Venmo is a popular peer-to-peer payment app that has become increasingly popular in recent years. With its easy-to-use interface and ability to quickly transfer funds between friends and family, it’s no wonder why so many people have turned to Venmo for their payment needs. However, with so many scams and fraudulent transactions happening online, many people wonder if Venmo offers any kind of buyer protection.

The short answer is no, Venmo does not offer buyer protection. Unlike PayPal, which offers robust protection for both buyers and sellers, Venmo is not designed for transactions with strangers. Venmo is intended to be used for payments between people who already know and trust each other, such as splitting a restaurant bill or paying back a friend for concert tickets.

That beng said, Venmo does offer some fraud protection measures. If you believe that you have been scammed or sent money to a fraudulent account, Venmo will investigate the situation and explore any available options for recovering the funds. However, Venmo makes no promises that they will be able to refund the money, so it’s important to be careful when using the app.

To protect yourself when using Venmo, it’s important to only send money to people you know and trust. Avoid making transactions with strangers, especially if you are purchasing goods or services. If you do need to make a transaction with someone you don’t know well, consider using a more secure payment method like PayPal.

If you do run into issues with a Venmo transaction, you can contact support through the app or through their online form. Be sure to include the username of the person you sent money to, as well as any other relevant information about the transaction.

Venmo does not offer buyer protection like PayPal does. While Venmo does have some fraud protection measures in place, it’s important to be cautious when using the app and only send money to people you know and trust. If you do run into issues with a Venmo transaction, don’t hesitate to reach out to their support team for assistance.

Getting a Refund on Venmo if Scammed

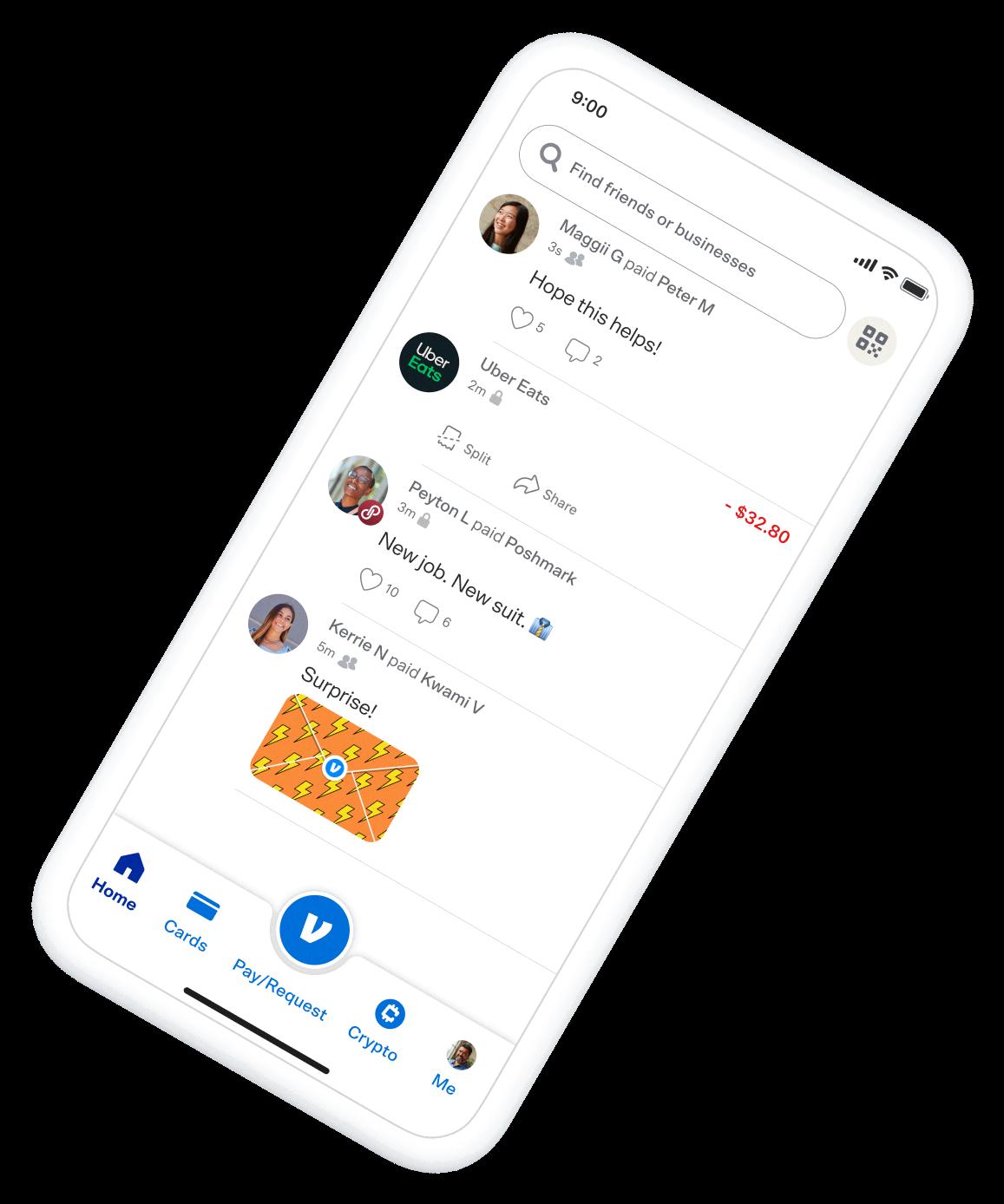

If you have been scammed on Venmo, the platform does not guarantee a refund of your money. However, they will investigate any avilable options to recover your funds. To begin the process, you can contact Venmo support through the app by navigating to the “Home” tab and selecting “Get Help.” Alternatively, you can use the online form provided by Venmo. When submitting your request, ensure that you include the username of the person to whom you sent the money. It is worth noting that Venmo’s policy states that users should only send money to people they know and trust, as they cannot protect against unauthorized transactions or scams. Therefore, it is essential to exercise caution when sending payments to unfamiliar recipients on Venmo.

Source: bigcommerce.com

Comparing Venmo Buyer Protection to PayPal’s Buyer Protection

Venmo does not offer the same level of buyer or seller protection as PayPal. Venmo is designed to be used among friends and family, and it assumes that you already know and trust the person you are transacting with. Therefore, it does not have any kind of built-in protection against fraudulent transactions or disputes.

On the other hand, PayPal offers a range of robust buyer and seller protection policies that are designed to protect both parties from fraudulent transactions and disputes. PayPal’s buyer protection policy, for example, covers eligible purchases that are not received or are significantly different from what was described in the listing, while its seller protection policy protects eligible sellers against fraudulent chargebacks and other payment disputes.

While Venmo is a convenient and user-friendly payment option for transactions with people you already know and trust, PayPal is a beter choice for online transactions with strangers, thanks to its comprehensive buyer and seller protection policies.

Dealing with Venmo Scams

If you believe that you have been scammed on Venmo, thre are a few steps that you can take to try to resolve the issue.

Firstly, you should report the incident to Venmo’s customer support team by contacting them through the app or website. They will be able to investigate the transaction and take appropriate action if necessary.

Secondly, if the transaction was made using a credit card, you should contact your credit card company to report the fraud and request a chargeback. This may allow you to recover your funds.

Thirdly, if you believe that your Venmo account has been compromised, you should change your password immediately and enable two-factor authentication for added security.

It’s also a good idea to be cautious when using Venmo in the future to avoid falling victim to scams. Only send money to people you know and trust, and be wary of any requests for payment from unknown individuals. Additionally, always double-check the details of a transaction before sending money to ensure that it is legitimate.

Using Venmo Buyer Protection

Venmo does not offer a buyer protection program by default for transactions conducted using the Venmo app or Venmo.com. However, in certain cases, Venmo may offer buyer protection for eligible purchases made thrugh the Venmo app.

To be eligible for buyer protection, you must have used the “Pay with Venmo” feature to make the purchase, and the seller must have been verified by Venmo. Additionally, the purchase must have been for physical goods that were shipped to you, rather than digital goods or services.

If you believe you are eligible for buyer protection, you can file a dispute through the Venmo app by selecting the transaction in question and clicking “Dispute.” You will be prompted to provide evidence of the purchase and any communication you had with the seller. Venmo will review your dispute and may provide a refund if they determine that the seller did not deliver the promised goods or services.

It’s important to note that Venmo’s buyer protection program is not a guarantee and only applies to certain types of purchases. As such, it’s important to use caution when making purchases through Venmo and to only buy from trusted sellers.

Disputing a Venmo Payment

You can dispute a Venmo payment if you beieve that there has been an unauthorized or fraudulent transaction made through your account. To dispute a payment, you can contact Venmo’s customer support team by sending a message through the contact form on their website, emailing them at support@venmo.com, or using the chat feature in their mobile app.

When disputing a payment, it’s important to provide as much information as possible about the transaction, such as the date, time, and amount of the payment, as well as any relevant details about the person or merchant that received the payment. Venmo’s customer support team will then investigate the dispute and may work with you to reverse the transaction and refund your money, if necessary.

It’s worth noting that Venmo’s dispute process is subject to certain terms and conditions, so it’s important to review their policies and guidelines before filing a dispute. It’s also a good idea to regularly monitor your Venmo account and transactions to ensure that all activity is authorized and accurate.

Source: venmo.com

Does Zelle or Venmo Offer Buyer Protection?

Venmo and Zelle have different policies when it comes to buyer protection. Venmo offers limited purchase protection for unauthorized transactions, fraudulent sellers, and items that are significantly not as described. However, Venmo’s protection only applies to transactions for goods and services made trough the app, and not for personal transactions between friends and family.

On the other hand, Zelle does not offer any protection program for authorized payments made through the service. This means that if you make a payment to someone through Zelle and do not receive what you paid for, you will not be able to dispute the transaction or receive a refund through Zelle.

It’s important to note that neither Venmo nor Zelle offer protection for transactions involving cash withdrawals or payments made outside of their platforms. Therefore, it’s always a good idea to use caution when making payments to people you don’t know and to consider using a payment method with purchase protection, such as a credit card, for added security.

Conclusion

Venmo is a popular mobile payment app that alows users to easily send and receive money from friends and family. It is a convenient and efficient way to split bills, pay rent, or simply send money to someone in need. However, it is important to keep in mind that Venmo is not designed for use with strangers and does not offer any kind of buyer or seller protection. If you need to make online transactions with people you don’t know well, it is better to use a platform like PayPal that offers more security and protection. Venmo is a great tool for personal transactions with trusted individuals, but it is important to be cautious and use other platforms for more high-risk transactions.