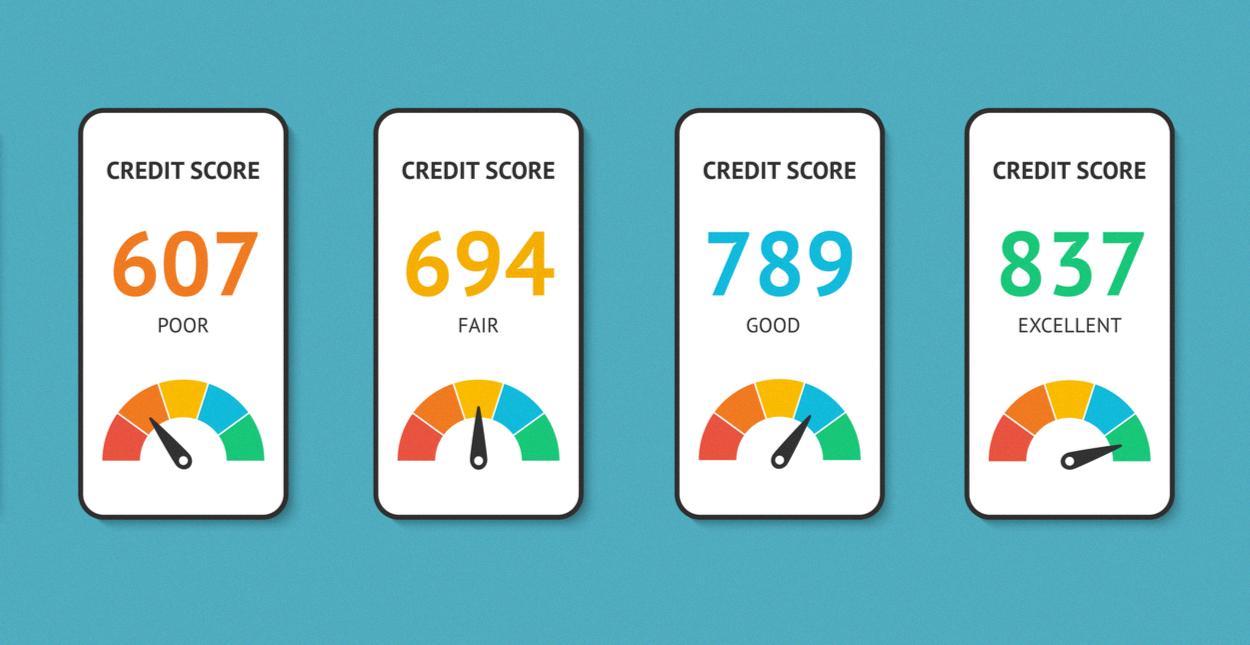

If you’re considering applying for an Affirm loan, one important factor to conider is your credit score. Your credit score is a three-digit number that gives lenders an idea of how likely you are to make payments on time and in full. It’s an important factor in determining whether or not you’ll be approved for a loan.

So what credit score do you need to qualify for an Affirm loan? Generally, the better your credit score, the easier it may be to get approved for a point of sale installment loan. However, Affirm does not specfy a minimum credit score required for approval. Instead, qualification is based on other factors such as income, employment history and debt-to-income ratio (DTI). If these criteria are met, you may be approved even if your credit score isn’t particularly high.

It’s also worth noting that even if your application is accepted by Affirm, it doesn’t guarantee that you will be approved every time – they may refuse to give you a loan at cetain stores or decline an application due to current economic conditions. If your application isn’t accepted, they will send you an email explaining their decision.

Having a good credit rating is always beneficial when it comes to applying for finance but it’s not the only factor taen into consideration with Affirm loans. Other elements such as income, employment and DTI are also important and can help determine whether or not you qualify.

Affirm provides instant approval on loans and flexible payment terms that may suit some people better than traditional bank loans or other forms of financing. So if you think this type of loan might work for you, make sure to check out their website and see what options are avaiable – but don’t forget about your credit score!

Minimum Credit Score Required for Affirm

In order to qualify for an Affirm loan, you need to have a minimum credit score of 550. While this is the absolute minimum requirement, other factors such as income, employment and debt-to-income ratio (DTI) are also taken into account when evaluating your loan application. It’s important to remember that having a higher credit score can help you receive more favorable loan terms and rates. So even if you do have a credit score of 550 or higher, it may be beneficial to take steps to improve your score before applying for a loan.

Getting Approved for Affirm Credit

No, Affirm is not hard to get approved for. As long as you have a good credit rating, typically a score of 550 or higher, you can easily apply for financing and get instant approval. With Affirm, you can also benefit from flexible payment terms that can be tailored to your personal situation.

Can Affirm Approve Low Credit Scores?

Affirm considers a variety of factors when determining whether to approve an application for a point of sale installment loan, including your overall credit history, your history with Affirm, and current economic conditions. While they don’t have a minimum credit score requirement, applicants with lower credit scores may find it more difficult to be approved. However, Affirm considers more than just your credit score when evaluating applications, so even those with low scores may still be approved.

Does Affirm Approve Everyone?

No, not everyone gets approved with Affirm. We review every application and make decisions based on our assessment of the applicant’s financial data. While we try to approve as many applicants as possible, some may not be eligible for a loan at this time. If your application isn’t approved, we’ll send you an email explaining more about our decision.

Factors That Determine Affirm Approval

Affirm uses a variety of factors to determine your eligibility for a loan. These include your credit score, payment history with Affirm (if applicable), length of time you’ve had an Affirm account, credit utilization rate, income, existing debt and any recent bankruptcies. We aim to provide loans to those who are likely to have the ability to pay them back in a timely manner. Ultimately, our goal is to help make financing more accessible and affordable for everyone.

What Is the Maximum Affirm Credit Limit?

The maximum credit limit for an Affirm loan is $17,500. This amount is the maximum amount that you can borrow in a single loan from Affirm. It is important to note that taking out one loan does not guarantee that you will be approved for anther loan, so it’s best to make sure you only take out what you need.

Reasons Why Affirm Does Not Approve Applications

We understand that you may be frustrated when Affirm is not able to provide an approval for your purchase. There are a variety of reasons why Affirm may not approve a loan:

1. Your credit information didn’t allow us to provide an approval: If we cannot assess your creditworthiness in order to determine the appropriate terms and conditions for a loan, then we will not be able to approve a loan.

2. You have an existing PayBright spending limit: If the amount of money you are tring to borrow exceeds your current spending limit with PayBright, then we will not be able to approve the loan.

3. We could not gather sufficient credit information from the credit bureaus: If the information available from the credit bureaus is insufficient for us to assess your creditworthiness, then we will not be able to approve a loan.

If you find yourself in this situation, please reach out to our customer service team so that we can help you better understand why Affirm was unable to approve your loan and how you can improve your chances of being approved in the future. Thank you for considering Affirm!

Why Is My Affirm Application Not Getting Approved?

Thank you for your interest in Affirm. Unfortunately, it appears that there is incorrect information in your application which is preventing us from approving it. We take the accuracy of our records very seriously, so we must ensure that everything matches up with public record.

If you believe thre is an inaccuracy in your application, please fill out this form and we’ll review it as soon as possible. Please note that if we find any discrepancies, we may need additional information from you before we can move forward with the approval process.

We apologize for the inconvenience and appeciate your patience as we work to get your application approved. Thank you again for considering Affirm!

Comparing Afterpay and Affirm: Which is Better?

Afterpay and Affirm are both great options for financing purchases, but they have different features that make them better suited to different needs. Afterpay offers four installments over eight weeks with no interest or fees, making it a great option for budgeting smaller purchases. On the oher hand, Affirm has more flexible financing terms and can be used for larger purchases, such as furniture and appliances. It also offers longer repayment periods of up to 36 months and the potential to build credit with your on-time payments. Ultimately, it’s up to you to decide which one is the better fit for your needs.

Source: badcredit.org

Do I Need Income to Qualify for Affirm?

Yes, Affirm may sometimes need more information aout your income in order to make a credit decision. This is to help Affirm better understand your financial situation and determine if you are able to repay any loan or purchase you make with Affirm. Income can be provided as either employment income or other sources of income such as rental income, Social Security, alimony, or pension benefits. Providing your income helps Affirm assess your ability to repay and make sure that you are taking on a manageable debt load for the long-term.

Conclusion

In conclusion, having a good credit score is important when applying for an Affirm loan. Generally, you need to have a credit score of at least 550 to qualify but other factors like your income and employment history are also taken into consideration. It is possible to be approved for a loan at one store but not another, or even be approved for one loan but not another. Affirm does not provde exact criteria for what credit score you need to qualify, but if your application can’t be approved they will send you an email explaining their decision. Overall, having a good credit score is essential in obtaining an Affirm loan and it is important to maintain and build your credit history in order to improve your chances of approval.