When you file your tax return, you may check the status of your refund on the IRS website. One of the statuses you may see is “being processed.” This status means that the IRS has received your tax return and is currently reviewing it to ensure that it is accurate and complete.

The process of reviewing a tax return can take some time, and the length of time it takes for the IRS to process your return can vary depending on a number of factors, including the complexity of your return, the time of year you filed, and whether or not there are any errors or discrepancies on your return.

While your return is being processed, you may not see any updates or changes to your refund status. This can be frustrating for taxpayers who are eagerly awaiting their refund, but it is important to remember that the IRS is working to ensure that your return is processed correctly and that you receive the correct refund amount.

If there are no issues with your return, the next status update you will see is likely to be “approved.” Once your refund is approved, the IRS will prvide you with a personalized refund date, and you can expect to receive your refund within 21 days.

If there are any issues or errors on your return, the IRS may need to contact you to request additional information or clarification. This can delay the processing of your return, and it may take longer for you to receive your refund.

In some cases, the IRS may also delay the processing of your return if they suspect that there is fraud or identity theft involved. If this happens, you may need to provide additional documentation or take other steps to verify your identity before your return can be processed.

Seeing the status of “being processed” on your tax refund status means that the IRS has received your tax return and is currently reviewing it for accuracy and completeness. While it can be frustrating to wait for your refund, it is important to be patient and wait for the IRS to complete their review to ensure that you receive the correct refund amount.

Does Processing Indicate Approval?

When you file your tax return, the IRS will process it to determine if everything is in order. The processing time can vary depending on several factors, such as the complexity of your return or the number of returns the IRS is processing at the time. While your tax return is being processed, it means that the IRS is reviewing your return and verifying the iformation you provided.

However, being processed does not necessarily mean that your return has been approved. The IRS may need to ask for additional information or clarification on your return before they can approve it. Once the IRS approves your return, they will issue you a refund if you are owed one.

So, to summarize, being processed means that the IRS is reviewing your return, but it does not necessarily mean that your return has been approved. You should continue to check the status of your return and look for updates from the IRS. If they need more information from you, they will likely contact you by mail or phone.

What Does It Mean When Something Is Being Processed?

When you file your tax return, the Internal Revenue Service (IRS) receives it and begins to process it. The term “being processed” typically means that the IRS is reviewing your return and verifying that all the information you have provided is accurate. This process involves the IRS checking your income, deductions, and credits to ensure you have correctly reported them.

If your tax return is being processed, it means that the IRS has received it and is working on it. However, it doesn’t necessarily mean that your refund is on its way or that your return has been accepted. The processing time can vary depending on the complexity of your tax return and the volume of returns the IRS is receiving.

It’s essential to note that being processed doesn’t necessarily mean that there are any issues with your return. However, it’s crucial to ensure that you have provided all the necessary information and that it is correct. Any discrepancies can cause delays in processing or even trigger an audit.

If you are wondering about the status of your tax return, you can check the IRS’s “Where’s My Refund?” tool. This tool allows you to track the status of your refund and provdes an estimated date of when you can expect to receive it.

If your tax return is being processed, it means that the IRS has received it and is working on reviewing the information you have provided. It’s essential to ensure that all the information is accurate to avoid any delays or issues.

Understanding the IRS Processing Process

When the status of your tax return on the IRS website shows “being processed,” it means that the IRS has received your tax return and is currently working on it. The IRS needs to process your tax return to verify the inforation you provided, including your income, deductions, and credits. It is a critical step in ensuring that your tax return is accurate and that you receive the refund you are entitled to.

The processing time can vary depending on different factors, such as the complexity of your tax return, the accuracy of the information provided, and the number of returns the IRS is processing at the time. However, most tax returns are processed within 21 days.

During the processing time, the IRS will review your tax return and may contact you if they need additional information or clarification. Once the IRS completes the processing, you will receive a personalized refund date, which indicates when you can expect to receive your refund.

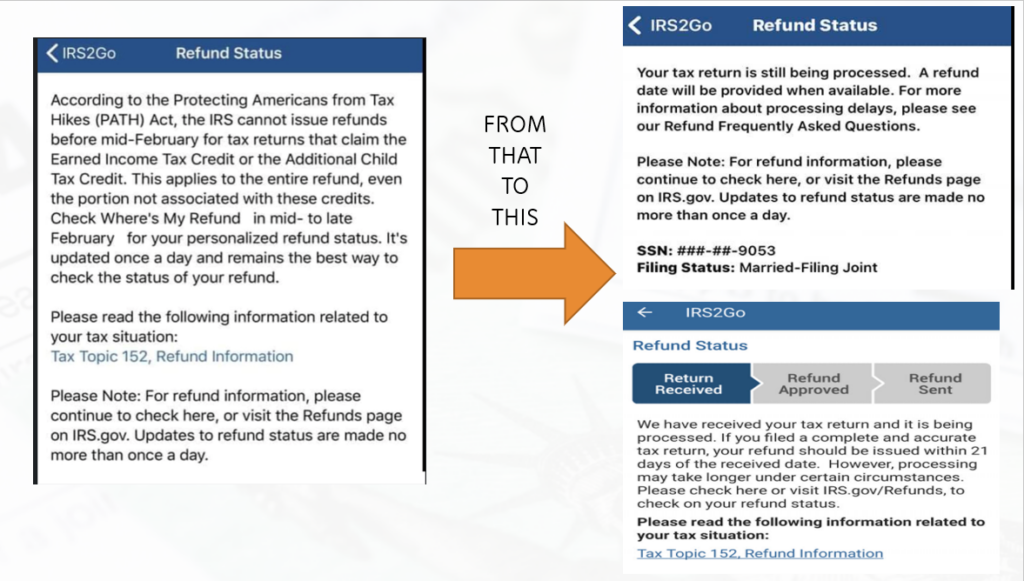

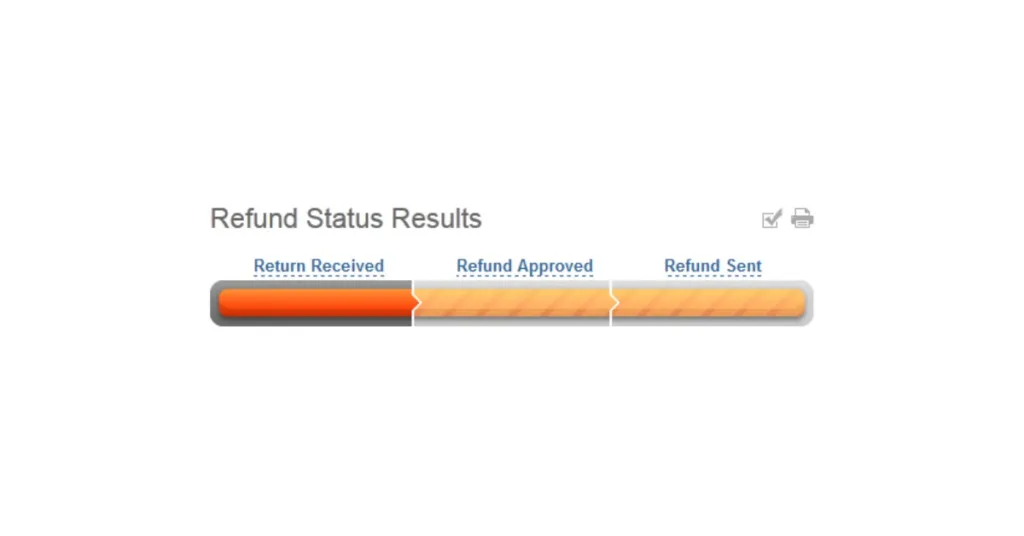

It’s important to note that the status of your tax return may change from “being processed” to “refund approved” or “refund sent” once the IRS completes processing. If you are concerned about the status of your tax return, you can check the IRS website or contact the IRS directly.

Being processed by the IRS means that your tax return is in the review and verification process, and you should expect your refund within 21 days once the processing is complete.

The Benefits of Being Processed

If you see the message “Being Processed” when checking the status of your tax return, it can generally be considered a good thing. This message indicaes that the IRS has received your tax return and is currently reviewing it for accuracy and completeness. It is important to note that processing times can vary depending on a number of factors, such as the complexity of your return and the volume of returns being processed by the IRS.

While the processing of your tax return may take some time, it is important to be patient and allow the IRS to complete their review. Once your return has been processed and approved, you can expect to receive any refund owed to you in a timely manner. If there are any issues or discrepancies with your return, the IRS will contact you to resolve these issues.

If you see the “Being Processed” message when checking your tax return status, it is generally a good thing, indicating that your return has been received and is currently being reviewed by the IRS.

Conclusion

After reviewing the informtion provided, it can be concluded that “being processed” means that the IRS has received your tax return and is currently working on processing it. It is a positive sign that your return is progressing through the system, but it does not necessarily indicate that your refund has been approved or a date has been set for its release. It is important to continue checking the status of your return regularly and to be patient as the process can take up to 21 days or longer in some cases. By staying informed and aware of the meaning behind the status updates, you can better understand the progress of your tax return and anticipate when to expect your refund.