Stop Losses are an essential tool for traders looking to manage their risk and protect their investments. By setting a predetermined point at which to sell a stock, traders can limit their losses and avoid emotional decision-making in volatile markets. However, one question that often arises is whether stop losses work after hours.

To understand the answer to this question, it’s essential to first understand how stop losses work. A stop loss is a type of order that is triggered when a stock’s price reaches a certain level. Once triggered, the order becomes a market order and is executed at the next available price. For example, if a trader sets a stop loss at $50 for a stock that is currently trading at $60, the order will be triggered if the stock falls to $50, and the trader’s shares will be sold at the next available price, which may be below $50.

Now, the question is whether stop losses work after hours. The short answer is no; stop losses will only be triggered during standard market hours, which are generally 9:30 a.m. to 4 p.m. Eastern time. They will not get executed during extended-hours sessions or when the market is closed for weekends and holidays.

This means that if a trader sets a stop loss order after hours, it will not be triggered untl the next trading day. For example, if a trader sets a stop loss at $50 for a stock that is currently trading at $60 after the market has closed, and the stock falls to $50 in the pre-market session, the stop loss order will not be triggered until the market opens at 9:30 a.m. the next day.

It’s important to note that stop losses are not foolproof and can sometimes result in unexpected outcomes. For instance, if a stock gaps down below the stop loss level due to a significant news event, the stop loss order may be executed at a much lower price than expected. This is known as slippage and is a risk that traders need to be aware of when using stop losses.

Stop losses are an essential tool for traders looking to manage their risk, but they only work during standard market hours. Traders need to be aware of the limitations of stop losses and understand that unexpected events can sometimes result in slippage. By using stop losses wisely and staying informed about market conditions, traders can manage their risk and protect their investments.

The Use of Stop Losses in After Hours Trading

Stop-loss orders are a commonly used tool by investors and traders to limit ther potential losses on a particular investment. However, it is important to note that stop-loss orders can only be triggered during standard market hours, which typically run from 9:30 a.m. to 4 p.m. Eastern time. Therefore, stop-loss orders will not be executed during extended-hours sessions or when the market is closed for weekends and holidays.

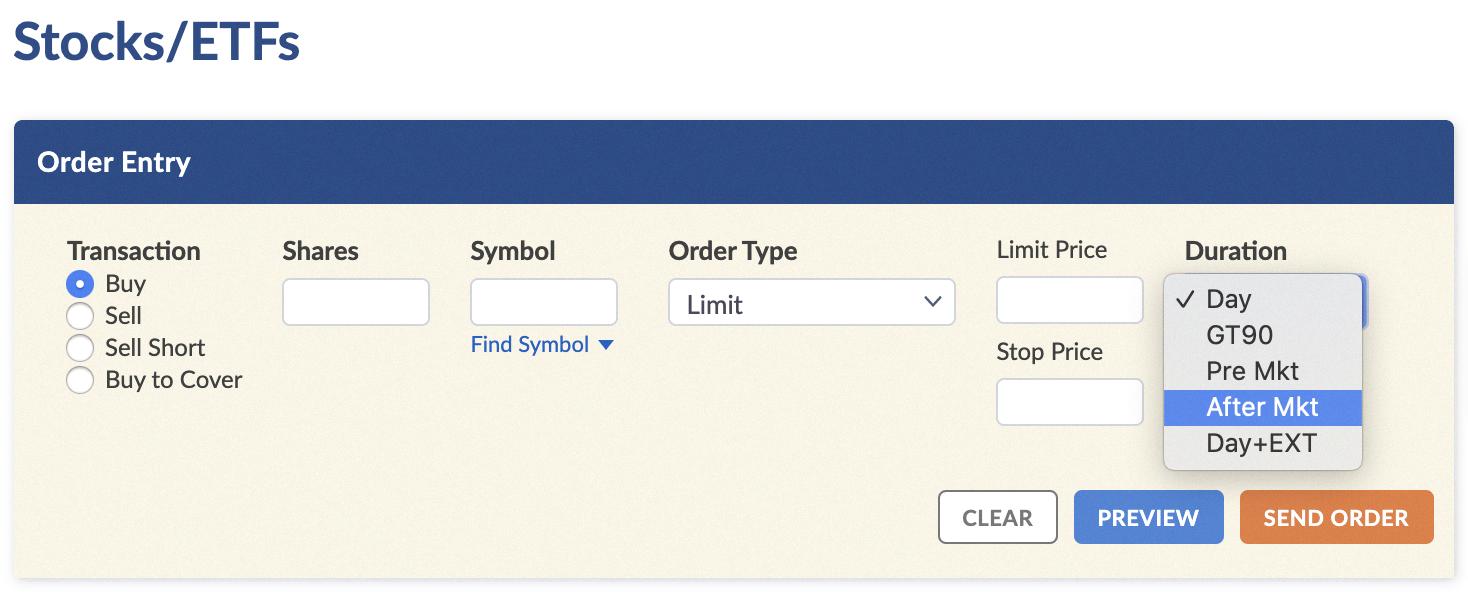

It is worth noting that some brokers may offer after-hours trading, which allows investors to buy and sell securities outside of standard market hours. However, the execution of stop-loss orders during after-hours trading is dependent on the specific rules and regulations of the broker and the exchange on which the security is traded. In some cases, stop-loss orders may be triggered during after-hours trading, while in others they may not be.

Overall, it is important for investors to be aware of the limitations of stop-loss orders during after-hours trading and to consult with their broker to fully understand how their orders will be executed in these situations.

Do Stop Limit Orders Work Outside of Regular Trading Hours?

Stop limit orders are a type of order that combines the functionality of a stop order and a limit order. They can be used to automatically trigger a buy or sell order once a certain price level is reached, and then execute that order at a specified limit price or better.

However, it’s important to note that stop limit orders may not work after hours. This is because after-hours trading sessions typically have lower trading volumes and less liquidity, which can make it difficult for orders to be executed at the specified prices. Additionally, some brokerages may not allow stop limit orders to be placed during extended hours trading sessions.

It’s always a good idea to check with your brokerage firm to confirm their policies and procedures for stop limit orders during after-hours trading sessions. You may also want to consider using other types of orders, such as market orders or limit orders, that may be btter suited for trading during extended hours.

Do Stop Losses Work After Hours on Webull?

No, stop losses do not work after hours on Webull. This is because stop losses are triggered based on the current market price of a stock, which cannot be determined outside of market hours. Therefore, if you place a stop loss order outside of market hours, it will not be executed until the market opens again. It is important to note that on Webull, trailing stop orders can only be placed during market hours and will expire at the end of each trading day. If your order is not filled, you will need to place the order aain on the following trading day. So, it is crucial to keep track of market hours and place stop loss orders accordingly to protect your investments.

Does Stop-Loss Work After Hours on Robinhood?

No, stop-loss orders will not execute after hours on Robinhood. When you place a stop-loss order during extended hours, it will queue for the opening of regular market hours on the next trading day. It’s important to keep in mind that extended-hours trading sessions are typically less liquid than regular trading hours, which can increase the risk of price gaps and volatility. Therefore, it’s crucial to carefully cnsider your risk management strategy and adjust your stop-loss orders accordingly. Additionally, it’s important to monitor your positions and market movements during regular trading hours to make informed decisions about when to execute your stop-loss orders.

Does Stop-Loss Trading Work Overnight?

Stop-loss orders can work overnight in certain conditions. If a stop-loss order is triggered during regular trading hours, the order will be executed at the prevailing market price at that time. However, if the trigger price is reached outside of regular trading hours, such as overnight or during pre-market hours, the order will not be executed untl the market opens again. In this case, the order will be filled at the prevailing market price at the time the market opens, which may be different from the trigger price. It’s important to note that stop-loss orders are not a guarantee of protection against losses, as market conditions and volatility can cause the price to gap through the stop-loss level, resulting in a larger loss than anticipated. Therefore, it’s essential to understand the risks and benefits of using stop-loss orders and to always monitor your trades closely.

Source: help.en-us.firstrade.com

Setting a Stop-Loss: Is it Possible at Any Time?

Yes, you can set a stop-loss at any time. In fact, stop-loss orders can be modified or canceled at any point during the trading process. Traders often place stop-loss orders when they initiate trades to minimize potential losses. A stop-loss order can be set at a specific price point or percentage below the current market price, and it will execute a market order to sell the security if the price falls to or below the set threshold. It is important to note that stop-loss orders do not guarantee that losses will be completely avoided, as market prices can gap down beyond the set threshold. It is recommended to regularly monitor and adjust stop-loss orders as market conditions and the vlue of the security change.

Difference Between Stop-Limit and Stop-Loss

A stop-limit order and a stop-loss order are both trading tools that can help investors manage and mitigate risk. The main difference between the two is in ther execution. A stop-loss order is used to limit losses by automatically triggering a market order to sell a security when it falls to a certain price. This ensures that the investor doesn’t suffer more losses than they are willing to bear.

On the other hand, a stop-limit order is designed to give investors more control over the price at which they sell their securities. This type of order sets both a stop price and a limit price. If the security reaches the stop price, a limit order is triggered to sell the security at the limit price or better. This means that the investor can sell their securities at a more favourable price, but there is a risk that the order may not be executed if the security does not reach the limit price.

In summary, while both stop-loss and stop-limit orders can help manage risk, the main difference is that a stop-loss order guarantees execution at a certain price, while a stop-limit order builds in a limit price that the order gets filled at. Ultimately, the choice between the two will depend on the investor’s risk tolerance and trading strategy.

What Happens When the Market Opens Below My Stop-Loss?

If the market opens below your stop-loss, your stop-loss order will be triggered and executed at the next available price, even if the price is substantially lower than your stop-loss level. This may occur if thre is a sudden and significant market event, such as a major news announcement or economic report that causes a sharp drop in the market. When this happens, it is important to remember that your stop-loss is designed to limit your losses and protect your capital, even if it means selling your position at a loss. While it can be frustrating to see a position sell at a lower price than expected, it is important to stick to your trading plan and not let emotions guide your decision-making. It is also important to regularly review and adjust your stop-loss levels based on market conditions and other factors that may impact your trades.

Understanding Why a Stop-Limit Order Did Not Execute

There are several reasons why a stop-limit order may not execute. One common reason is that the market may experience short-term fluctuations that prevent the order from being executed. For example, if the market jumps btween the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Another reason why a stop-limit order may not execute is that there may not be enough liquidity in the market to fill the order. This can happen when there are not enough buyers or sellers at the specified price levels. Additionally, if the stop price is too close to the market price, the order may not execute because the market may not have enough time to react to the price movement. It is also possible that the order was not placed correctly or was cancelled before it could be executed. It is important to monitor your orders and make adjustments as necessary to ensure that they are executed as intended.

Can Stop Losses Protect Against Losses?

Stop losses are a risk management tool that can be used to help mitigate losses in the event of a sudden downturn in the market. By setting a predetermined price at which your position will automatically be sold, stop losses can protect investors from losing more money than they can afford to. However, it is important to note that stop losses are not a foolproof method of preventing losses. In certain market conditions, such as a rapid and significant drop in price, stop losses may not be able to execute at the intended price, resulting in a larger loss than anticipated. Additionally, if the market experiences a sudden gap down, the order may execute at a significantly lower price than expected. Ultimately, while stop losses can be a helpful tool in reducing risk, they should be used in conjunction with othr risk management strategies and should not be relied upon as the sole measure of protection against losses.

Do Day Traders Utilize Stop Loss?

Yes, day traders often use stop loss orders to manage their risk and limit potential losses in their trades. A stop loss order is a type of order that is paced with a broker to automatically close out a trade at a certain price. When a day trader enters a trade, they will typically set a stop loss order at a level that represents an acceptable level of risk for them. If the price of the asset being traded reaches this level, the stop loss order is triggered and the trade is closed automatically, regardless of whether the trader is actively monitoring the trade or not. By using stop loss orders, day traders can help to protect their capital and limit their potential losses, which is an important aspect of successful trading.

Do Stop Losses Qualify as Day Trades?

Placing a stop-loss order does not count as a day trade on its own. A stop-loss order is simply a risk management tool used by traders to limit potential losses on a trade. However, if the stop-loss order is triggered on the same day the position is opened, then that will be counted as a day trade. This means that if a trader buys a stock and sets a stop-loss order to sell the stock if it drops belw a certain price, and that stop-loss order is triggered on the same day the stock was purchased, then that will be considered a day trade. Therefore, it is important for traders to be aware of the potential consequences of using stop-loss orders and to carefully monitor their positions to avoid unintentionally triggering a day trade.

Selling a Stock After Hours: What to Expect

If you sell a stock after hours, the trade will be executed during the after-hours trading session. This means that the price you receive for the sale may be different from the price during regular trading hours due to lower liquidity and fewer participants. Additionally, after-hours trading is generally more volatile and riskier than trading during regular hours, which may increase the likelihood of experiencing a significant price change. It is important to note that after-hours trading may also be subject to different rules and regulations than regular trading hours, so it is important to understand the risks and potential consequences beore deciding to trade outside of regular hours.

The Stop-Loss Rule Explained

The stop-loss rule is a risk management tool used in investing that involves placing an order with a broker to buy or sell a specific stock once it reaches a predetermined price point. This rule is designed to help investors limit their potential losses on a security position by automatically triggering a trade when the stock reaches a certain price level. For example, if an investor sets a stop-loss order for 10% beow the price at which they purchased the stock, the order will be executed automatically when the stock falls to that price level. This means that the investor’s loss will be limited to 10%, preventing them from incurring further losses if the stock continues to decline. The stop-loss rule is an important tool for investors to manage their risk and protect their investments in the stock market.

The Impact of After-Hours Trading on Opening Prices

Yes, after-hours trading (AHT) can have a significant impact on the opening price of a stock. AHT refers to the buying and selling of securities outside of regular trading hours, which usually takes place between 9:30 am to 4:00 pm Eastern Time. The development of AHT means that investors and traders can react to news and events that occur outside of regular trading hours, which can cause the price of a stock to fluctuate.

For example, if a company announces positive financial results afer the market closes, investors may react to this news by buying shares in the company during AHT. This increased demand for the stock can push up its price, which could result in a higher opening price the following day. Conversely, negative news or events can cause investors to sell their shares during AHT, which could push down the price of the stock and result in a lower opening price.

It’s important to note that AHT trading volume is typically lower than regular trading hours, which means that the impact of trades during this time may be more significant. Additionally, the opening price is not solely determined by AHT, as other factors such as pre-market trading, news releases, and market sentiment can also influence the opening price.

Conclusion

In conclusion, stop-loss orders are a valuable tool for traders and investors to manage their risks and protect their investments. By setting a predetermined price at which to sell a security, stop-loss orders can help prevent losses and limit potential damages during market fluctuations. However, it is important to understand the limitations of stop-loss orders, including their potential to trigger premature sales or miss out on opportunities during after-hours trading. Traders shuld also consider the type of stop-loss order that best suits their needs, whether it be a market, limit, or trailing stop order. Overall, stop-loss orders can be a powerful asset in any trader’s toolkit, but it is important to use them wisely and in conjunction with other risk management strategies.