When it comes to filling out the Free Application for Federal Student Aid (FAFSA), one of the most important numbers you will receive is your Expected Family Contribution (EFC). This is the amount of money that the government expects you and your family to contribute towards your college education. The EFC is based on a variety of factors, including your family’s income, assets, and the number of family members in college.

While there is no maximum EFC, it is possible to have a very high EFC that will significantly impact your financial aid package. A high EFC generally means that your family has a high income and/or a significant amount of assets. In some cases, a high EFC can even make you ineligible for need-based financial aid.

So, what is the highest EFC possible? The answer is that it depends on your family’s financial situation. The EFC formula takes into account both parental and student income, as well as assets and other factors. However, in general, the highest EFC you can receive is 99,999.

If your EFC is 99,999, it means that the government expects you and your family to contribute a significant amount towards your college education. This may make you ineligible for need-based financial aid, but you may sill be able to qualify for scholarships, grants, and other forms of aid.

If you have a high EFC, it’s important to explore all of your options for paying for college. This may include applying for merit-based scholarships, taking out student loans, or even considering a part-time job while in school. You may also want to talk to a financial aid advisor at your school to see what other options are available.

While there is no maximum EFC, a high EFC can significantly impact your financial aid package. If you have a high EFC, it’s important to explore all of your options for paying for college and to talk to a financial aid advisor to see what options are available to you.

What is the Maximum Possible EFC Number?

The Expected Family Contribution (EFC) is a numerical figure used to determine a student’s eligibility for federal financial aid programs. The EFC is calculated based on various financial factors, including income, assets, family size, and number of family members attending college.

Technically speaking, there is no maximum EFC number. The EFC can range from zero to any six-digit number. This means that even if a student’s family has a high income and significant assets, they may stil be eligible for some level of financial aid, depending on the cost of attendance at their chosen school.

It’s important to note that a high EFC does not necessarily mean that a student will receive less financial aid. The EFC is just one factor that is used to determine a student’s eligibility for aid, and each school has its own policies and procedures for awarding aid.

The highest possible EFC number is any six-digit number, and a high EFC does not necessarily mean that a student will receive less financial aid.

What Is the Meaning of an EFC of 50000?

When it comes to college financial aid, the term EFC stands for Expected Family Contribution. This is the amount of money that financial aid formulas determine a family should be able to contribute towards one year of their child’s college education. An EFC of $50,000 means that financial aid formulas have calculated that a family with an AGI (Adjusted Gross Income) of $50,000 should be able to contribute $50,000 towards their child’s college education for one year.

It’s important to note that an EFC of $50,000 does not necessarily mean that a family will have to pay that exact amount out of pocket. Financial aid packages are typically made up of a combination of grants, scholarships, work-study programs, and loans. The amount of aid a family receives will depend on a variety of factors, including their financial need, the cost of attendance at the college or university, and the availability of funds from federal and state governments, as well as private sources.

It’s also worth mentioning that an EFC of $50,000 is considered relaively high in terms of financial need. Families with lower EFCs may be eligible for more aid, while those with higher EFCs may be expected to contribute more towards their child’s education.

An EFC of $50,000 represents the expected amount of money a family with an AGI of $50,000 should be able to contribute towards one year of their child’s college education. However, the actual amount of financial aid a family receives will depend on a variety of factors, including their financial need and the availability of funds from various sources.

Understanding Why Your Expected Family Contribution May Be High

When it comes to financial aid for college, one of the most important factors to cnsider is your Expected Family Contribution, or EFC. This is the amount of money that the federal government expects you and your family to contribute towards your education, based on your financial situation. If your EFC is high, it means that you may not be eligible for as much financial aid as you had hoped.

There are several reasons why your EFC might be high. One of the main factors is your family’s income. The higher your family’s income, the higher your EFC is likely to be. This is because the federal government assumes that families with higher incomes have more money available to contribute towards their child’s education.

In addition to income, the FAFSA (Free Application for Federal Student Aid) also takes into account other factors such as the number of family members in college, assets, and certain deductions. For example, if you have siblings who are also attending college, your EFC may be lower because the federal government assumes that your family will need to contribute less money to support multiple children in college.

It’s also worth noting that your EFC is not necessarily the amount of money that you will actually have to pay for college. It simply serves as a benchmark for determining your eligibility for financial aid. Depending on the cost of attendance at the college you plan to attend, you may still be eligible for some forms of financial aid even if your EFC is high.

A high EFC is often due to a family’s high income, but there are other factors that can also impact your EFC. It’s important to understand how your EFC is calculated so that you can plan accordingly when it comes to paying for college.

What Does an Estimated Family Contribution (EFC) of $20,000 Mean?

An Expected Family Contribution (EFC) of $20,000 is the amount of money that the federal government expects a family to contribute toards their child’s education for one academic year. The EFC is determined by filling out the Free Application for Federal Student Aid (FAFSA), which takes into account factors such as family income, assets, and size.

If an EFC of $20,000 is calculated, it means that the family is expected to contribute $20,000 towards their child’s college education for one year. However, the actual cost of attendance at a college may be higher than the EFC, which leads to unmet financial need.

To determine how much financial aid a student may be eligible for, colleges and universities use a formula that takes into account the cost of attendance and the EFC. If a college meets a certain percentage of a student’s financial need, the unmet need is the amount that a family will have to pay out of pocket or through other means, such as private loans.

It’s important to note that the EFC is not necessarily the amount that a family will have to pay for college, but rather a starting point for financial aid calculations. Families may be eligible for various types of financial aid, such as grants, scholarships, and loans, which can help cover the cost of attendance.

What Are the Implications of an EFC of 7000?

The Expected Family Contribution (EFC) is a crucial factor in determining your eligibility for need-based financial aid programs. If your EFC is calculated to be $7,000, it means that your family’s financial situation is such that you are eligible for up to $7,000 in need-based aid. This aid can come in the form of scholarships, grants, work-study programs, and other financial assistance programs.

It’s important to note that your EFC also affects your eligibility and award amounts for federal need-based aid programs, such as the Federal Pell Grant, Federal Supplemental Educational Opportunity Grant (FSEOG), and Federal Work-Study. The lower your EFC, the higher your eligibility for these programs.

If your EFC is $7,000, it’s recommended that you explore all of your financial aid options to maximize your eligibility and award amounts. You can start by filling out the Free Application for Federal Student Aid (FAFSA), which is used to determine your eligibility for federal and state financial aid programs. Additionally, you can reach out to your college’s financial aid office to learn about other need-based aid programs that may be avalable to you.

If your EFC is $7,000, it means that you are eligible for up to $7,000 in need-based financial aid. However, it’s important to explore all of your financial aid options to maximize your eligibility and award amounts.

Understanding the Meaning of an EFC of 90000

The Expected Family Contribution (EFC) is a number that is calculated based on your family’s income, assets, and other factors. It is used to determine your eligibility for financial aid when applying for college. If your EFC is 90000, it means that the government expects you to contribute 47% of your net income towards your child’s education. This amount is calculated by taking into consideration your family’s income, assets, and other factors. The higher your EFC, the less financial aid you will be eligible for. However, it is important to note that even families with a high EFC may still be eligible for certain types of aid, such as unsubsidized loans or merit-based scholarships. It is aways a good idea to explore all of your options and speak with a financial aid advisor to determine the best course of action for your family’s situation.

The Impact of Independent Student Status on Expected Family Contribution (EFC)

As an independent student, your EFC (Expected Family Contribution) may still be high due to several factors. Some of the reasons are:

1. High Income: The primary reason for a high EFC as an independent student is a high income. The EFC calculation assumes that the student can contribute a significant amount towads their education costs, even if they are not receiving financial support from their parents or guardians.

2. Assets: The amount of assets you own also plays a crucial role in determining your EFC. If you have substantial savings, stocks, or other investments, it can increase your EFC, leading to a lower amount of financial aid.

3. Dependents: If you have dependents, such as children or elderly parents, it may affect your EFC. The calculation assumes that you have additional financial responsibilities and can contribute less towards your education costs.

4. Tax Credits: As an independent student, you may qualify for tax credits such as the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC). These credits can increase your taxable income, leading to a higher EFC.

5. Other Income: Any other sources of income, such as rental income or investment income, can also increase your EFC.

It is essential to understand that the EFC is just an estimate of how much you can contribute towards your education costs. It is not a guarantee of how much financial aid you will receive. Other factors such as the cost of attendance, availability of funds, and your academic performance also play a crucial role in determining your financial aid package.

Can High EFC Affect Financial Aid Eligibility?

If you have a high expected family contribution (EFC), you may be wondering if you are still eligible for financial aid. The short answer is yes, you can still receive financial aid even if your EFC is high.

It’s important to understand that your EFC is just one factor that is taken into consideration when determining your financial aid eligibility. Other factors include the cost of attendance at your chosen school, your academic record, and your family’s financial situation.

Completing the Free Application for Federal Student Aid (FAFSA) is the first step in applying for financial aid. Even if you have a high EFC, filling out the FAFSA is still important because it generates a financial profile that is used to determine your eligibility for various types of financial aid, including scholarships, grants, and loans.

While some types of financial aid, such as need-based grants, may be more difficult to obtain with a high EFC, thre are still many other types of aid available that are not based on financial need. For example, some scholarships are awarded based on academic or athletic achievement, while others are awarded based on a student’s career goals or background.

In addition, some schools offer merit-based aid that is not based on financial need. These types of aid are often awarded to students who have excelled academically, artistically, or athletically.

To maximize your chances of receiving financial aid, it’s important to apply early and research all available options. Don’t assume that a high EFC automatically disqualifies you from receiving aid. By filling out the FAFSA and exploring all available options, you may be able to obtain the financial assistance you need to achieve your educational goals.

How Does Income Affect Expected Family Contribution?

When it comes to determining your eligibility for financial aid, your income plays a significant role in the calculation of your expected family contribution (EFC). The EFC is a measure of your family’s financial strength and is used to determine how much federal student aid you are eligible to receive.

Your income, along with your savings and assets, are reported on the Free Application for Federal Student Aid (FAFSA). The FAFSA uses a formula that takes into consideration a variety of factors to determine your EFC.

If you are married, your spouse’s income will also be included in the calculation of your EFC. This means that if you and your spouse both have significant incomes, your EFC may be higher than if you were single.

It’s important to note that whle your income does impact your EFC, it’s not the only factor that is considered. The FAFSA also takes into account your family size, the number of family members who are attending college, and other factors that may impact your ability to pay for college.

Your income can affect your EFC, but it’s important to remember that it’s just one of many factors that are considered. By filling out the FAFSA accurately and completely, you can ensure that you are considered for all the financial aid for which you may be eligible.

What Does an EFC of 10000 Mean?

When you fill out the Free Application for Federal Student Aid (FAFSA), you will be given an Expected Family Contribution (EFC) number. This number represents the amount of money that you and your family are expected to contribute towards your college education for one year.

If your EFC is $10,000, it means that the government expects you and your family to contribute $10,000 towards your college education for one year. However, this does not necessarily mean that you will only have to pay $10,000 for your college education.

The total cost of attending a college or university includes not only tuition and fees but also room and board, textbooks, and other expenses. The financial aid package that you receive from the school will take into account the total cost of attendance and your EFC to determine how much financial aid you are eligible for.

So, even if your EFC is $10,000, the financial aid package that you receive may stil require you to pay more than $10,000, depending on the total cost of attendance at the college or university you plan to attend. This could be $12,000, $15,000, or even $20,000.

It is important to keep in mind that financial aid packages can vary greatly from school to school, so it is a good idea to compare the financial aid packages offered by different schools before making a final decision on where to attend.

Having an EFC of $10,000 means that you and your family are expected to contribute a certain amount towards your college education, but the final cost will depend on the total cost of attendance and the financial aid package you receive from the school.

What Is the Meaning of an EFC of 30000?

When filling out the Free Application for Federal Student Aid (FAFSA), one of the most important pieces of information that is generated is the Expected Family Contribution (EFC). The EFC is a measure of how much a family is expected to contribute towards teir child’s education. An EFC of $30,000 means that the family is expected to pay $30,000 towards the child’s education for that academic year.

It is important to note that the EFC is not necessarily the amount that a family will pay for college. Rather, it is a measure of the family’s ability to pay for college. The amount a family will actually pay will depend on a number of factors, including the cost of attendance at the college, the student’s eligibility for financial aid, and the family’s own financial situation.

It is also important to note that an EFC of $30,000 does not necessarily mean that a family will receive $30,000 in financial aid. Financial aid is awarded based on a number of factors, including the student’s financial need, the availability of funds, and the policies of the particular college or university.

An EFC of $30,000 means that the family is expected to contribute $30,000 towards their child’s education for that academic year, but the actual amount they will pay will depend on a variety of factors.

Understanding the Reasons for Variations in Expected Family Contribution (EFC) Between Siblings

When it comes to financial aid for college, the Expected Family Contribution (EFC) plays a crucial role in determining eligibility. The EFC is calculated by taking into account various factors such as the family’s income, assets, and household size. However, one common question that arises is why the EFC may differ among siblings, even when they come from the same household.

The answer lies in the fact that the financial aid formula recognizes that families have an obligation to each college student in the household. When the eldest child starts college, the EFC is usually the highest, as there are no additional college costs for other siblings. However, when the younger siblings start college, the EFC may be lower since the family’s resources are being divided among multiple students.

Moreover, it’s essential to note that the EFC is not a fixed value and can vary from year to year, depending on changes in the family’s income and assets. It’s also important to note that the EFC is not the same as the amount a family will pay for college, as colleges may offer need-based and merit-based aid that can reduce the ovrall cost.

To summarize, the EFC may be higher for the eldest child in the family since there are no additional college costs for other siblings. However, the EFC can vary from year to year and is not the same as the amount a family will pay for college.

What Does an EFC of 00000 Mean?

When your Expected Family Contribution (EFC) is 00000, it means that you are not expected to contribute any money towards your college education. This is great news, as it means that you are eligible for a lot of federal financial aid for college. However, it is important to note that not all of this financial aid will be free. Here are some things to keep in mind if your EFC is 00000:

1. You may be eligible for grants: When your EFC is 00000, you may be eligible for federal grants like the Pell Grant, which can provide you with up to $6,345 for the 2020-2021 school year. You may also be eligible for state grants, depending on where you live.

2. You may be eligible for work-study: Work-study is a federal program that provides students with part-time jobs to help them pay for college. When your EFC is 00000, you may be eligible for work-study, which can provide you with a part-time job on campus or with a participating organization.

3. You may be eligible for loans: While you may not be expected to contribute any money towards your college education, you may stil be eligible for federal student loans. These loans have lower interest rates than private loans and come with flexible repayment options.

It is important to remember that while your EFC is 00000, there may be other costs associated with attending college, such as room and board, textbooks, and transportation. It is important to budget for these costs and to explore all of your financial aid options to ensure that you can afford to attend college.

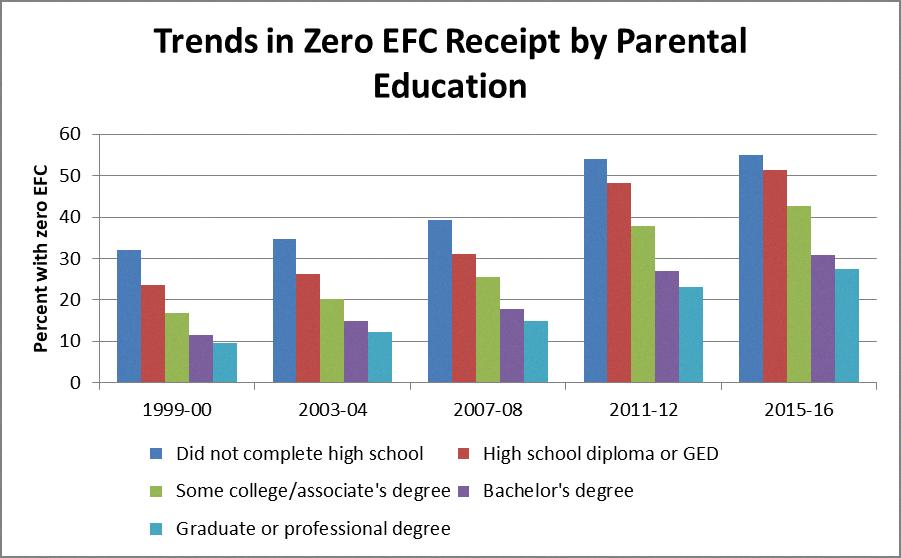

Source: robertkelchen.com

Is a $3,000 Expected Family Contribution Considered High?

The Expected Family Contribution (EFC) is a measure of a family’s ability to pay for college, based on ther income, assets, and other factors. It is calculated using a formula established by the federal government and is used to determine a student’s eligibility for need-based financial aid.

Whether or not $3,000 is considered a high EFC depends on a variety of factors, such as the cost of attendance at the college or university the student plans to attend, as well as their individual financial situation. For some families, an EFC of $3,000 may be manageable, while for others it may represent a significant financial burden.

It’s worth noting that EFCs can vary widely, depending on a number of variables such as income, assets, family size, and number of children in college. Wealthy families may receive an EFC that is much higher than $3,000, while families with lower incomes may receive an EFC that is much lower.

Ultimately, it’s important for families to understand their EFC and how it may impact their ability to pay for college. Working with a financial aid advisor or using online tools can help families better understand their options for paying for college, including scholarships, grants, loans, and work-study programs.

What is the Meaning of an EFC of 00400?

When it coms to college financial aid, the Expected Family Contribution (EFC) is a crucial factor. Essentially, the EFC is a number that represents how much money a student and their family are expected to contribute towards their college expenses. This number is calculated based on various factors, such as income, assets, family size, and the number of family members in college.

An EFC of 00400 means that a student’s family is expected to contribute $400 towards their college expenses. This number is determined through the Free Application for Federal Student Aid (FAFSA) process, which takes into account the family’s financial information and calculates the EFC accordingly.

It’s essential to note that the EFC is used to determine a student’s eligibility for need-based financial aid, such as grants, scholarships, and loans. The lower the EFC, the more financial aid a student may be eligible to receive. However, it’s also possible that a student with an EFC of 00400 may not qualify for need-based aid if the college’s Cost of Attendance (COA) is less than or equal to that number.

Understanding the EFC is crucial for students and their families when navigating the financial aid process. It’s important to provide accurate financial information when completing the FAFSA to ensure that the EFC is calculated correctly and to maximize the potential for financial aid.

Conclusion

The EFC, or Expected Family Contribution, is a crucial factor in determining financial aid eligibility for college students. This six-digit number represents what financial aid formulas believe a family sould be able to pay for one year of their child’s college education. The higher the EFC, the more difficult it may be to receive financial aid.

While there is technically no maximum EFC, the highest possible number is 999,999. This indicates that the family is expected to contribute nearly one million dollars towards their child’s education. It is important to note that this extreme EFC is incredibly rare and typically only applies to extremely high-income families.

Families with a high EFC may still be eligible for some financial aid, but it will likely be in the form of loans rather than grants or scholarships. It is crucial for families to carefully consider their financial situation and plan accordingly when it comes to paying for college.

While there may not be a maximum EFC, a number as high as 999,999 is incredibly rare and usually only applies to the wealthiest of families. It is important for families to understand their EFC and plan accordingly when it comes to paying for college.