When it comes to managing your finances, one of the most important things you can do is save money. One of the best ways to do this is by opening a savings account. A savings account is a type of bank account that allows you to earn interest on the money you deposit. This interest can help your money grow over time, making it an excellent tool for building wealth.

One question that often comes up when it comes to savings accounts is whether or not they have routing numbers. The answer is yes, savings accounts do have routing numbers. A routing number is a unique nine-digit code that is used to identify a bank or credit union. It is important for a variety of financial transactions, including direct deposits, wire transfers, and automatic bill payments.

If you have a savings account at a bank or credit union, it will have its own routing number that is specific to that institution. This routing number is different from the routing number for your checking account or any other accounts you may have with the same bank or credit union.

To find the routing number for your savings account, you can look at your account statement or log in to your online banking account. The routing number may also be printed on your savings account deposit slips or checks. If you are unsure of your routing number, you can always contact your bank or credit union for assistance.

It is important to note that wile savings accounts do have routing numbers, they do not have account numbers. Your savings account is typically linked to your checking account, and any transfers between the two accounts will be identified by your name and account number.

If you have a savings account, it does have a routing number. This number is essential for conducting financial transactions and can be found on your account statement, deposit slips, or checks. By understanding the importance of routing numbers, you can better manage your finances and make the most of your savings account.

Do Checking and Savings Accounts Have the Same Routing Number?

No, checking and savings accounts do not always have the same routing number. Although both checking and savings accounts are typically held at the same financial institution, they are considered separate accounts and may have different routing numbers. The routing number is a unique identifier that is assigned to each financial institution and is used to process transactions such as direct deposits, wire transfers, and electronic payments. It is important to ensure that you have the correct routing number for the specific account you are usng in order to avoid any processing errors or delays. If you are unsure of the routing number for your checking or savings account, you can typically find it on your account statement or by contacting your financial institution directly.

Finding Routing and Account Numbers for Savings Accounts

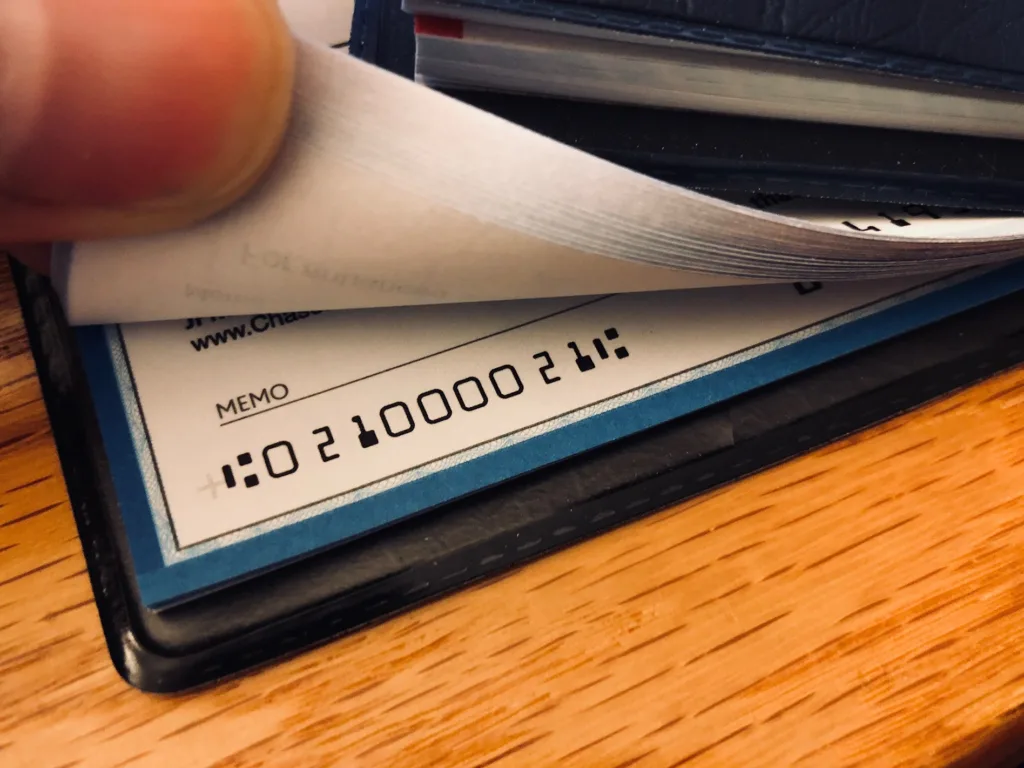

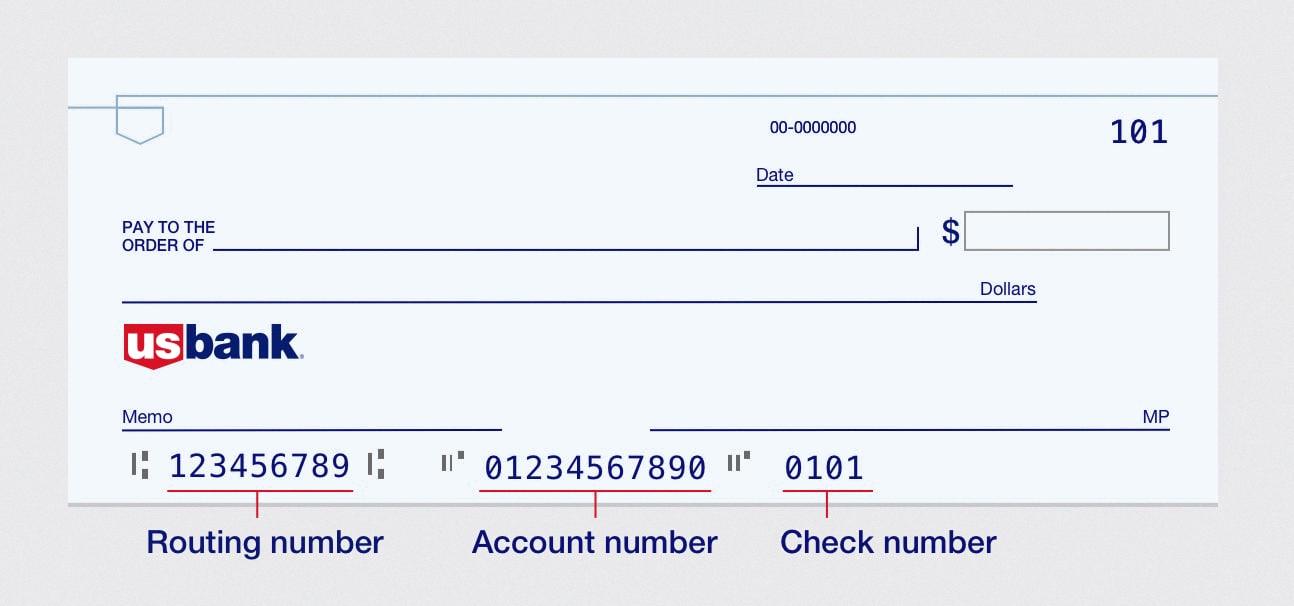

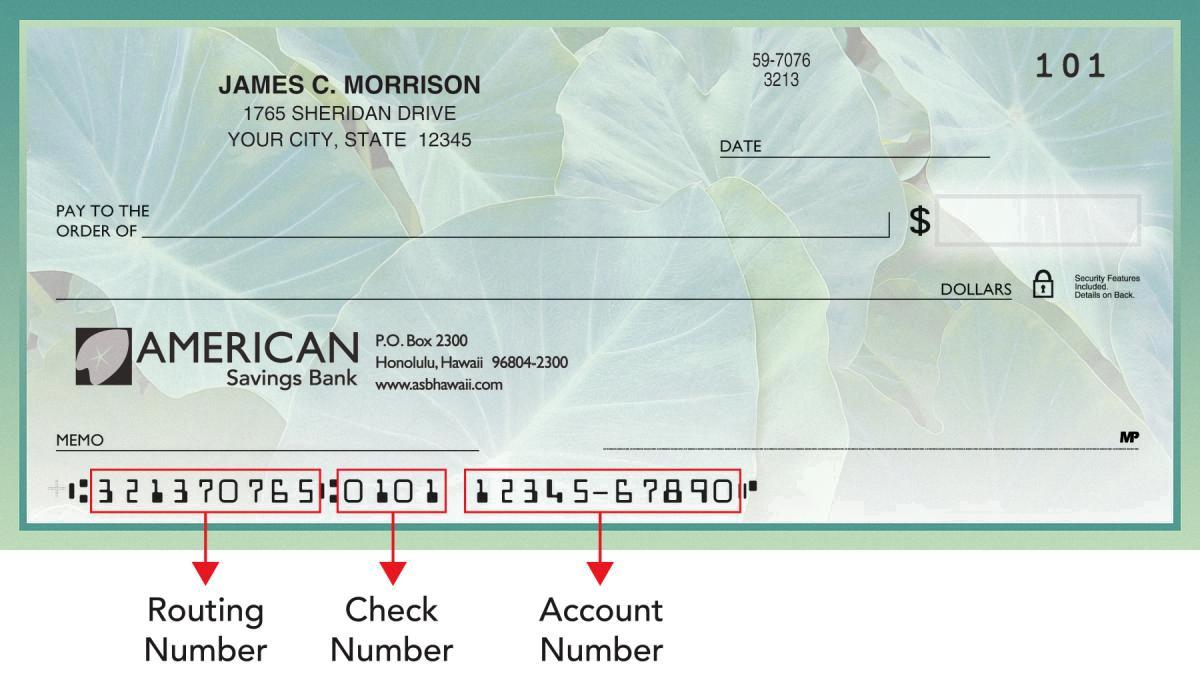

To find the routing and account number for your savings account, there are a few different options available to you. One of the easiest ways to find your routing number is to check your personalized savings deposit slips. Typically, these slips will have a nine-digit code towards the bottom left that represents your routing number.

If you don’t have your deposit slips handy, you can also find your routing number on your account statement. This document should be sent to you regularly by your bank and will contain important information about your account, including your routing number.

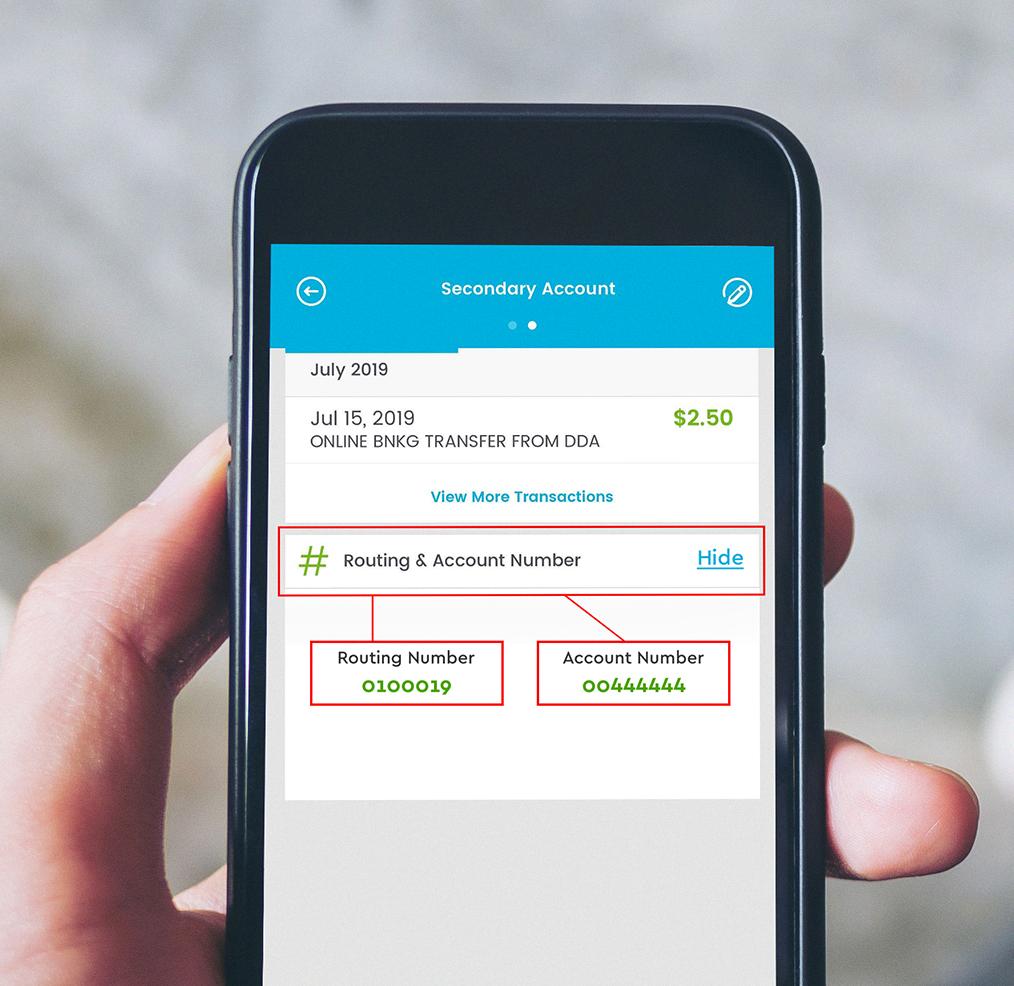

Another option is to check your bank’s website. Many banks will have a section on their website specifically dedicated to providing their customers with information about their accounts. This section may include your routing and account number, as well as othr important details about your savings account.

Overall, there are a few different ways you can find your routing and account number for your savings account. Whether you check your deposit slips, your account statement, or your bank’s website, you should be able to easily locate this information and use it as needed.

Do Checking and Savings Accounts Have Different Account Numbers?

Yes, checking and savings accounts have dfferent account numbers. When you open a checking account and a savings account at a bank, each account is assigned a unique account number. This account number is used to identify your account and keep track of your transactions. The account number is usually a combination of numbers and letters, and it is unique to your account. The checking account and savings account may also have different features, such as different interest rates or minimum balance requirements. However, both accounts will typically have the same ABA routing number, which is used to identify the bank where the accounts are held.

Finding Your Savings Account Number

To find your savings account number, you can check any bank statements or documents that were provided to you when you opened the account. Additionally, you may be able to find your savings account number by logging into your online banking account or by contacting your bank’s customer service department. Your savings account number is a unique identifier that is used to link your account to your personal information, so it is important to keep it safe and secure. If you are having difficulty locating your savings account number, don’t hesitate to reach out to your bank for assistance.

The Purpose of Having Two Routing Numbers

There are two routing numbers used in the United States banking system because they serve different purposes. The frst type of routing number is the ABA routing number, which is used for paper or check transfers. This routing number is a nine-digit code that identifies the bank, credit union, or financial institution that the check is drawn on. The ABA routing number is printed on the bottom left-hand corner of a check and is used to process the check through the banking system.

The second type of routing number is the ACH routing number, which is used for electronic transfers. ACH stands for Automated Clearing House, which is a network that processes electronic payments and transfers between banks. The ACH routing number is also a nine-digit code, but it is used to identify the bank that is receiving the funds electronically. Transactions using ACH routing numbers “clear” faster than funds transferred on paper checks using ABA numbers. This means that transactions using ACH routing numbers are processed and completed more quickly, often within the same day or the next day.

In summary, there are two routing numbers used in the United States banking system because they serve different purposes. The ABA routing number is used for paper or check transfers, while the ACH routing number is used for electronic transfers. Both routing numbers are nine-digit codes that help to identify the banks involved in a transaction, but they are used in different ways to ensure that funds are transferred efficiently and securely between accounts.

Source: usbank.com

The Purpose of Banks Having Two Routing Numbers

Banks have two routing numbers to ensure that transactions are processed accurately and efficiently. One routing number is used for processing paper checks, while the other is used for wire transfers and electronic transactions.

The routing number used for paper checks is also known as the ABA routing number. This number is a 9-digit code that identifies the bank and the location of the account holder’s bank branch. When a check is deposited, the routing number is used to identify the bank and the specific branch where the funds should be taken from.

On the other hand, the routing number used for wire transfers and electronic transactions is called the ACH routing number. This number is also a 9-digit code, but it is used for processing electronic transactions such as direct deposits, online bill payments, and wire transfers. The ACH routing number is used to identify the bank and the specific account where the funds should be transferred to or from.

Having two routing numbers alows banks to process different types of transactions more efficiently. Using the correct routing number ensures that the transaction is processed accurately and in a timely manner. It also helps to reduce errors and delays in the processing of financial transactions.

Length of a Savings Account Routing Number

A savings account routing number is typically the same length as a checking account routing number, which is a nine-digit number. This routing number serves as a unique identifier for your bank and is used to facilitate electronic transactions, such as direct deposits, wire transfers, bill payments, and other types of financial transactions. It is important to note that the routing number for your savings account may differ from the routing number for your checking account, so it is always a good idea to double-check the routing number before initiating any electronic transactions.

Can You Deposit Funds Directly Into a Savings Account?

Yes, it is typically possible to direct deposit into a savings account. Many direct deposit programs offer the option to split your paycheck between multiple accounts, including savings and checking accounts at different banks. To set up direct deposit into a savings account, you will need to provde the bank’s routing number, your account number, and the account type for the savings account. This can be a helpful strategy for saving money, as it allows you to automatically allocate a portion of your income towards saving without having to take any additional steps. It’s important to note that some banks may have specific requirements or restrictions for setting up direct deposit into a savings account, so it’s a good idea to check with your bank or employer to ensure that you have all the necessary information and documentation.

Do All Bank Accounts Have a Routing Number?

No, not all accounts have a routing number. A routing number is a unique nine-digit code assigned to financial institutions by the American Bankers Association (ABA) in the United States. This number is used to identify the bank or credit union that holds the account and facilitates the transfer of funds between accounts. However, not all accounts require a routing number. For example, some prepaid debit cards or gift cards may not have a routing number as they are not associated with a traditional bank account. Additionally, some international banks may not use the ABA routing number system, and instead use alternative routing numbers or codes. It’s always best to check with your financial institution to determine if your account has a routing number or if thee are alternative methods for transferring funds.

Source: asbhawaii.com

The Safety of Savings Accounts Compared to Checking Accounts

Both savings and checking accounts are safe and secure options for managing your money. However, in terms of safety, savings accounts have a slight edge over checking accounts.

Savings accounts are typically designed for long-term savings goals and are less likely to be used for frequent transactions. As a result, they often have higher interest rates and lower fees compared to checking accounts. Additionally, savings accounts are FDIC-insured up to $250,000 per depositor, per insured bank, whch means that even if the bank were to fail, your money would be protected.

On the other hand, checking accounts are designed for more frequent transactions, such as paying bills and making purchases. While they also offer FDIC insurance, checking accounts may have more fees and lower interest rates compared to savings accounts. Additionally, they may be more susceptible to fraud and security breaches due to the increased usage.

Overall, both savings and checking accounts are safe and secure options for managing your money. However, if you are looking for a slightly safer option with higher interest rates and lower fees, a savings account may be the better choice.

Benefits of Having a Savings Account Over a Checking Account

A savings account is an excellent option for individuals who are looking to save money over time. Unlike a checking account, savings accounts offer higher interest rates, meaning that banks pay you interest on the money you deposit into your account. This interest is usually paid out monthly and accumulates as long as your money remains in the account.

Another benefit of a savings account is that it can help you develop good financial habits. By putting money into a savings account, you can budget and save for future expenses or financial goals. Savings accounts also typically have limits on how often you can withdraw money, which can help you avoid impulse spending and encourage you to save more over time.

Savings accounts also provide a layer of security for your money. Most banks offer FDIC insurance, which means that your money is protected up to $250,000 per account in case of bank failure or oter financial issues.

Overall, a savings account is a great option for those who want to save money, earn interest, and develop good financial habits. While checking accounts are useful for daily expenses and bill payments, savings accounts are a valuable tool for long-term financial planning and security.

Linking Savings Accounts to Checks and Debit Cards

Savings accounts are not typically linked to checks or debit cards. Savings accounts are designed for individuals to save money, earn interest on their savings and to withdraw funds as needed, but not for frequent transactions like a checking account. While some financial institutions may offer an ATM card for savings accounts, it is not as common as with checking accounts. Additionally, savings accounts do not usally come with a checkbook, as they are not intended for regular payments or transactions. Instead, savings accounts encourage individuals to save money over time and build their emergency fund or meet long-term financial goals.

Identifying the Account Number on a Savings Account

The account number on a savings account is a unique set of digits that is assigned to the account holder when they open a savings account. This number serves as an identifier for the account and is used by the bank for various purposes such as tracking deposits, withdrawals, and oher transactions. It typically consists of a series of numbers and can be found on account statements, deposit slips, or online banking portals. It is important to keep this number confidential as it is used to access your account and perform transactions. In case you forget your account number or need to provide it to someone else, you can usually find it on your account statement or by contacting your bank’s customer service department.

Source: commercebank.com

Accessing a Savings Account

To access your savings account, you have several options. The most common way is to visit your local branch and speak with a teller. You can provide your account information and request to withdraw or deposit funds. Another option is to use an ATM card to access your account at any ATM. Keep in mind that you may incur fees if you use an ATM that is not in your bank’s network. Additionally, you can access your account online by logging into your bank’s website or mobile app. This allws you to view your account balance, make transfers, and even deposit checks. Make sure to keep your account information secure and to follow any security measures provided by your bank to protect your savings account.

Does My Debit Card Contain My Savings Account Number?

No, your savings account number is not on your debit card. Your debit card is linked to your checking account, and the 16-digit number on the front of the card is the card number used to make purchases or withdraw cash from an ATM. Your savings account number is a different set of numbers that is specific to your savings account, and it is usually provided to you separately by your bank. If you are unsure of your savings account number, you can contact your bank or check your account details online or on your account statement.

Conclusion

In conclusion, savings accounts are a popular and effective way to save money and earn interest on your deposits. They offer a range of benefits, including easy access to your funds, low fees, and FDIC insurance protection. When choosing a savings account, it’s important to compare interest rates, fees, and other features to find the best option for your financial goals and needs. With the right account, you can start building your savings and achieving your long-term financial objectives.