If you have recently received a call from Credence Resource Management, then you may be wondering who they are and what they want. Credence is a debt collection agency that specializes in collecting on behalf of healthcare, phone, utilities, and credit card companies. They use automatic dialing systems commonly referred to as “robocalls” as well as other conventional debt collection strategies such as skip-tracing and letters.

It is important to make sure that the person you are speaking to is actually an employee of Credence Resource Management. This is becase there are many debt collection scammers out there who will claim to represent well-known companies. Therefore, it is important to verify the identity of the caller and to ask for more information about the debt they claim you owe.

Credence Resource Management typically collects debts owed to popular telecom providers such as AT&T and DirectTV. Unless you reach an agreement with them or make successful repayment arrangements, then this account can remain on your credit report for up to seven years.

If you do receive a call from Credence Resource Management it is important that you be polite but firm when dealing with them. Advise them that it is your policy to only deal with everything in writing. Request that they send you a letter detailing the original debt before hanging up the phone call. If they keep calling then sending a cease & desist letter can often help in stopping further contact from them. It may also be beneficial for you to record their phone calls if this situation arises as this can prove useful if any legal proceedings occur at a later date.

Overall, if you receive a call from Credence Resource Management it is important not to panic but instead stay informed and informed of your rights when dealing with debt collectors so that you can successfully navigate any situation that may arise.

Should I Accept a Call from Credence?

No, you should not answer a call from Credence Resource Management unless you are certain it is an actual representative from the company. If you are unsure whether or not the call is legitimate, do not provide any personal information or payment information to the caller. Instead, hang up the call and contact Credence directly using the contact information provided on their website. This will ensure that you are speaking with a legitimate representative and that your personal information remains secure.

Credence’s Collecting Habits

Credence is a debt collection agency that specializes in collecting for telecom providers, including cable, satellite, and mobile services. Some of the most popular providers Credence collects for are AT&T, DirectTV, Verizon Wireless, Sprint, T-Mobile and U.S. Cellular. Credence also collects for other telecom providers not listed here, so it’s important to contact them directly to find out who else they collect on behalf of.

Credence generally works with creditors to reach an agreement that allows consumers to pay their debts without haing them remain on their credit report for seven years. If no such agreement can be reached, however, the account can remain on your credit report as a negative item for up to seven years.

Dealing with Credence

I always deal with Credence Resource Management in writing. I would like to receive a letter from them detailing the original debt so that I can accurately assess the situation. If they continue to call, I will be sending them a cease & desist letter, and I may also keep records of any phone calls they make.

Credence’s Topics of Discussion

Credence is a coming-of-age story about a young girl named Isla, who finds herself orphaned at 17 and taken in by her estranged step-uncle, who lives in a remote location in Colorado. The novel follows Isla as she faces the challenges of growing up without any parental guidance. She must learn to navigate the unfamiliar terrain of her new home while learning to trust her step-family and build relationships with them. Along the way, she discovers new things about herself, as well as the secrets that have been kept from her by those closest to her. Credence delves into topics such as family dynamics, identity struggles, trust issues, and self-discovery as Isla learns important life lessons that will shape who she will become.

Consequences of Not Answering a Collection Agency

If you don’t answer a collection agency, they may take legal action against you. This could include filing a lawsuit against you in court and seeking a judgment to collect the debt. Additionally, they may contact the credit bureaus to report the debt and negatively affect your credit score. If the collection agency is able to get a judgment from the court, they may garnish your wages or bank account to satisfy the debt. Therefore, it’s important that you respond to any communication from a collection agency, even if you can’t pay the debt in full.

What Not to Say During a Collection Call

In a collection call, you should not provide any personal financial information, make a “good faith” payment, make promises to pay the debt, or admit that the debt is valid. You should also not agree to any payment arrangements without first getting all the details in writing. Additionally, you should not threaten legal action, argue with the collector, or use abusive language.

Ignoring Debt Collector Calls: What are the Consequences?

If you ignore debt collector calls, the debt collector may take additional steps to try to collect the debt. They may file a lawsuit aganst you, or they may attempt to garnish your wages. Ignoring the debt collector could also result in late fees and additional interest charges being added to the amount you owe. This could make it more difficult for you to pay off your debt in the future. Additionally, ignoring a debt collector can have a negative impact on your credit score. Therefore, it is best to address any outstanding debts as soon as possible so that you can avoid any additional financial issues down the road.

Source: youtube.com

Is Credence a Collection Agency?

Yes, Credence Resource Management, LLC is a collection agency. They specialize in first- and third-party accounts receivable management and debt collection services for industries such as healthcare, telecommunications, insurance, utilities, retail and financial services. Credence provides nationwide debt recovery solutions using advanced technology and compliance standards to ensure their clients receive the highest level of service. Their experienced team of certified collectors ensures that all collection activities are compliant with federal and state regulations.

What is Credence’s Phone Number?

The phone number for Credence Resource Management is 1-855-880-4791. Our office hours are Monday through Friday 8AM EST to 9PM PST, Saturday 11AM EST to 7PM EST, and Sunday closed. We look forward to speaking with you!

The Adoption of Credence

Credence was put up for adoption by his aunt, who had unexpectedly taken him to America one year after his birth. After five years inAmerica, Credence was taken to the Adopted Children Register and adopted by Mary Lou Barebone, the leader of a No-Maj anti-witchcraft group called the New Salem Philanthropic Society. It is unclear why Credence’s aunt chose to put him up for adoption but it could be assumed that she felt it was in Credence’s best interests.

Can Collection Agencies Make Threats?

No, a collection agency cannot threaten you. The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from engaging in threats, harassment or other abusive tactics when attempting to collect a debt. This includes threats of harm or violence, use of obscene or profane language, calling repeatedly to harass you or falsely representing the amount you owe. If you believe a collection agency is using any type of threatening or harassing behavior, you should contact your state attorney general or the Federal Trade Commission.

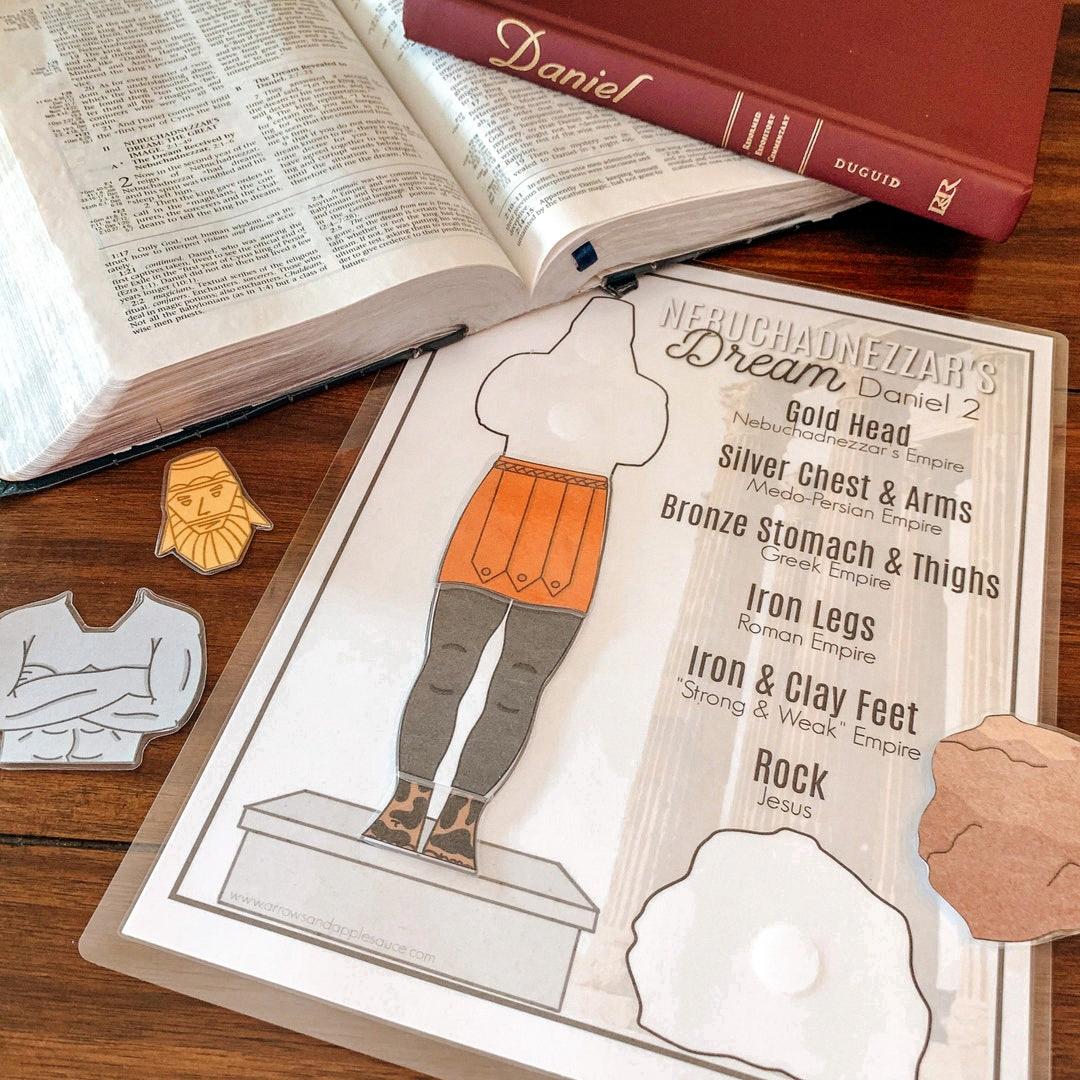

Source: etsy.com

Outsmarting a Debt Collector

Outsmarting a debt collector can be a tricky process, but it is not impossible. The first step is to keep a record of all communication with the debt collector. This includes copies of any letters or emails you send or receive, as well as phone logs showing the date and time of calls. You sould also send a Debt Validation Letter, which forces the debt collector to verify your debt. You can then write a Cease and Desist letter explaining that the debt is not legitimate. Additionally, it’s important to review your credit reports closely for any errors that may have been made by the creditor or collection agency. Finally, if you truly cannot afford to pay back the amount owed, explain this in writing to the debt collector and request a settlement offer or payment plan. With these steps in mind, you can outsmart a debt collector and protect your rights as a consumer.

The Tactics of Debt Collectors: Do They Try to Scare You?

Yes, debt collectors can try to scare people into paying their debts. They may call multiple times a day or late at night, use aggressive language and threats, or even show up at your home. The goal is to create a sense of urgency and pressure you into making payments. Debt collectors are also legally prohibited from certain practices, such as threatening to take away your property or using obscene language. If you feel that a debt collector is using harassing or abusive tactics, you should contact the Federal Trade Commission and report the incident.

Conclusion

In conclusion, it is important to remember that Credence Resource Management is a legitimate debt collection agency. They utilize various strategies such as robocalls, skip-tracing, letters, and other conventional collection activities for healthcare, phone, utilities, and credit card companies. Before engaging in any conversation with a representative from Credence Resource Management, verify that they are indeed from the company and not a scammer. It is also advisable to keep all communication in writing for record-keeping purposes. If the calls become too frequent or bothersome, you can send them a cease & desist letter and record their phone calls if necessary.