When it comes to managing your finances, there are many apps available for download to help you keep track of your spending, save money, and pay down debt. Two of the most popular options are Truebill and Cushion. While both apps aim to help you save money and manage your finances, they have some distinct differences that may make one better suited for your needs than the other.

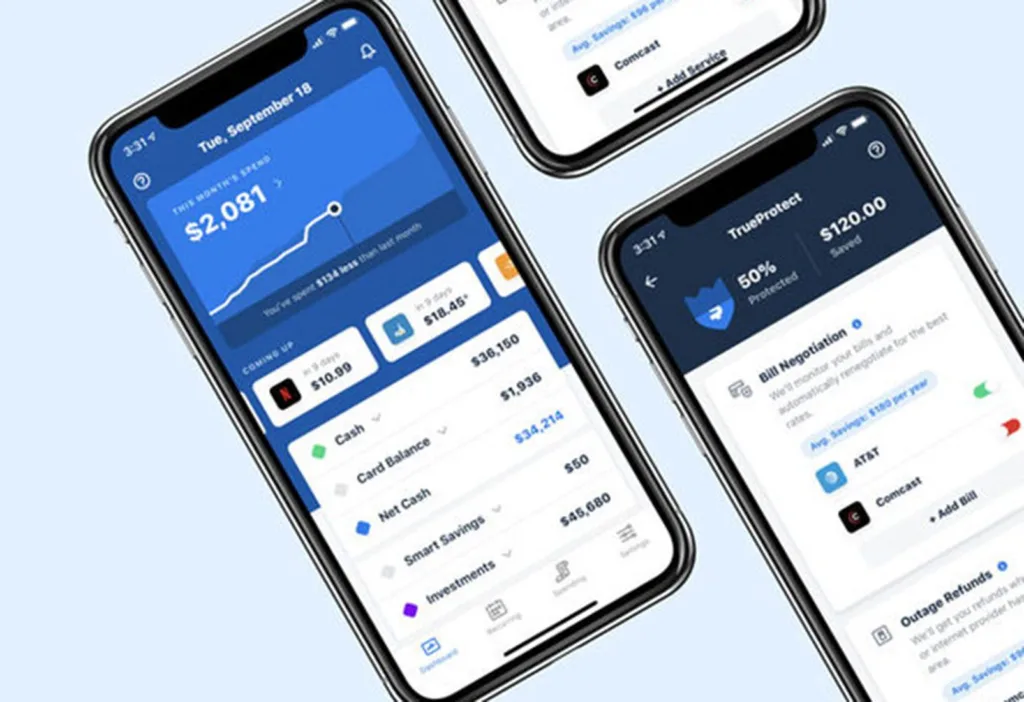

Truebill is a free financial app that helps you track your spending and manage your bills. It allows you to connect your bank accounts and credit cards to the app, so you can see all of your transactions in one place. Truebill also helps you cancel unwanted subscriptions and negotiate lower bills for services like cable and internet. Additionally, Truebill offers a budgeting tool that helps you track your spending and set financial goals.

Cushion, on the other hand, is a paid service that offers to negotiate bank fees and overdraft charges on your behalf. Cushion connects to your bank account and analyzes your transactions to find any potential fees or charges that could be refunded. Then, the app works to negotiate with your bank to get those fees waived or refunded. Cushion also offers a feature called “Cushion Coach,” which helps you set and achieve financial goals.

One of the key differences between Truebill and Cushion is that Truebill is a free app, while Cushion requires a monthly subscription fee. Additionally, the focus of each app is slightly different. Truebill is more geared towards budgeting and managing bills, while Cushion is focused on saving you money on bank fees and charges.

Another difference between the two apps is that Truebill offers more customization options for budgeting. With Truebill, you can create custom budget categories and set spending limits for each one. Cushion, on the other hand, doesn’t offer as much flexibility when it comes to budgeting.

Whether you choose Truebill or Cushion will depend on your specific financial needs and goals. If you’re looking for a free app to help you manage your bills, track your spending, and set financial goals, Truebill is a great option. If you’re wiling to pay a monthly fee for a service that helps you save money on bank fees and charges, Cushion may be a better choice.

Is There Anything Better Than Truebill?

There are several other budgeting apps available in the market that are better than Truebill. Some of these apps offer more advanced features and functionality, while others provide a simpler and more user-friendly experience. Here are a few examples:

1. YNAB (You Need a Budget): This app is designed to help users create and stick to a budget by proviing real-time updates on their spending and offering personalized tips and advice.

2. PocketGuard: This app helps users track their spending and manage their bills by syncing with their bank accounts and providing alerts when bills are due or when spending limits are exceeded.

3. Personal Capital: This app offers a comprehensive financial management platform, including budgeting tools, investment tracking, and retirement planning.

4. Simplifi by Quicken: This app provides personalized budgeting and spending tracking features, as well as bill management and investment tracking tools.

The best budgeting app for you will depend on your specific needs and preferences. It’s important to research and compare different options to find the app that’s right for you.

What Is Better Truebill Or Trim?

Both Truebill and Trim are helpful apps that can assist you in cutting your monthly costs. However, the choice between them depends on your specific financial neds and goals.

Truebill is designed to help you manage your budget and control your spending. It provides tools that allow you to track your expenses, monitor your bills, and get insights into your spending patterns. Truebill can also help you cancel unwanted subscriptions, negotiate lower bills, and even get refunds for fees that you may have been charged incorrectly.

On the other hand, Trim is focused on helping you tackle your debt. It provides tools that allow you to track your debt, set up payment plans, and even negotiate with your creditors to lower your interest rates or monthly payments. Trim can also help you cancel unwanted subscriptions and negotiate lower bills, just like Truebill.

If you’re looking to manage your budget and control your spending, Truebill may be the better choice. But if you’re focused on paying off debt, then Trim may be the more appropriate option. both apps can be helpful in reducing your monthly expenses, and it’s up to you to decide which one fits your needs best.

Is Truebill Good For Budgeting?

Truebill, now known as Rocket Money, is a financial services app that can be a useful tool for budgeting. The app helps users to track their expenses and create a budget based on their income and spending habits. This can help people to see where their money is going and make adjustments to their spending habits to reach their financial goals.

In addition to budgeting, Rocket Money can also help users to save money on bills and subscriptions. The app analyzes bills and identifies opportunities for savings, such as negotiating lower rates or canceling unwanted subscriptions. This can help users to reduce their expenses and free up more money for savings or other financial goals.

Rocket Money can be a valuable tool for budgeting and saving money. However, it’s important to note that the app is only one part of a comprehensive financial plan. It’s sill important to practice good financial habits, such as avoiding unnecessary expenses and saving regularly, in order to achieve long-term financial success.

Is There A Free Version Of Truebill?

There is a free version of Truebill, which is now called Rocket Money. The Rocket Money app can be downloaded for free from the App Store or Google Play. The free version of Rocket Money provides users with basic features, such as tracking ther subscriptions, creating a budget, and monitoring their bank accounts. However, to access some of its more advanced features, such as bill negotiation, advanced budgeting, and custom savings goals, users will need to upgrade to a premium membership. The premium membership of Rocket Money comes with a monthly fee, but it may be worth it for those who want to save money on their bills and improve their financial management.

Conclusion

Truebill and Cushion are both excellent financial apps that can help you save money and manage your finances effectively. Truebill shines in its ability to track your spending and identify areas where you can cut costs, while also providing a range of tools to help you negotiate better deals on your bills and subscriptions. Cushion, on the oter hand, is focused on helping you avoid overdraft fees and late payment penalties by monitoring your accounts and alerting you to potential issues. Ultimately, the choice between these two apps will depend on your specific financial needs and goals. If you’re looking for a comprehensive budgeting app that can help you save money in a variety of ways, Truebill is an excellent choice. But if you’re primarily concerned with avoiding fees and keeping your accounts in good standing, Cushion may be the better option for you.