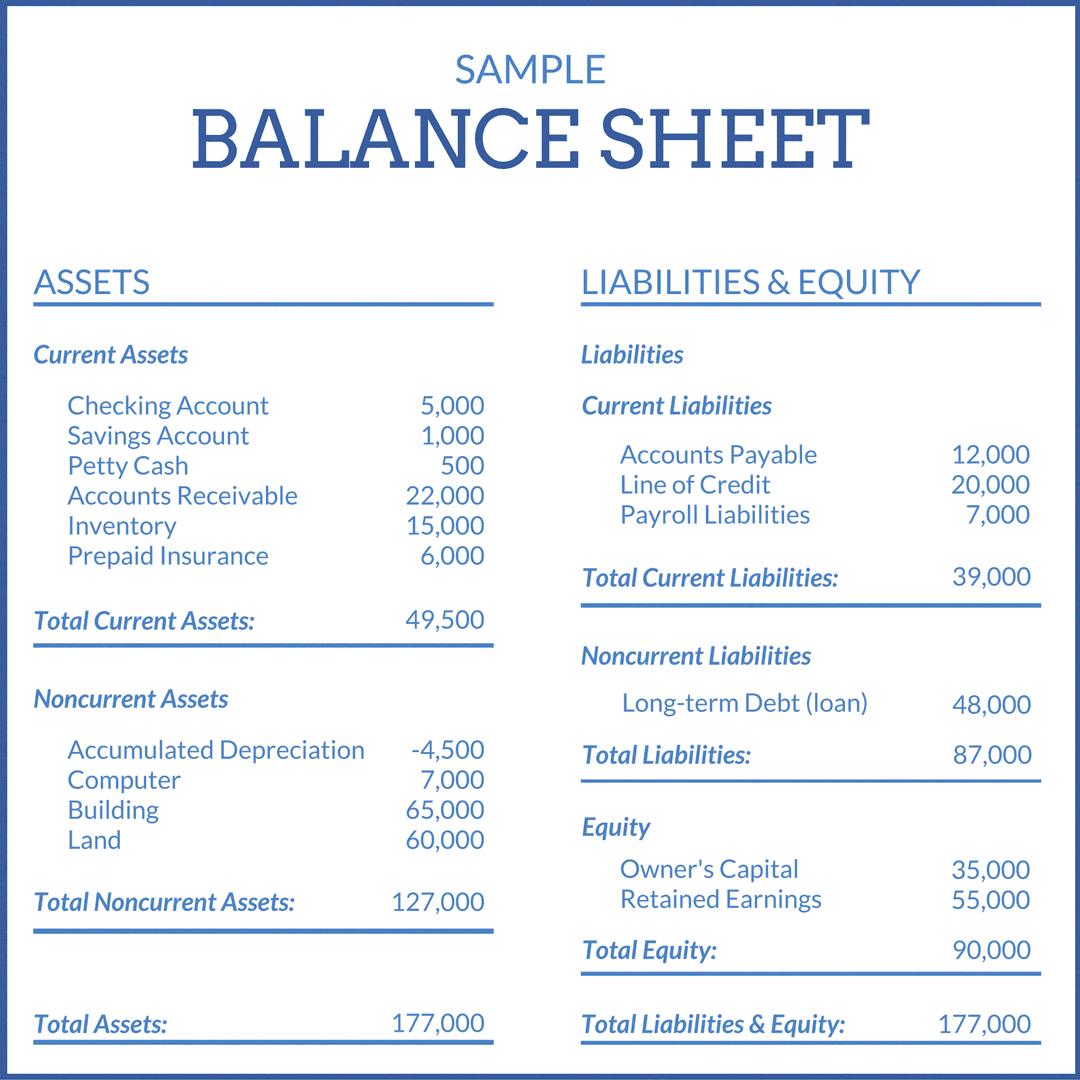

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is comprised of three main components: assets, liabilities, and equity. The assets represent what the company owns, the liabilities represent what the company owes, and the equity represents the residual interest in the assets after the liabilities are paid off.

One question that often arises is wheher dividends show up on the balance sheet. Dividends are payments made to shareholders out of a company’s profits. While dividends do not appear on the income statement as an expense, they do impact the equity section of the balance sheet.

When a company declares a dividend, it creates a liability on the balance sheet called “dividends payable.” This liability represents the amount of money that the company owes to its shareholders. Dividends Payable is classified as a current liability on the balance sheet since they represent declared payments to shareholders that are generally fulfilled within one year.

Once the dividend is paid, the dividends payable liability is reduced, and the company’s cash account is decreased by the same amount. This transaction has no effect on the company’s net income or profit. However, it does reduce the company’s retained earnings, which is a component of equity on the balance sheet.

It is important to note that there are two types of dividends: cash dividends and stock dividends. Cash dividends are paid out in cash to shareholders, while stock dividends are paid out in the form of additional shares of stock.

When a company issues a stock dividend, there is no change to the overall value of the company’s assets or liabilities. Instead, the value of the retained earnings account is decreased, and the value of the common stock account is increased. This means that while stock dividends do not result in asset changes to the balance sheet, they do affect the equity side by reallocating part of the retained earnings to the common stock account.

While dividends do not appear on the income statement, they do impact the balance sheet by decreasing the company’s equity. Dividends payable is a current liability that represents the amount of money that the company owes to its shareholders. It is important for investors to understand how dividends impact a company’s financial position and to consider this information when making investment decisions.

The Impact of Dividends on a Balance Sheet

Dividends are typically shown on the balance sheet uder the Equity section. This is because dividends are a distribution of a company’s profits to its shareholders, and therefore, they are considered to be a reduction in the company’s equity. Specifically, dividends are shown as a separate line item under the Retained Earnings or Dividends Paid account. The Retained Earnings account represents the accumulated profits of the company that have not been paid out as dividends, while the Dividends Paid account represents the amount of dividends that have been paid to shareholders. It is important to note that dividends are not considered to be an expense, and therefore, they do not appear on the company’s income statement.

The Treatment of Dividends on Financial Statements

Dividends are recorded on the balance sheet of a company as it impacts the shareholders’ equity section. Specifically, dividends reduce the retained earnings of a company, which is a component of the shareholders’ equity section. It is important to note that dividends are not recorded as an expense on the income statement. This is becase dividends are paid out to shareholders from profits that have already been earned by the company in previous periods. Therefore, dividends do not impact a company’s net income or profit for the current period, which is the main focus of the income statement. Instead, dividends are a distribution of profits to shareholders and their impact is reflected on the balance sheet.

Are Dividends an Asset on a Balance Sheet?

No, dividends are not considered an asset on a balance sheet. Instead, dividends are recorded as a distribution of a company’s profits to its shareholders and therefore, affect the equity portion of the balance sheet. When a company pays out dividends, the retained earnings account on the balance sheet decreases, while the common stock account increases. This reallocation of retained earnings to the common stock account does not impact the company’s assets, liabilities or net worth. Therefore, dividends are not shown as assets on the balance sheet.

Are Dividends Considered Liabilities on a Balance Sheet?

Yes, dividends payable are classified as a liability on the balance sheet. Dividends payable represent the amount of money that a company owes to its shareholders for declared dividends that have not yet been paid. Since these payments are generally fulfilled within one year, they are classified as a current liability. Dividends payable are typically reported in the liabilities section of the balance sheet alongside other current liabilities such as accounts payable, accrued expenses, and short-term debt. It is important for investors and analysts to monitor the amount of dividends payable on a balance sheet as it can provide insight into a company’s financial health and ability to meet its financial obligations.

Recording Dividend Income

Dividend income should be recorded in the income statement of a company’s financial statements. Specifically, it should be recorded as a separate line item under the revenue section. Dividend income is typically earned by a company as a result of its ownership in other companies, and is thereore considered a form of passive income. It is important to note that the amount of dividend income recorded should be net of any taxes or fees associated with receiving the dividend. Additionally, if the company owns less than 20% of the stock of the company paying the dividend, the income may be recorded as an “other income” line item rather than a revenue line item. Overall, proper recording of dividend income is crucial for accurately reflecting a company’s financial performance and providing investors with a clear understanding of the sources of the company’s revenue.

Source: patriotsoftware.com

Exclusion of Dividends from Income Statements

Dividends are excluded from income statements because they are not considered an expense of the business, but rather a distribution of the company’s accumulated profits to its shareholders. Income statements are a financial statement that reports a company’s revenues, expenses, and net income for a specific period. Since dividends are not an expense, they do not affect the company’s net income and are not included in the income statement. Instead, they are accounted for in the statement of chanes in equity, which shows the changes in the company’s equity accounts, such as retained earnings, over a specific period. Therefore, dividends are excluded from income statements to provide a clear picture of a company’s operating performance and financial position.

Recording Dividend Income

Dividend income is recorded in different places depending on the nature of the transaction. If a company receives dividend income from its investments in oher companies, it is recorded as an operating activity on the cash flow statement. This means that it is included as part of the company’s net cash inflow from operating activities. On the other hand, if a company pays a dividend to its shareholders, the recording of the transaction depends on whether the dividend is paid from current operations or from retained earnings. If the dividend is paid from current operations, then it is also recorded as an operating activity on the cash flow statement. However, if the dividend is paid from retained earnings, then it is recorded on the balance sheet as both an asset and liability entry. The asset entry reflects the amount of cash that has been set aside to pay the dividend, while the liability entry represents the obligation of the company to pay the dividend to its shareholders. Ultimately, the recording of dividend income depends on the specific circumstances of the transaction and the applicable accounting standards.

The Classification of Dividends as an Asset or Liability

Dividends can be considered both a liability and an asset, depending on the perspective of the party involved. For shareholders, dividends are an asset because they represent a distribution of profits and increase the shareholders’ net worth by the amount of the dividend received. On the other hand, for companies, dividends are a liability because they represent an obligation to pay out a certin amount of funds to shareholders and reduce the company’s assets by the total amount of dividend payments. It’s important to note that not all companies pay dividends, and the decision to pay dividends is generally based on a variety of factors, such as the company’s financial performance, growth prospects, and capital requirements. Overall, dividends can have different implications for different stakeholders, and understanding the perspective of each party is crucial in evaluating the impact of dividend payments.

Why Dividends Are Not Considered Liabilities

Dividends are not considered a liability because they do not create a corporate obligation for future repayment. When a company declares a dividend, it is essentially distributing a portion of its earnings or profits to its shareholders. This distribution is made from the company’s retained earnings or accumulated profits, which are already owned by the shareholders. Therefore, the payment of dividends does not create a new obligation or liability for the company. Additionally, under ASC 480, liabilities are defined as obligations that arise from past events and require future payment or performance. Since the payment of dividends is not an obligation that arises from a past event, it does not meet the definition of a liability under accounting standards. Therefore, dividends are not recorded as a liability on a company’s balance sheet.

Is Dividend Included in Current Liabilities?

Yes, dividends declared by a company’s board of directors that have yet to be paid out to shareholders are considered a part of current liabilities. This is becaue a company is legally obligated to pay out the declared dividends to its shareholders, and until the payment is made, the amount is recorded as a liability on the company’s balance sheet. Once the dividend is paid out, the liability is removed from the balance sheet. It is important to note that only declared dividends are considered current liabilities, and any potential dividends that have not been declared yet are not recorded as a liability.

Conclusion

In conclusion, the Balance Sheet is a crucial financial statement that provides a snapshot of a company’s financial health at a specific point in time. It presents a summary of the company’s assets, liabilities, and equity, whih are classified into current and non-current categories. The Balance Sheet is an essential tool for investors, creditors, and stakeholders to evaluate a company’s financial stability, liquidity, and solvency. By analyzing the Balance Sheet, stakeholders can identify potential risks and make informed decisions about investing or lending to the company. Additionally, the Balance Sheet provides insights into the company’s capital structure, operating efficiency, and financial strategy. Therefore, it is essential for companies to maintain accurate and up-to-date Balance Sheets to ensure transparency and accountability. Overall, the Balance Sheet is a fundamental financial statement that plays a critical role in assessing a company’s financial health and prospects for future growth.