to Obtain a DUNS Number?

To obtain a DUNS number, you will need to provide certain documents that verify your business’s legal name and physical address. The most important requirement is that the documents must clearly display the legal business name and current physical address of the business.

If you are a sole proprietorship, your legal business name is your full legal given name, so the document must contain your full legal name. Some of the commonly accepted documents for obtaining a DUNS number include a business license, a lease agreement, a utility bill, a tax return, or any other official document that shows your business’s legal name and address.

It is important to note that the DUNS number application process may vary depending on your country or region, so it is alwys a good idea to check with the local DUNS office or website for specific requirements. Additionally, it may be helpful to have a clear understanding of why you need a DUNS number and how it will benefit your business.

Building Business Credit with a DBA

It is possible to build business credit with a DBA (Doing Business As) as long as your business is incorporated. A DBA is a name under whih a business operates and it adds a level of professional credibility to a one-person operation. However, it is important to note that a DBA alone does not establish a separate legal entity for the business.

Incorporating your business with a DBA provides certain advantages, such as limiting personal liability and allowing you to build a separate credit profile for your business. Your business can apply for credit using its DBA name and establish a credit history for itself, separate from your personal credit history.

To build business credit with a DBA, you need to follow a few steps. First, incorporate your business with the state by filing articles of incorporation or articles of organization. Then, obtain a tax ID number from the IRS and open a separate business bank account. Use your DBA name consistently on all business documents, invoices, and credit applications.

To establish credit, start by applying for a small business credit card or line of credit. Make sure to pay your bills on time and keep your credit utilization low. Over time, your business credit score will improve, allowing you to qualify for larger loans and credit lines.

A DBA can add professional credibility to your business, but it is only useful for building business credit if your business is incorporated. By following the proper steps and using your DBA name consistently, you can establish a separate credit profile for your business and qualify for financing based on your business’s creditworthiness.

Source: creditstrong.com

What is Considered a High Business Credit Score on a DUNS Number?

A high business credit score on a DUNS number is typically considered to be a score of 80 or higher on the PAYDEX® Score scale. This indicates a low risk of late payment and demonstrates a strong track record of paying bills on time. It is important to note that credit scores can vary depending on the specific credit bureau and scoring model being used, but a high PAYDEX® Score is generally a positive indicator of a business’s creditworthiness. Maintaining a high score can help businesses secure favorable terms and conditions when applying for loans, leases, and other credit-based services.

Conclusion

It’s important to understand the differences between a DUNS number and an EIN. While both serve important purposes, they are used for differet reasons. A DUNS number is primarily used for business credit reporting purposes, and is often required for businesses that contract with government agencies. On the other hand, an EIN is issued by the IRS and is used for tax identification purposes. It’s important to note that a DUNS number is not a replacement for an EIN or a Social Security number for lending and application purposes. Small businesses can benefit greatly from establishing a DUNS number, as it can help lenders understand a business’ credit history and creditworthiness. Ultimately, understanding the differences between these two numbers can help small business owners navigate the complex world of business credit and financing.