The Apple Card is an excellent and convenient way to pay for purchases, but it does not feature cash advances. Cash advances are a type of loan that allows a cardholder to withdraw a certain amount of money from their credit card, usually in the form of an ATM withdrawal or at a bank or other financial institution. Unfortunately, cash advances are not available with the Apple Card.

The Apple Card does have some great features, such as no annual fees, no foreign transaction fees, and up to 3% cash back on eligible purchases. But because it does not offer cash advances, it’s important to understand why this is the case and what other options you have if you need access to cash quickly.

One reason why the Apple Card doesn’t offer cash advances is becase it’s a credit card that’s designed for making purchases. Cash advances involve taking out a loan using your credit card and this isn’t something that the Apple Card was designed to do. By offering no cash advance features, the company is able to keep its costs low and give customers access to more competitive interest rates when they use their card for purchases.

However, if you need access to quick cash thee are still ways you can get it with your Apple Card. You can use the card for purchases wherever cards on the Mastercard network are accepted or transfer funds from your Apple Cash account directly into your bank account in 1-3 business days. This is a much faster option than taking out a loan and may be more suitable for those who need access to funds quickly.

In conclusion, while the Apple Card doesn’t offer cash advances like some other credit cards do, tere are still ways that you can get access to quick funds if needed. Understanding how these features work will help you make informed decisions about how best to use your card and make sure that you always have access to the money you need when you need it.

Does the Apple Card Offer Cash Advances?

No, the Apple Card does not have a cash advance feature. The Apple Card is a credit card that allows you to make purchases wherever cards on the Mastercard network are accepted. However, this card does not allow you to take out a cash advance from an ATM or oter financial institution. Cash advances are usually associated with higher interest rates and fees than regular credit card purchases, so the Apple Card does not offer this feature.

Source: macrumors.com

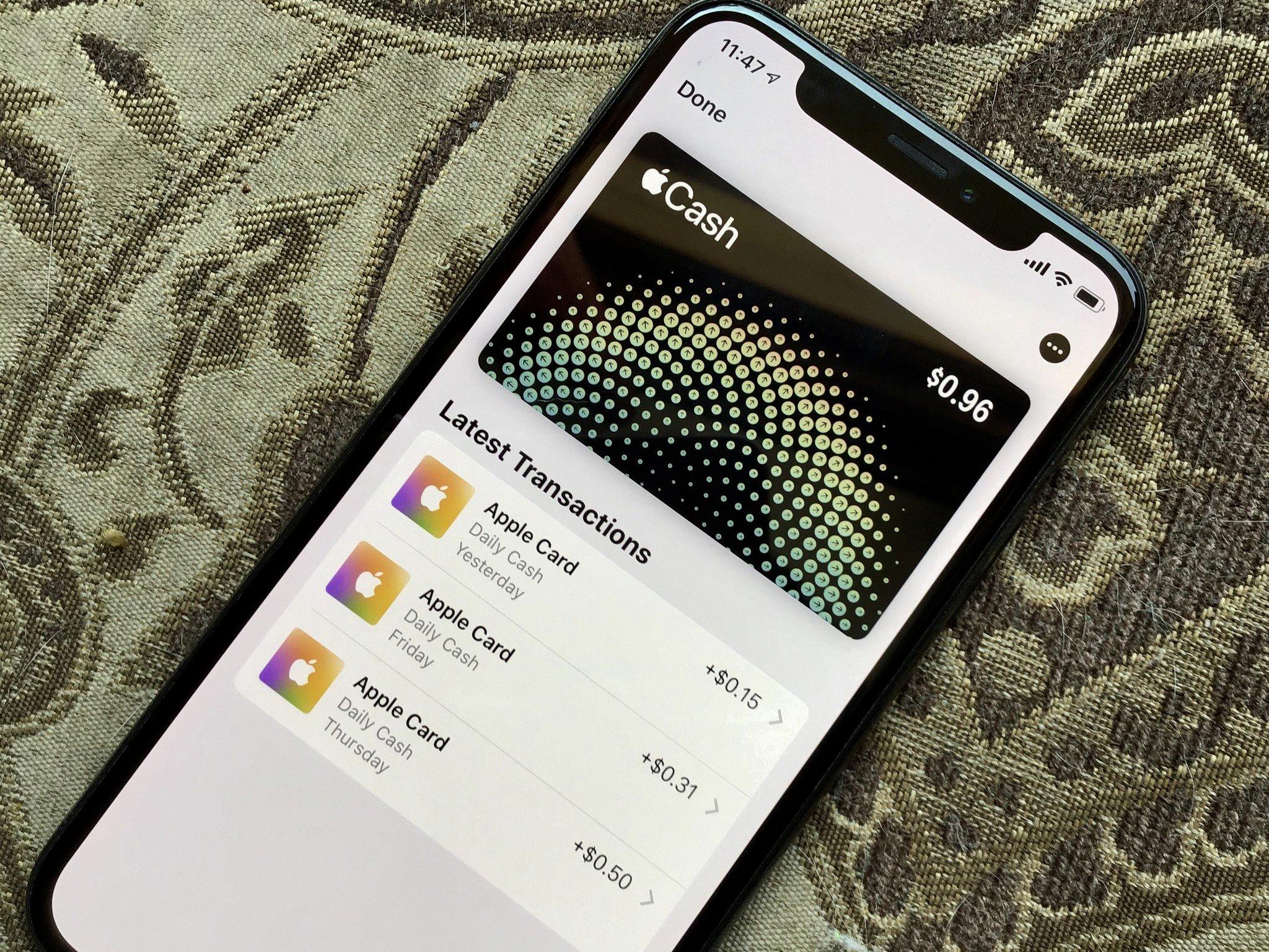

How to Withdraw Cash From an Apple Card

To get cash from your Apple Card, you’ll need to transfer the funds to your bank account. On an iPhone, open the Wallet app, tap your Apple Cash card, tap the More button, and then tap Transfer to Bank. On an iPad, open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, and then tap Transfer to Bank. This transfer usally takes 1-3 business days depending on your bank’s processing time. Once the funds have been transferred to your bank account, you can withdraw cash from any ATM or use your debit card at stores that accept it.

The Cost of Cash Advances with Apple Card

The Apple Card does not charge for cash advances because it does not allow cash advances. The Apple Card can only be used for purchases, and can be used wherevr cards on the Mastercard network are accepted. There are no fees associated with using the Apple Card for purchases, so you don’t need to worry about any additional costs when you use it.

Can I Withdraw Cash Using My Apple Card at an ATM?

No, you cannt use your Apple Card at an ATM to get cash. The Apple Card is a credit card that can only be used to make purchases. There are no cash advance features available on the Apple Card, so it cannot be used to withdraw cash from an ATM.

Which Banks Allow Apple Pay at ATMs?

Apple Pay is accepted at ATMs from many of the major banks in the United States, including Wells Fargo, Chase, Bank of America, Citi, U.S. Bank, TD Bank and PNC. To use Apple Pay at an ATM, simply look for the contactless symbol at the ATM and hover your iPhone or Apple Watch near it. You will then be prompted to enter your pin code on the screen to authenticate your identity and complete the transaction.

Source: imore.com

Conclusion

In conclusion, the Apple Card does not offer cash advances as a feature. This means that users cannot use the card to withdraw cash from ATMs or banks. The Apple Card is only available for making purchases, wherever cards on the Mastercard network are accepted. Additionally, there is no cash advance fee associatd with the Apple Card because it does not support this feature. Ultimately, this card is designed to be used for purchasing items and services rather than getting access to cash.