If you have received a U.S. Treasury check and want to endorse it over to someone else, there are a few things you need to know. First, it is important to understand what a U.S. Treasury check is and how it differs from other types of checks.

A U.S. Treasury check is a type of government-issued check that is used to make payments to individuals or businesses. These checks are issued by the U.S. Department of the Treasury and are often used for things like tax refunds, Social Security payments, and other government benefits.

When it comes to endorsing a U.S. Treasury check to someone else, there are a few different options. One option is to sign the back of the check and write “pay to the order of [insert name]” underneath your signature. This is called a “third-party endorsement” and allows you to transfer the check to someone else.

However, it is important to note that not all banks will accept third-party endorsed checks. Some banks have policies in place that only alow checks to be deposited into an account that is in the same name as the payee on the check. This is to help prevent fraud and ensure that the funds are going to the intended recipient.

Another option for endorsing a U.S. Treasury check to someone else is to deposit the check into your own account and then write a separate check to the person you want to give the money to. This can be a good option if you are unsure whether the person you are giving the check to will be able to cash it or if you want to avoid any potential issues with third-party endorsements.

When endorsing a U.S. Treasury check, it is important to be careful and make sure that you are following all the proper procedures. This includes signing the check in the correct place, writing any necessary information (such as “pay to the order of [insert name]”) underneath your signature, and making sure that the check is going to the intended recipient.

U.S. Treasury checks can be endorsed over to someone else, but it is important to be aware of any bank policies and to follow the proper procedures when doing so. Whether you choose to use a third-party endorsement or deposit the check into your own account and write a separate check, make sure that you are taking the necessary precautions to ensure that the funds are going to the intended recipient.

Depositing Government Checks into Another Person’s Account

It is possible to deposit a government check into someone else’s account, but there are certain guidelines to follow. The main consideration is whether the bank will allow the deposit. Most banks have policies in place to prevent fraud, and they may not allow checks to be deposited into accounts that do not match the name on the check. However, some banks may allow it if certain conditions are met.

To deposit a government check into someone else’s account, both parties will need to be present at the bank. The person whse account the check is being deposited into will need to sign a consent form, giving permission for the deposit to be made. In addition, the person receiving the check will need to endorse the back of the check, signifying that they are allowing the deposit.

It’s important to note that if the check is for a large amount, the bank may place a hold on the funds for a certain period of time. This is to ensure that the check clears and there are no issues before the funds are released. It’s also important to keep records of the transaction, including the consent form and the endorsed check, in case there are any questions or issues that arise.

While it is possible to deposit a government check into someone else’s account, it’s important to follow the bank’s policies and procedures to ensure that the deposit is allowed and the funds are properly credited.

Endorsing a Treasury Check for Mobile Deposit

Endorsing a Treasury check for mobile deposit is a simple process that requires a bit of attention to detail. The first step is to make sure that you have signed the check in the endorsement area on the back. This area is usually located on the top half of the back of the check and is marked with a line that says “Endorse Here.”

Once you have signed the check, you will need to add the words “For Mobile Deposit Only” below your signature. This is an important step because it tells the bank that you want to deposit the check using your mobile device rather than by going to a physical branch.

It is essential to write “For Mobile Deposit Only” in a clear and legible manner to avoid any confusion or misinterpretation by the bank. If the endorsement is not clear, the bank may reject the deposit, and you may need to go throuh the process again.

To make sure that your endorsement is correct, take a moment to review it before submitting the check for mobile deposit. You can also ask your bank for specific guidelines on how to endorse Treasury checks for mobile deposit to ensure that you are following their procedures correctly.

Endorsing a Treasury check for mobile deposit requires signing the check in the endorsement area and adding “For Mobile Deposit Only” below your signature in a clear and legible manner. By following these simple steps, you can ensure that your deposit is processed quickly and accurately.

Endorsing a Government Check to Someone

It is possible to endorse a government check to someone else. In fact, there is no law that prohibits this practice. However, it is important to keep in mind that the depositary bank or check casher may have its own policies rearding the acceptance of such checks. To properly endorse a government check to someone else, the payee must use the correct form of endorsement. This can usually be done by signing the back of the check and writing “Pay to the order of [third party’s name]” underneath the signature. It is important to ensure that the third party is trustworthy and has the legal right to receive the funds before endorsing the check to them. In addition, it is always a good idea to keep a record of the transaction for future reference.

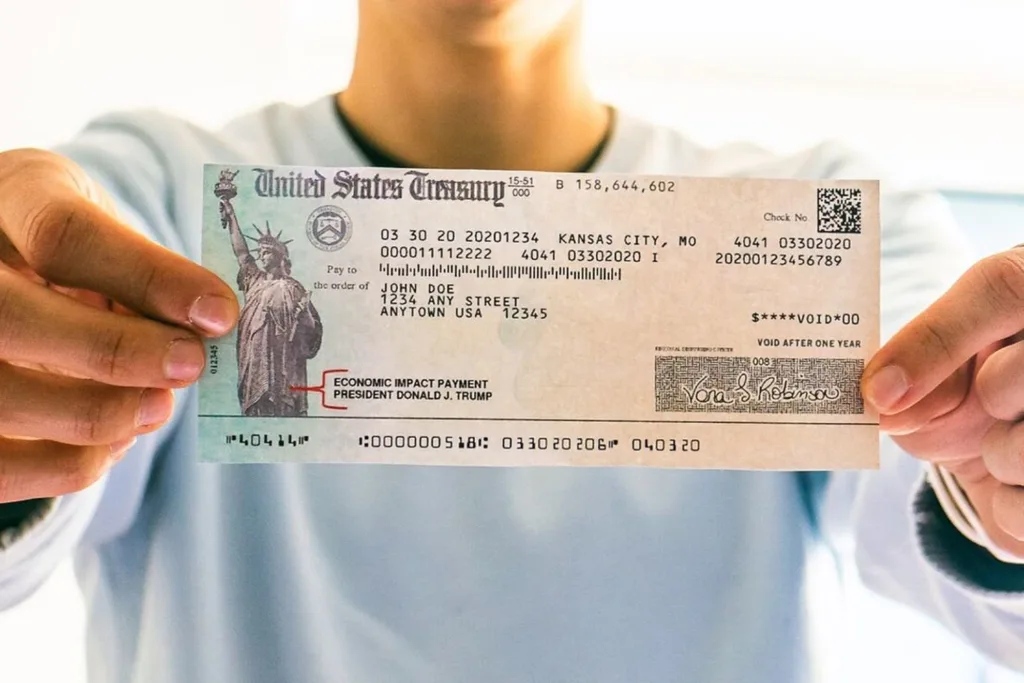

Endorsing a Stimulus Check to Someone Else

The short answer to the question is no, you cannot endorse your stimulus check to someone else. According to the Citizens Bank, stimulus checks are not eligible for double endorsement. This means that they cannot be signed over to another person or deposited into a bank account that is not owned by the recipient of the check.

It is important to note that the stimulus checks are issued by the government as a form of economic relief in response to the COVID-19 pandemic. They are intended to provide financial assistance to individuals and families who are struggling to make ends meet during these difficult times.

The Internal Revenue Service (IRS) is responsible for distributing the stimulus checks. Generally, the checks are sent to the last known address that the IRS has on file. If you have moved since your last tax return, it is important to update your address with the IRS to ensure that you receive your check.

If you have received a stimulus check, it is important to cash or deposit it as soon as possible. The checks are only valid for a limited time, and if they are not cashed or deposited within that time frame, they will become void.

If you have received a stimulus check, you cannot endorse it to someone else. It must be deposited into a bank account that is owned by the recipient of the check. If you have any questions or concerns abut your stimulus check, it is recommended that you contact the IRS or your bank for further assistance.

Conclusion

U.S. Treasury checks can be deposited into your own bank account, but depositing them into someone else’s account can be risky due to fraud prevention measures that most banks have in place. However, with the proper form of endorsement, government checks can be signed over to a third party. It is important to note that policies regarding double endorsement or depositing into a different account may vary from bank to bank. As always, it is best to check with your bank or financial institution for their specific policies and procedures.