Employee stock options are often a valuable component of a compensation package, providing employees with an opportunity to share in the growth and success of the company they work for. However, understanding the nuances of exercising or vesting those options can be confusing. In this post, we’ll take a closer look at what it means to exercise or vest stock options, and some of the reasons you may want to wait before taking action.

First, let’s define a few key terms. “Vesting” refers to the date upon which the stock option becomes exercisable. In other words, the option holder must wait until the option “vests” before they can purchase the stock under the option agreement. The “vesting date” is the date upon which the stock option becomes exercisable, while the “exercise date” is the date on which the option holder actually exercises thir options. the “expiration date” is the date by which the options must be exercised before they expire.

So why might an employee choose to wait before exercising their options? One common reason is a belief that the market price of the company stock will continue to increase over time. If an employee exercises their options too soon, they may miss out on potential future gains. Additionally, exercising options can trigger taxes, so delaying exercise may help an employee manage their tax liability.

It’s worth noting that waiting too long to exercise options can also come with risks. Stock prices can decline, potentially reducing the value of the options. Additionally, if an employee leaves the company before their options vest, they may lose the right to exercise those options.

Occasionally, there may be other factors that influence an employee’s decision to exercise their options. For example, if a stock pays a large dividend, exercising a call option to capture the dividend may be worthwhile. Or, if an option is deep in the money, an employee may not be able to sell it at fair value. In this case, it may be preferable to exercise the option to buy or sell the stock.

To summarize, exercising or vesting stock options requires careful consideration of a number of factors, including the current and future market price of the stock, tax implications, and the risk of losing the right to exercise options. While it can be tempting to exercise options as soon as they vest, waiting can sometimes be the smarter move. Ultimately, the best approach depends on an employee’s individual circumstances and financial goals.

The Benefits of Exercising Stock Options Upon Vesting

If you have stock options that have just vested, you may be wondering whether you should exercise them right away or wait for a better opportunity. The answer to this question depends on your individual financial situation and investment goals.

Firstly, it is important to understand what exercising your stock options means. Exercising your option gives you the right to purchase company stock at a predetermined price, known as the exercise price or strike price. Once you exercise your options, you own the stock outright and can sell it or hold onto it for future gains.

If you believe that the market price of the company stock will continue to increase over time, it may be beneficial to wait bfore exercising your options. This way, you can potentially capture more of the stock’s appreciation in value. However, this strategy also comes with risks, as the market price may fall as well.

On the other hand, if you need the cash or want to lock in a profit, exercising your options as soon as they vest may be the best choice for you. This is especially true if the stock price has already appreciated significantly and you don’t want to risk losing those gains.

Another factor to consider is the tax implications of exercising your options. When you exercise, you will owe taxes on the difference between the market price and the exercise price. If you hold onto the stock for at least a year before selling, you will qualify for long-term capital gains tax rates, which are generally lower than short-term rates.

The decision to exercise your stock options immediately or wait depends on your individual financial situation and investment goals. It is important to consider the potential risks and rewards, as well as the tax implications, before making a decision. It may be beneficial to consult with a financial professional for guidance.

Source: mystockoptions.com

Are Vesting Dates and Exercise Dates the Same?

The vesting date is not the same as the exercise date. The vesting date is the date on which you are eligible to exercise your options according to the terms of your employee stock option plan. It is the date on which you have earned the right to exercise your options. On the oter hand, the exercise date is the date on which you actually choose to exercise your options by buying the stock at the exercise price. It is the date on which you decide to put your options to use and realize the potential benefits of owning the stock. It is important to note that the exercise date must occur before the expiration date, which is the date by which you must exercise your options before they expire.

Understanding Vested and Exercisable Rights

When it comes to stock options, “vested” refers to the point in time when the option holder has earned the right to exercise their option. In other words, they have fulfilled the necessary conditions, such as working for the company for a certain period of time or meeting specific performance goals. Once an option is vested, the holder can then choose to exercise it, which means they can purchase the underlying stock at the predetermined price.

On the other hand, “exercisable” refers to the point at which the option holder has the right to exercise their option, regardless of whether it has vested or not. For example, if an option agreement grants an employee the right to purchase stock over a 5-year period, but the option doesn’t vest until the end of the third year, the employee may still be able to exercise the option during the first tree years, even though it hasn’t vested yet.

“vested” means the option holder has earned the right to exercise their option, while “exercisable” means the option holder has the right to exercise their option, regardless of whether it has vested or not. Both terms are important to understand when it comes to stock options and can have a significant impact on an employee’s compensation package.

The Benefits of Exercising an Option Versus Selling It

The decision to exercise an option or sell it depends on varios factors, including the option’s current price, time remaining until expiration, and the underlying stock’s price. Typically, if an option is out of the money, it is better to sell it rather than exercising it, as exercising would result in a loss of the premium paid for the option.

However, if the option is in the money and has a significant time premium remaining, it may be more profitable to sell the option rather than exercising it. In contrast, if the option is deep in the money with little time premium remaining, exercising the option may be more advantageous as it allows the holder to capture the intrinsic value of the option.

Moreover, if the underlying stock pays a substantial dividend, exercising a call option may be worthwhile to capture the dividend. Similarly, if the option is deep in the money, and bids are too low, exercising the option may be preferable to selling it at a price below fair value.

Ultimately, the decision to exercise or sell an option depends on the specific circumstances, and it is essential to evaluate the potential outcomes before making a decision.

Consequences of Not Exercising Stock Options

If you don’t exercise your stock options, you could lose them. Most companies have a policy that requires employees to exercise their options wihin 90 days of leaving the company. If you don’t exercise your options within this time frame, they will typically expire, and you will no longer have the right to purchase the underlying stock at the exercise price.

It’s important to note that if you have incentive stock options (ISOs), there may be tax implications if you don’t exercise them. ISOs have special tax treatment, and if you don’t exercise them within the required time frame, you may lose their favorable tax treatment.

Failing to exercise your stock options could result in losing them, and you may also face tax consequences if you have ISOs. Therefore, it’s important to understand your company’s policy and the specific terms of your options, and to make a decision about exercising them before the expiration date.

Losing Vested Options

It is possible to lose vested options. Vested options are stock options that you have earned the right to exercise, typically throgh meeting certain employment-related conditions or timelines. However, even after you have vested in your options, there are a variety of circumstances that could cause you to lose them.

For example, if you fail to exercise your vested options within a certain period of time after leaving your employer, the options may expire and become worthless. Additionally, some stock option agreements include provisions that allow the company to buy back your vested options at a certain price or under certain conditions, which could result in you losing your options.

It’s important to carefully review your stock option agreement and understand the terms and conditions that govern your vested options. In some cases, you may be able to negotiate with your employer to extend the deadline for exercising your options or to modify other terms that could affect your ability to retain your vested options. Ultimately, the best way to avoid losing vested options is to stay informed about your options and to take action to exercise them before any deadlines or buyback provisions come into play.

What is the Meaning of Exercise Date?

Exercise date is a crucial term in the world of options trading. The exercise date is the date on which an options trader can choose to exercise their right to buy or sell the underlying asset at the predetermined price, also knon as the strike price. This right is specified in the options contract and is a key feature of options trading.

When an options trader decides to exercise their option, they must notify their broker or the exchange by the exercise date. The broker or exchange will then facilitate the transaction, which involves the transfer of the underlying asset and the payment of the agreed-upon price.

It’s important to note that not all options traders choose to exercise their options. Many options contracts are bought and sold purely for speculative purposes, without any intention of exercising the option. In these cases, the options contract may be sold to another trader before the exercise date, allowing the original buyer to realize a profit.

The exercise date is the date on which an options trader can choose to exercise their right to buy or sell the underlying asset at the predetermined price. It’s a critical aspect of options trading that must be carefully considered by traders as they navigate the complex world of options trading.

Exercising an Option

When you exercise an option, you are essentially buying or selling the underlying asset at the predetermined price, also known as the strike price. For example, if you have a call option, you have the right to buy a specific stock at the strike price, and if you have a put option, you have the right to sell the stock at the strike price.

When you exercise the option, you are committing to either buying or selling the underlying asset, depending on the type of option you hold. This means that if you hold a call option and decide to exercise it, you will have to pay the strike price to buy the stock. If the current market price of the stock is higher than the strike price, you can sell the stock for a profit. However, if the market price is lower than the strike price, you may end up losing money.

It is important to note that when you exercise an option, you must do so before the expiration date. If you fail to exercise the option before it expires, it will bcome worthless, and you will lose the premium you paid to purchase the option.

When you exercise an option, you are committing to either buying or selling the underlying asset at the predetermined price, and you must do so before the option expires.

Vesting Period: How Long Until You Are Vested?

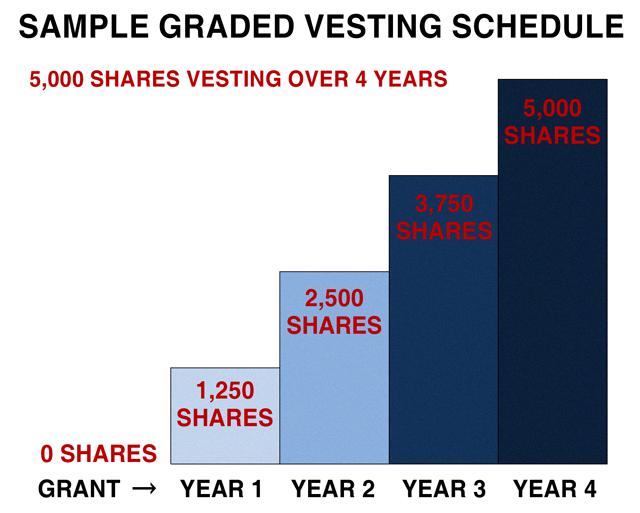

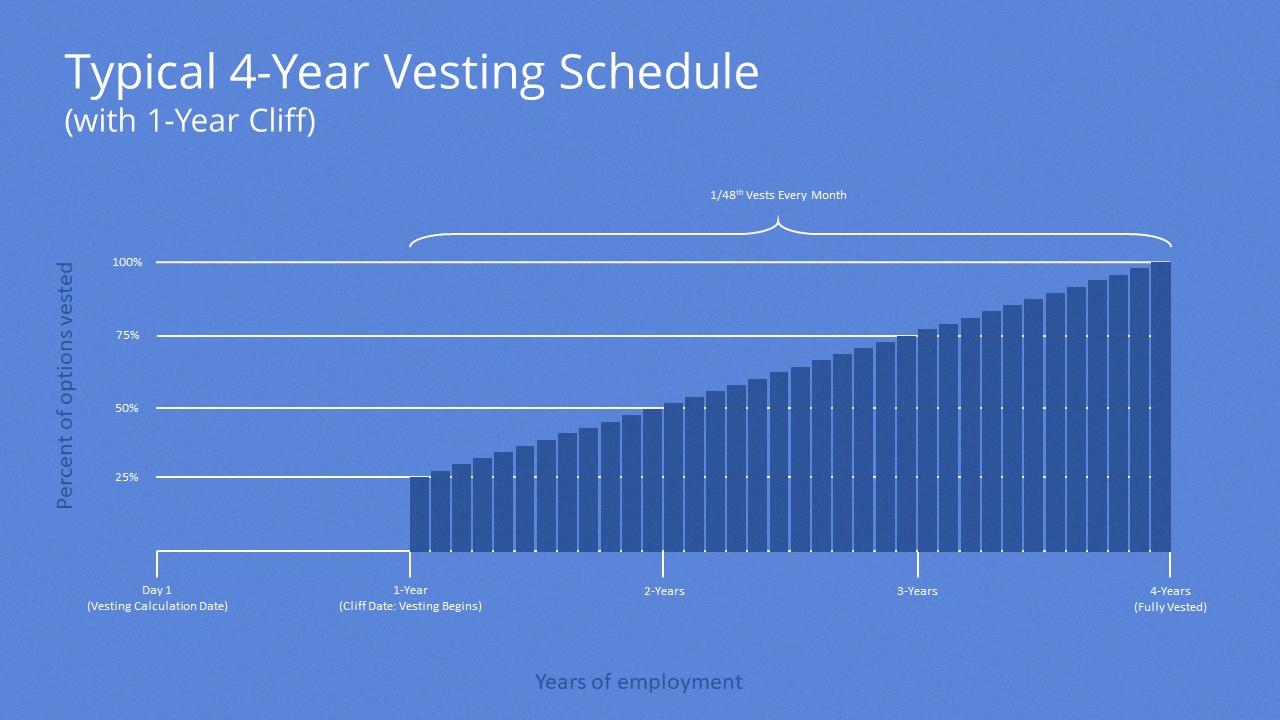

The length of time it takes for an employee to vest in their employer’s retirement plan can vary depending on the plan’s terms and conditions. Some plans offer immediate vesting, meaning that the employee is fully vested as soon as they start contributing to the plan. Other plans may have a graded vesting schedule, where the employee becomes increasingly vested in their plan benefits over time. For example, a plan might offer 20% vesting after two years of service, 40% after three years, and so on util reaching 100% vesting after a certain number of years. Generally, the period of service required to become fully vested in a plan is three to five years, but this can vary depending on the plan’s specific terms. It’s important to carefully review your employer’s retirement plan documents to understand the vesting schedule and eligibility requirements for your particular plan.

Source: esofund.com

What Does it Mean to be Vested?

Being vested means that you have met the criteria necessary to qualify for a pension benefit provided by your retirement plan. This means that you have earned enough service credit and worked for your employer for a certain period of time, as specified in the plan. Once you become vested, you are entitled to receive a pension benefit once you reach the minimum age requirement specified in the plan. It’s important to note that vesting is automatic and you do not need to take any steps to become vested in your retirement plan.

When is the Best Time to Exercise Stock Options?

The timing of exercising options depends on various personal and financial factors, including your current employment status, the company’s financial performance, and your personal tax situation.

If you believe in the long-term potential of the company and have the financial means to do so, it may be advantageous to exercise your options early. By doig so, you can lock in the current stock price and avoid potential tax liabilities in the future. However, if you are uncertain about the company’s future and do not have the financial means to exercise the options, it may be best to wait.

Another factor to consider is the expiration date of your options. If your options are nearing expiration, it may be wise to exercise them to avoid losing the opportunity to benefit from their value.

Ultimately, the decision to exercise options should be based on a careful analysis of your personal financial situation and the company’s financial outlook. It’s always best to seek the advice of a financial advisor or tax professional before making any decisions regarding stock options.

Understanding Vesting

Vesting is the process of granting an employee the right to receive or access certain benefits, such as retirement funds or stock options, based on the length of their employment. When an employee is “fully vested,” it means they have earned the right to receive the full amount of their employer’s contributions to their retirement plan, even if they leave the company before reaching the normal retirement age. Vesting can be done in different ways, such as a cliff vesting schedule (where an employee becomes fully vested afer a certain number of years) or a graded vesting schedule (where an employee becomes partially vested over a period of years). Vesting is an important aspect of employee benefits and can impact an employee’s financial future.

The Benefits of Exercising an Option

Options are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price, known as the strike price, on or before a specified date, known as the expiration date. The most common reason for exercising an option is when the holder wants to take advantage of the opportunity that the option provides.

For example, if an investor holds a call option on a particular stock, and the stock price has risen above the strike price of the option, exercising the option alows the investor to purchase the stock at the lower strike price and immediately sell it at the higher market price, realizing a profit. Similarly, if an investor holds a put option on a stock, and the stock price has fallen below the strike price of the option, exercising the option allows the investor to sell the stock at the higher strike price and avoid further losses.

In addition, exercising an option may be necessary in certain situations, such as when the option is about to expire, or when the holder needs to hedge against a potential loss in the underlying asset. However, it is important to note that exercising an option also involves transaction costs, and may not always be the most profitable or efficient strategy. Therefore, before exercising an option, it is important to carefully consider the underlying asset’s current market conditions and the potential risks and rewards of the decision.

Do I Need to Pay Taxes When Exercising Options?

You may have to pay taxes when you exercise stock options. When you exercise your options and purchase stock, the difference betwen the exercise price and the fair market value of the stock is called the “bargain element.” This bargain element is considered taxable income and is subject to federal income tax, as well as Social Security and Medicare taxes.

The type of tax you will pay on the income from exercising options depends on several factors, including the type of option (incentive or non-qualified) and how long you hold the stock after exercising the option. If you hold the stock for more than one year after exercising the option, any additional gain or loss when you sell the stock will be taxed as a long-term capital gain or loss.

However, if you sell the stock before meeting the holding period requirements, the income from the sale will be taxed as ordinary income. This means that your tax rate will be higher, and you may also be subject to additional taxes, such as the Net Investment Income Tax.

It’s important to understand the tax implications of exercising stock options before you make any decisions. Consulting with a tax professional can help you navigate the complexities of the tax code and make informed decisions about your financial future.

Benefits of Exercising an Option

An option gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price, known as the strike price, on or before a certain date. If the price of the underlying asset moves in a favorable direction, the option holder can exercise their option to either buy or sell the asset at a profit.

For example, if an investor owns a call option and the stock price rises above the strike price, they can exercise their option to buy the stock at the lower strike price and sell it at the higher market price. Alternatively, if an investor owns a put option and the stock price falls blow the strike price, they can exercise their option to sell the stock at the higher strike price and buy it back at the lower market price, also earning a profit.

Someone would exercise an option to capitalize on a favorable price movement and earn a profit. However, it is important to note that options come with risks and complexities, and investors should carefully consider their trading strategies and seek professional advice before engaging in options trading.

Conclusion

Exercising or vesting your employee stock options requires careful consideration of various factors. While it may be tempting to exercise your options as soon as they vest, waiting may be a better decision if you have faith that the market price of the company stock will continue to increase. The vesting date, exercise date, and expiration date are all important dates to keep in mind. Additionally, it’s important to consider the potential benefits of exercising an option to capture a big dividend or to sell the stock at a fair value. Ultimately, the decision to exercise or vest your options shoud be based on your individual financial goals and circumstances. By taking the time to weigh your options, you can make an informed decision that will help you maximize the value of your employee stock options.